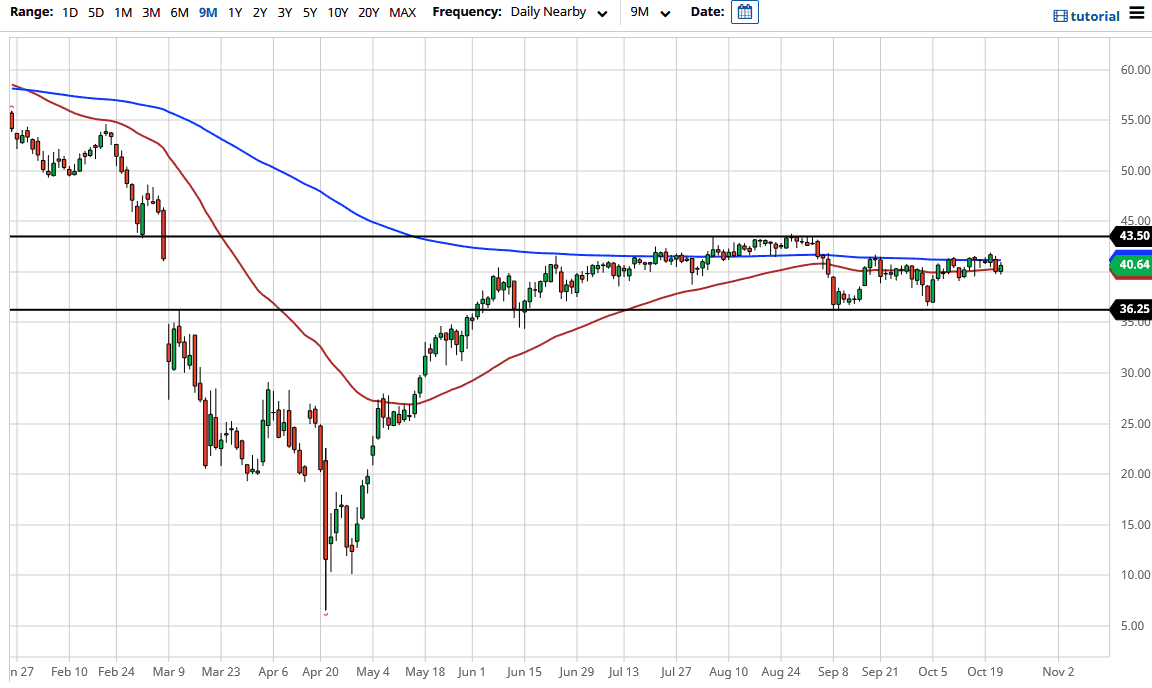

We have no momentum whatsoever and therefore I think you are looking at the market in a short-term type of attitude, as we simply bounce from the 50 day EMA to the 200 day EMA and back and forth.

The $40 level underneath is an area where we have seen buyers more than once, and therefore it is not a huge surprise to see that the market has bounced from there. Ultimately, this is a market that I think is desperately looking for some type of solution as to where it should go next, but we have so much in the way of noise out there that it is very difficult to get into the market with a huge position. At this point, most traders are simply scalping back and forth with small amounts, taking advantage of the relative stability of the market. However, eventually volatility will pick up and it is likely that we will go in one direction or the other.

As we are roughly in the middle of the larger consolidation area between $43.50 and $36.25, it makes a lot of sense that this market continues to be very benign and for that matter one that you cannot trust. It is not as if we are sitting on massive support below, or massive resistance above. Because of this, the market is likely to see little in the way of determination, and with the recent questions about whether or not stimulus is coming anytime soon the United States, that of course has people wondering whether or not the US dollar is going to make a big move.

Keep in mind that the US dollar does tend to run counter to the crude oil market, so with that being the case I think that the market participants will continue to be stuck dealing with this severe lack of directionality. That being said though, it can be traded back and forth in this tight range if you are watching short-term charts. Obviously, you have to be cautious about how much money you put into the market in this scenario, because there is the possibility of a headline coming out and make in the market take off, but at this point it certainly looks as if it is a short-term trading type of environment.