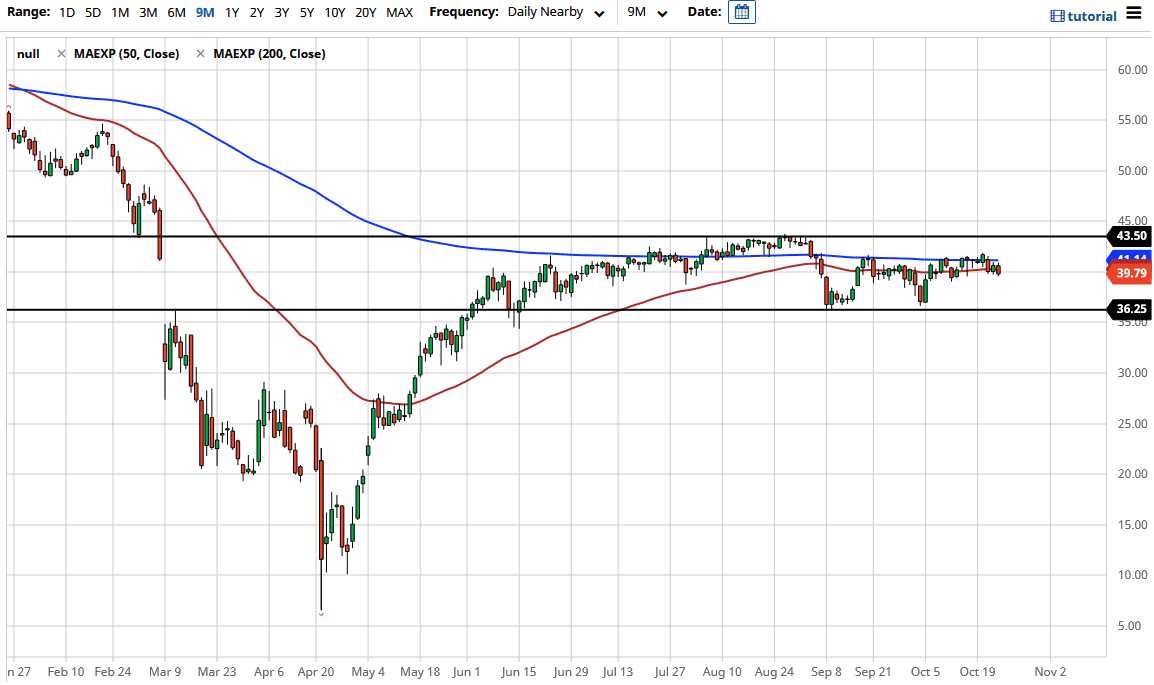

The West Texas Intermediate Crude Oil market has initially tried to rally during the trading session on Friday, but then broke down a bit to slice through the 50 day EMA. At this point time, the market is likely to show a proclivity to eventually break down, but in the short term it looks like we are going to go back and forth between the $43.50 level to the upside and the $36.25 level underneath offering support.

Looking at the chart, the 50 day EMA and the 200 day EMA are both flat and therefore it shows that there is no real drive to go in one direction or the other right now, and with that being the case it is likely that the market simply go back and forth on short-term charts more than anything else. It is difficult to imagine a scenario where we suddenly take off to the upside, although the stimulus passing could be a start. Given enough time, it is likely that the $43.50 level would cause enough resistance to sell this market off again, as there has been so much in the way of supply.

To the downside, if we were to break down below the last couple of candlesticks, we then open up the possibility of reaching down to the $36.25 level, and perhaps even lower. After all, we have to worry about the lack of demand for crude oil, and it makes quite a bit of sense that we would continue to see a bit of a lamp market. The market will be noisy between now and the election in general, but that being said I favor the downside in general, so I am looking towards short-term charts to fade signs of exhaustion.

I do believe that it is only a matter of time before we see volatility come back into the marketplace and weigh upon the crude oil market. At this point time, it is likely that exhaustion will be jumped upon and as the US dollar strengthens, that also weighs upon the value of crude oil as well. All things being equal, it is likely that we continue to see a lot of noisy trading, but as you can see it has been a very tight range that has been very reliable for the last couple of weeks.