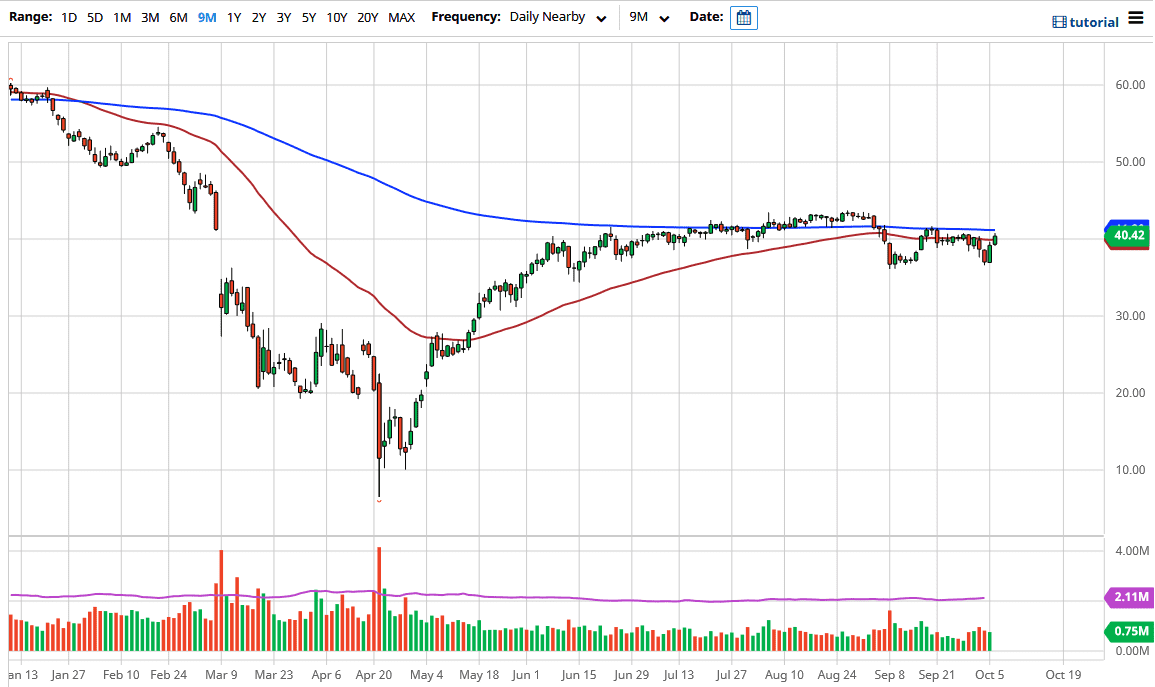

The West Texas Intermediate Crude Oil market has broken above the 50 day EMA during the trading session on Tuesday, as we continue to see a well-defined range that the market wants to be involved in. The $36.50 level on the bottom offers plenty of support while the $41 area seems to be offering significant resistance. Ultimately, to me it looks as if this market is still doing the same thing it has been doing for some time, simply killing time in trying to figure out whether or not they are going to be able to make a decision.

Looking at the candlestick for the trading session, it looks a bit bullish, but it should also be noted that the market pull back from the 200 day EMA from the way the chart looks. I think at this point it is very likely that we will see a reason come out of the woodwork for crude oil to start falling off again. Ultimately, the market is going to be paying close attention to the US dollar, because it has such a negative correlation on this market. If the US dollar starts to rally again, that will more than likely work against the value of crude oil, as it would other commodities.

However, if we were to break above the 200 day EMA, then the market is likely to go looking towards the $43 level, perhaps trying to push the market to break out even further. At this point, this is a market that looks as if it is getting stretched a bit, so I think that looking for a short-term exhaustion Canada will probably be the way going forward, giving the market the opportunity to reach down towards the bottom of this range again. If we can break down below the $36 level, it is likely that the market then breaks through there and goes looking towards the $35 level, perhaps even down to the $30.00 level. In general, the negative correlation between the US dollar and crude oil should continue to be something that a lot of people pay attention to. With this, I believe that eventually, people start to take a look at the lack of strength in demand, and the recent boost has probably had more to do with the possibility of stimulus coming, which has not worked yet, at least as far as demand is concerned.