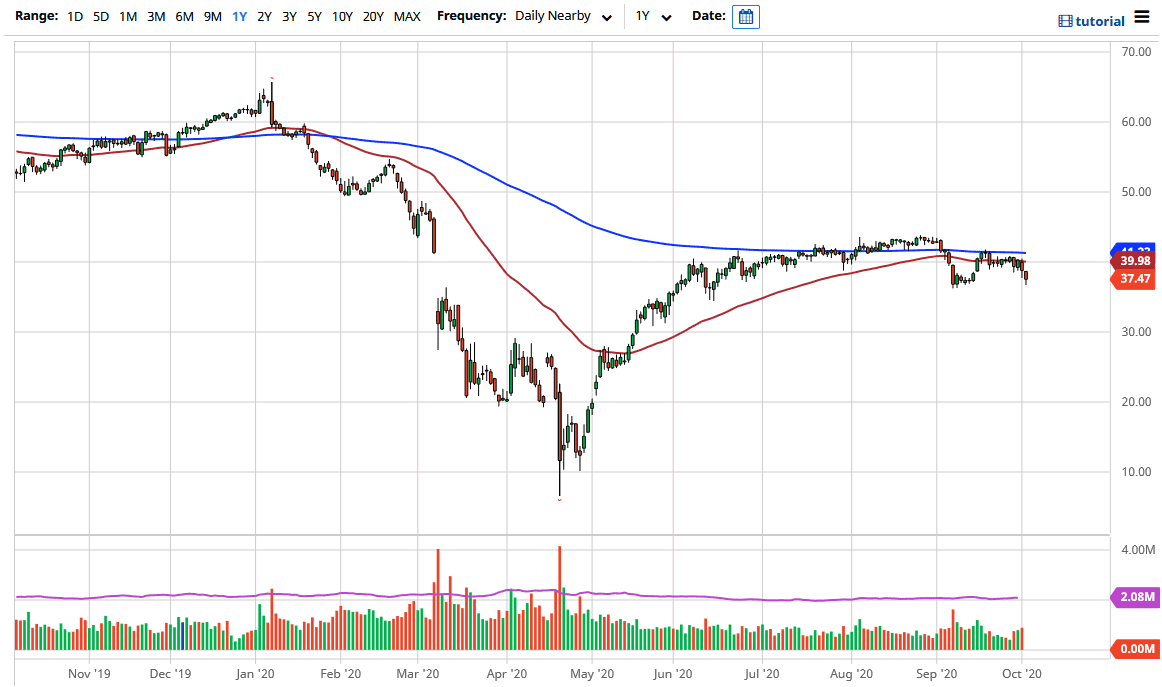

The West Texas Intermediate Crude Oil market has fallen a bit during the trading session on Friday, reaching down towards the $37 level, only to bounce slightly towards the end of the day. Ultimately, this is a market that looks like it is very vulnerable to selling pressure. If we break down below the lows of the Friday session, it is very likely that we could see the “trapdoor” open up and send the market down towards the $35 level. After that, the $30 level would then be a target. The $30 level is a very important psychologically significant figure, so having said that the market will probably react to it. If we break down below there, then this whole thing is going to come undone rather quickly. I do not expect that to happen, but that is a fear that you have to keep in mind.

To the upside, I believe that the 50 day EMA will offer a significant amount of resistance, especially near the $40 level. The $40 level also has psychological resistance attached to it, and we have the 50 day EMA is sitting right there, running parallel to the 200 day EMA which is also flat. In other words, this is a market that I think will eventually find plenty of selling pressure, because there is a serious lack of demand. With that being the case, do not be surprised at all to see this market rally a bit only to sell off yet again.

Another thing that comes into play is the fact that the US dollar has been showing signs of strengthening again, which works against the value of crude oil. Crude oil also has to worry about demand, because if the economy around the world continues to slow down, there is going to be a lot less demand for crude oil. At this juncture, I do not really have an interest in trying to buy crude oil, because there are far too many things out there working against it, not the least of which is a major oversupply position that I do not see being worked out of anytime soon. As long as the world economy is continuing to lock down randomly and slow down for that matter, it is likely that the crude oil markets will continue to be very soft.