The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday but found resistance above the 200 day EMA as we awaited the inventory figures. That being said, the inventory figures were weaker than anticipated, showing that perhaps the demand is falling yet again. The crude oil sector continues to struggle with the idea of demand overall, and it should be noted that the fact that there was less of a drawl than anticipated. People were concerned about whether or not crude oil is actually in demand.

The gasoline inventories also fell, at least in the United States. This suggests that there may not be as much demand going forward either. This would be very bad for petroleum if the world’s largest economy is demanding more energy. The markets continue to focus on the idea of stimulus, and the theory that it should continue to push demand forward, but at this point, it should be noted that we have had four stimulus packages pass, including this one if it does, and here we are. Because of this, any rally based upon stimulus is probably short-term at best.

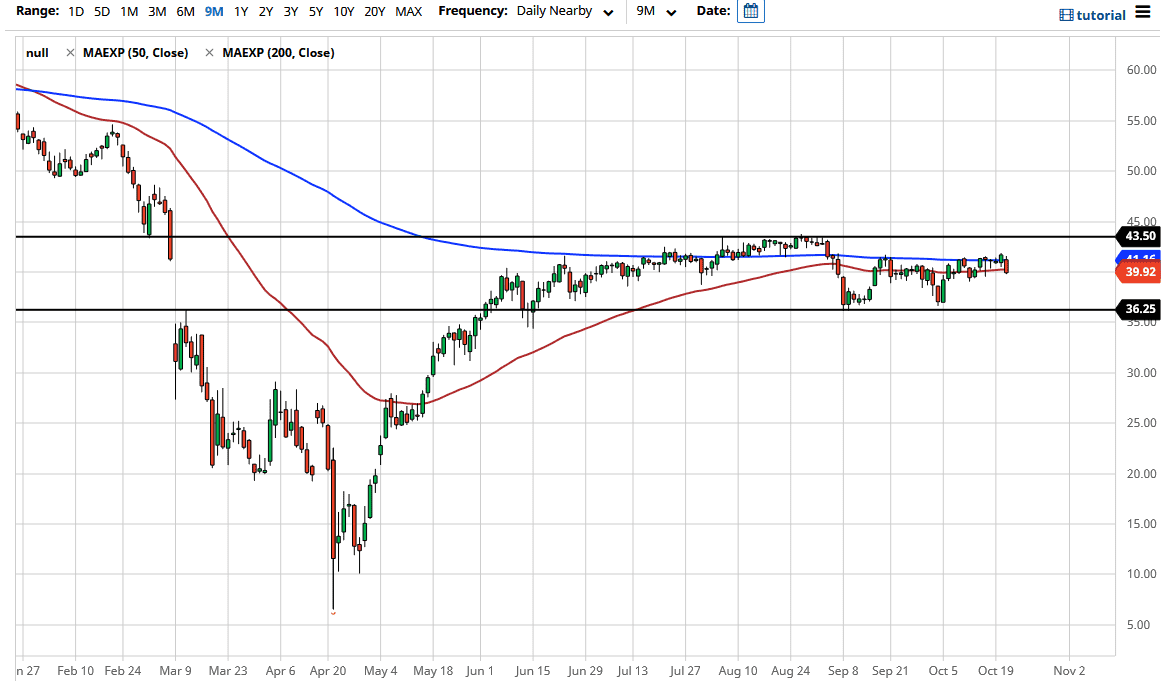

The real problem is the longer-term lack of demand, and that does not look like it is changing anytime soon. Currently, we find ourselves trading between the $43.50 level and the $36.25 level underneath. We are roughly in the middle, so I would fully anticipate a lot of back and forth short-term scalping more than anything else. I prefer fading rallies that show signs of exhaustion on short-term charts because I think the longer-term trend is probably still to the downside. That being said, you must be cognizant of the fact that if we do break above the $43.50 level, we are probably racing towards the $45 level rather quickly.

A breakdown below the $36.53 level would open up the door to the $35 level and below, but obviously, we are quite far from that happening. The day was pretty negative for crude oil, dropping over 4% so that is something to keep in mind as well, but there seems to be plenty of support right around the $39 level so keep that in mind. All things being equal, I think that we continue to see a lot of choppy back-and-forth trading and it is more of a scalping opportunity in this little range that we are in.