The West Texas Intermediate Crude Oil market rallied rather significantly during the trading session on Monday as traders came back to work. While we gained over 5%, the idea of the oil market rallied based upon some type of recovery by Donald Trump is a bit farcical, but it is one of the main narratives being pushed around the markets. Furthermore, there is also a falling US dollar so that does help the idea of crude oil rising.

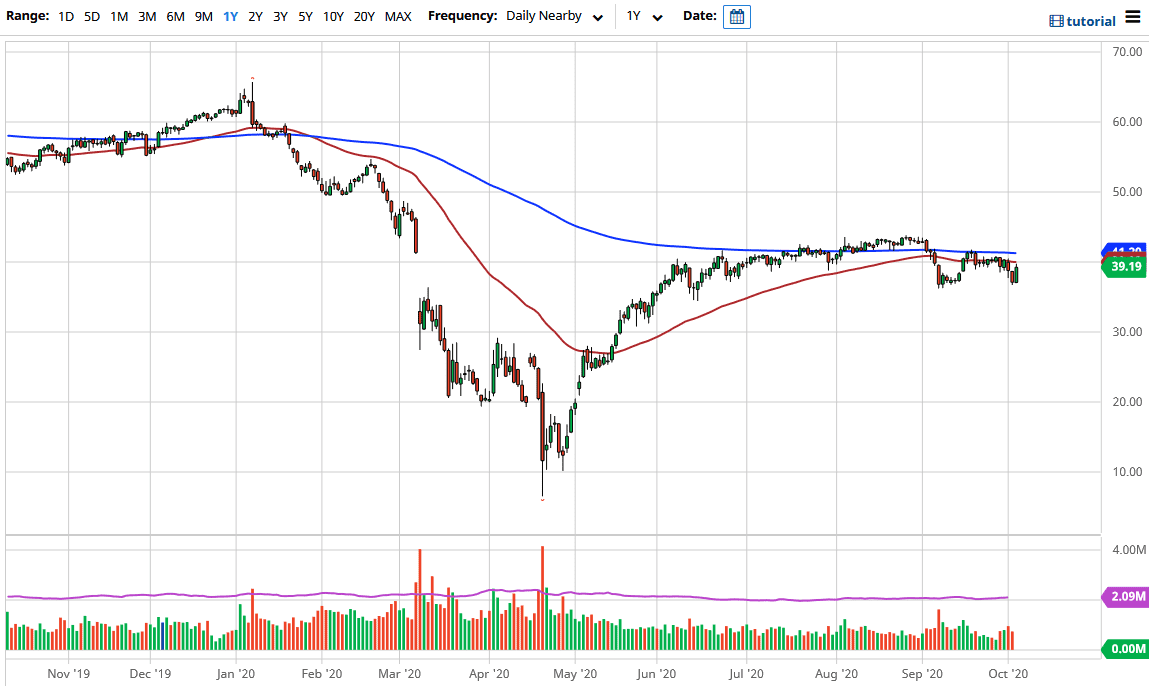

Beyond all of that, there is a lot of people out there looking to hold their hands out and wait for the next stimulus bill to pass. There is some signs of the market trying price in the idea of signs of stimulus that being past, so that has people thinking that suddenly the economy is going to take off straight up in the air. That is ridiculous, and I suspect that this rally will probably be sold into again. The $40 level just above is significant psychological resistance as well as the home of the 50 day EMA currently. After that, we have the 200 day EMA, so signs of exhaustion will be sold into on short-term charts. I have no interest whatsoever in buying oil, at least not until we break above the 200 day EMA substantially.

If the US dollar does in fact strengthen, that should continue to weigh upon the value of crude oil, and I think eventually break down below the recent lows. What is worth noting is that Brent is rallying as well, but it also made a “lower low”, which could lead this market even lower. At this point in time, it is going to continue to be a “fade the rally” type of market, offering the ability for the market to go down to the $35 level, possibly even the $30 level. In order for crude oil to take off to the upside, I think we would need some type of major event, something that is not been priced in right now. Ultimately, the US dollar would have to come undone, and there would have to suddenly be some type of major supply shock, something that is very difficult to imagine at this point as the world is simply a wash in petroleum.