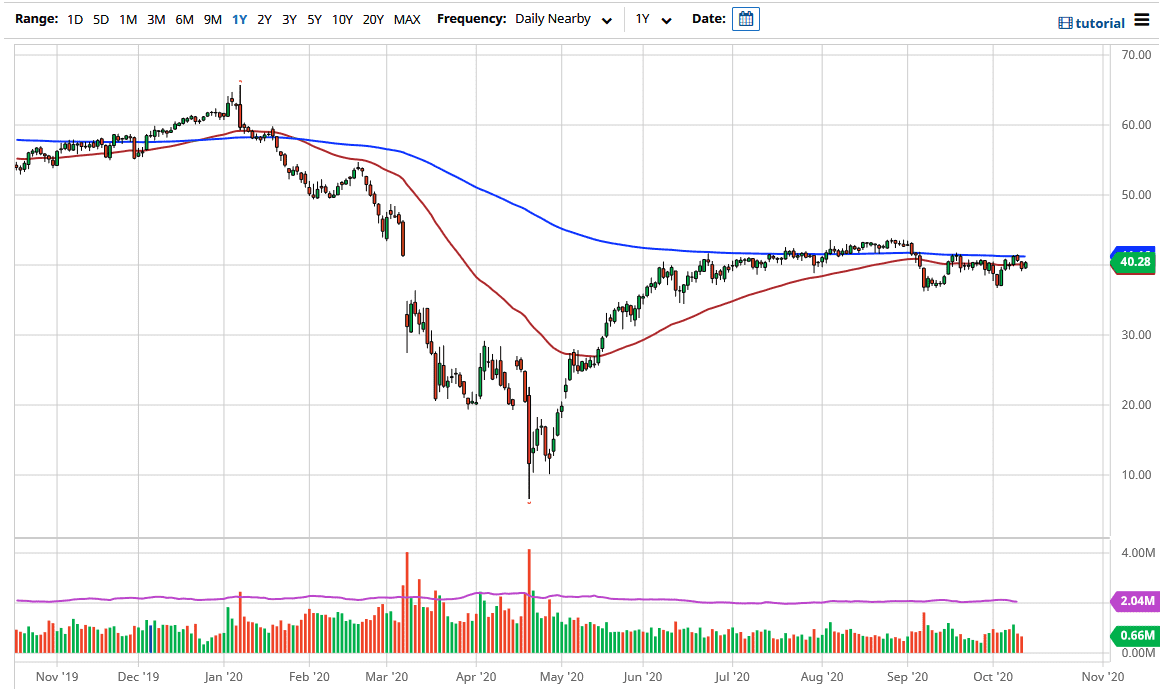

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Tuesday to break back above the 50 day EMA. Ultimately, the market still sees a lot of resistance above, especially near the 200 day EMA which is at basically $41. This is a market that continues to see a lot of volatility, mainly due to the fact that there has been an extraordinarily large amount of volatility as far as where we could go next. After all, there are a huge amount of concerns when it comes to various moving pieces.

Looking at the overall economic situation, it makes quite a bit of sense that people would be concerned about whether or not there is going to be demand for crude oil. After all, if the global economy is going to slow a bit, that means that there is no need for extra energy. Furthermore, there is the reality that we are significantly oversupplied with crude oil, so in that scenario, it is obvious that we should continue to see downward pressure.

On the positive side, the US dollar has been struggling a bit recently, and this suggests that we have potential upward pressure as well, because the commodity is priced in the same greenbacks. Ultimately, if we get a scenario where the US dollar plummets, then it would make sense that it takes more of those dollars to buy oil, thereby driving the price higher by extension. That being said, I think it is difficult to imagine that we will go much higher for a sustained move, we simply do not have the right economic environment, nor do we have a shortage. OPEC recently had a significant production cut agreement and line, but even that has not been enough to drive the price significantly higher. While OPEC may jawbone the market, but at the end of the day, the market continues to look at the supply/demand equation, which does not favor bullish pressure. With this, I like the idea of fading short-term rallies, simply because it gives you the ability to get involved but from a smaller time frame. As far as a longer-term move is concerned, it is probably going to be a bit difficult. Eventually, we will break out of this range between $37 and the $41 region, but right now I do not think it happens in the short term.