The West Texas Intermediate Crude Oil market fell rather hard during the trading session on Thursday, slicing through the 50 day EMA like it was not even there. That being said, we also turned right back around due to the strong bullish inventory figure coming out of the United States. The Crude Oil Inventories figure came out at -3.8 million barrels, much more bullish than the originally anticipated -2.1 million barrels. With that being the case, it does look like a market that is seeing a bit of demand, but it isn’t even demand and at the end of the day we also have to look at the fact that economies may be slowing down in Europe. The United States might be strong, but we will see a divergence as Europe is starting to see more lockdowns.

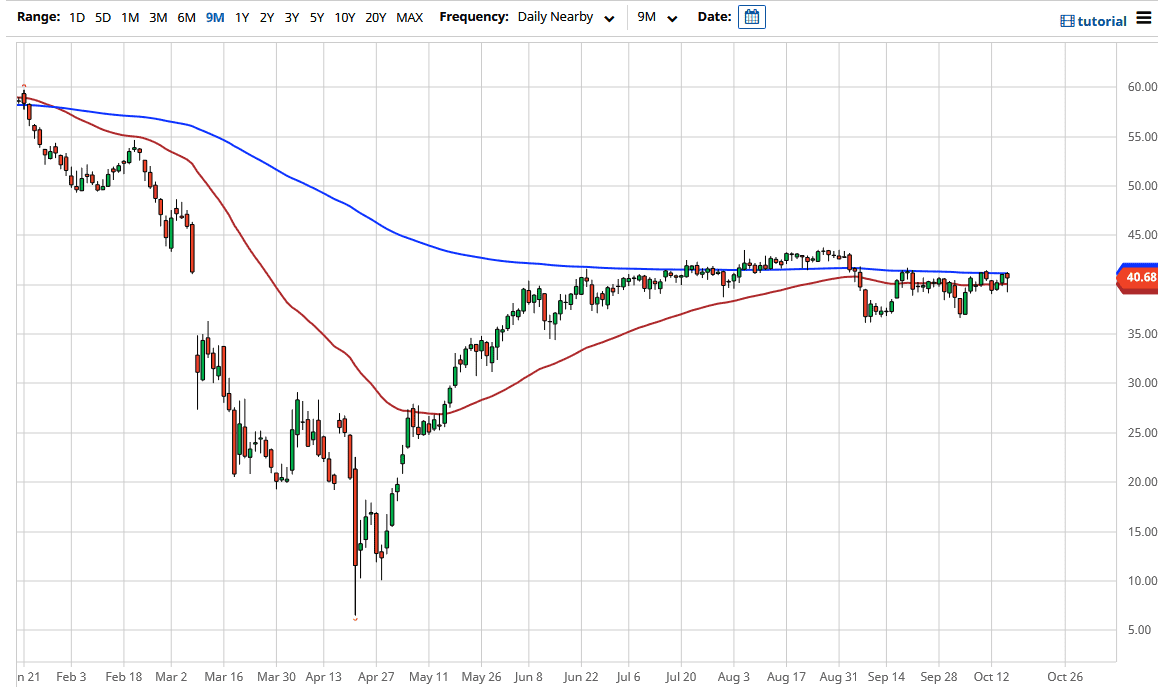

Looking at this chart, the 50 day EMA and the 200 day EMA is very flat at the moment, so it certainly looks as if we are still very much in a trend of going sideways. If we can break above the top of the 200 day EMA, then it is possible that we could go looking towards the $43 level, where we had seen some selling. I do think that it is likely that we could get a little bit of a bounce but more than likely we will see some type of selling opportunity based upon exhaustion.

I am looking for exhaustion above to start fading, and then I am also looking at selling this market if we break down below the bottom of the hammer for the trading session on Thursday. If we can break down below that level, then we could go looking towards the $37 level at that point. All things being equal, I believe that the market is more than likely going to go sideways as we just do not have a lot of clarity when it comes to global markets and of course the US dollar suddenly putting up a bit of a fight. If the US dollar strengthened quite drastically, that could also put negativity in the oil market as well as crude oil is sensitive to the greenback quite often. At this point, the longer-term outlook for crude oil is steady at best, and soft at worst.