The West Texas Intermediate Crude Oil market has done very little during the trading session on Wednesday as we continue to wait to see whether or not there is going to be a stimulus in the United States. That could have a major influence on what happens with most commodities because the theory is that the flooding of cheap money into the market will drive up demand for energy and other things as money will go into construction and the like. That being said, the market has seen multiple stimulus packages in the past, which has essentially done nothing. Because of this, I believe that any type of rally based upon the idea of stimulus is going to be short-term at best.

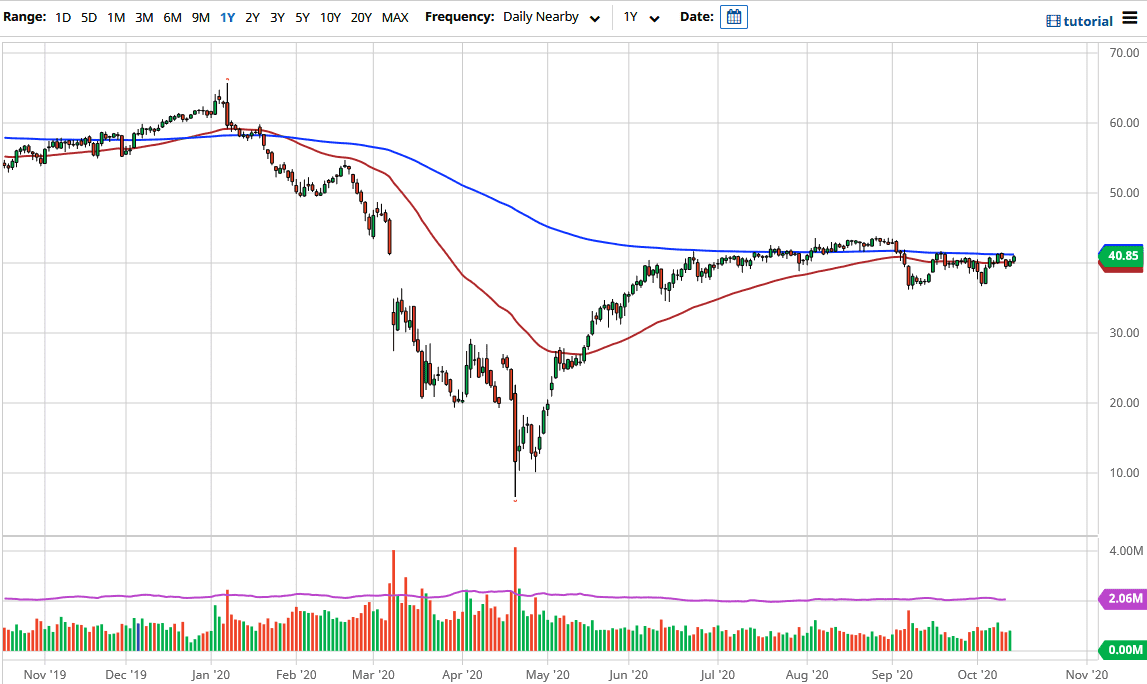

Through that prism, I am looking at this market as one that continues to see a lot of sideways action due to the fact that we just do not have any type of clarity. The 50 and 200 day EMA indicators remain flat, and as we sit around the $40 level, I think we are simply going back and forth in order to try to find a reason to move. Keep in mind that the contract is priced in US dollars, so you will have to pay close attention to what is going on with the greenback in order to get an idea as to where this market goes.

From a structural standpoint, we still have plenty of support near the $37 level underneath, just as the $43.50 level has offered major resistance. The market continues to bounce around in that general vicinity, so short-term back-and-forth positions are probably about as good as it gets. Ultimately, if we get some type of exhaustion towards the top, it is likely that we could start selling. On the other hand, we could look at the $37 level underneath as a potential and signs of support in order to turn around and go long again. I think we stay in this range until we get some type of resolution with economic figures.

At this point, we are essentially going sideways yet again. With this, short-term scalping is probably going to continue to be the best way to trade this market, although I favor longer-term selling more than anything else as the underlying economic conditions do not suggest that we will have a major demand for a sustained amount of time.