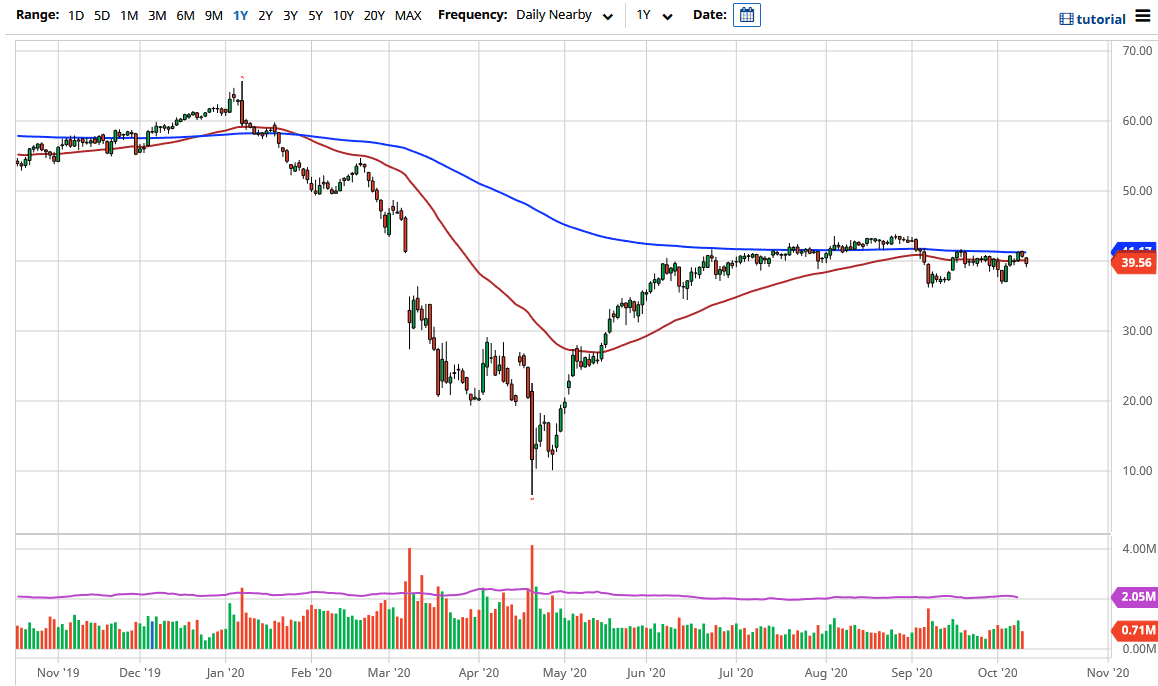

The West Texas Intermediate Crude Oil market has pulled back a bit during the trading session on Monday to kick off the week, showing signs of weakness yet again. The 200 day EMA has offered resistance yet again, and therefore it looks as if we are going to continue to go back and forth. That being said, I think that the market is completely range bound due to a whole plethora of reasons.

The US dollar has a major influence on the crude oil market, but during the trading session on Monday we saw the US dollar lose a bit of strength, while the oil market fell as well. That being said, it shows just how negative the crude oil market is at this point. Looking at this chart, I believe that we could go down towards the $37 level, which is where we had formed a couple of short-term lows recently. If we can break down below there, then the market is free to go much lower. When you look at the moving averages, both the 50 and the 200 day EMA, you can see that they are completely flat and with that being the case it makes quite a bit of sense that the market is ready to go sideways and kill time, or perhaps pull back.

To the downside, if the market breaks down it could be a pretty big move just waiting to happen. The $30 level underneath could be the target, and that will almost certainly have a certain amount of uncertainty out there as we have to pay attention to the lack of demand due to the fact that economies around the world continue to struggle. Looking at this chart, I think the short term is probably a lot of back-and-forth just waiting to happen, and therefore short-term traders will probably continue to get involved. All things been equal though, the idea of stimulus suggests that perhaps we could get more demand, but at the end of the day we have had several different stimulus packages in the past, so it should not be a surprise to think that perhaps we will only get a short-term boost before we break down again. If we broke above the $43.50 level, then it is likely that we could go looking towards the $45 level, possibly even the $50 level but that seems to be very unlikely.