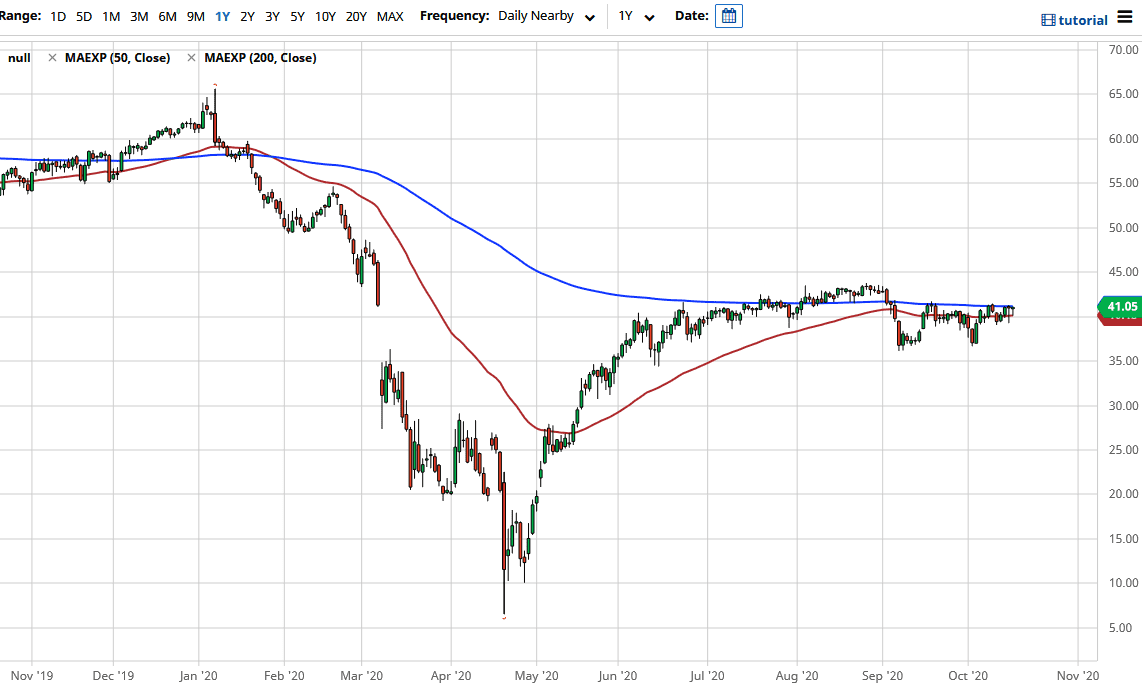

The West Texas Intermediate Crude Oil market pulled back a bit to kick off the trading session on Friday, reaching down towards the 50 day EMA. The 50 day EMA attracts a lot of attention, especially considering that it is sitting right at the $40 level. Between the two, that is a couple of reasons to think that the buyers will continue to pick up value as it occurs. Furthermore, the fact that the 50 day EMA is essentially flat, it suggests that we have nowhere to be. This makes sense because there are so many different forces pushing the market back and forth.

If the market can break above the 200 day EMA, then it is likely that it will go looking towards the $43.50 level we have seen a lot of supply. Because of this, the market would probably struggle to get above there, and as a result, I think that the market will probably selloff. All things being equal, the US dollar looks likely to rally a bit later in the week, so that will probably coincide quite nicely. After all, the US dollar has a negative correlation with crude oil, so if we do see a strengthening US dollar it will drag the market right back down.

When it comes to crude oil, we also have to worry about the demand, which is suffering to say the least. With that being the case, I think that eventually, we will break down. To the downside, I see the $37 level as potential support and a potential target of short-sellers. I believe that crude oil is still oversupplied, despite the fact that the latest inventory figure showed a relatively bullish number. After all, given enough time we still have to worry about whether or not there is going to be demand. The economic numbers in the United States look a little better, but the rest of the world is severely lacking, so it is difficult to imagine a scenario where crude oil gains longer-term strength. At best, we will have the occasional rally to the upside. Having said all of that, if we were to break above the $43.50 level, then crude oil probably goes looking for $45, possibly even $47.50 after that. I still see a lot of issues though, so expect volatile conditions.