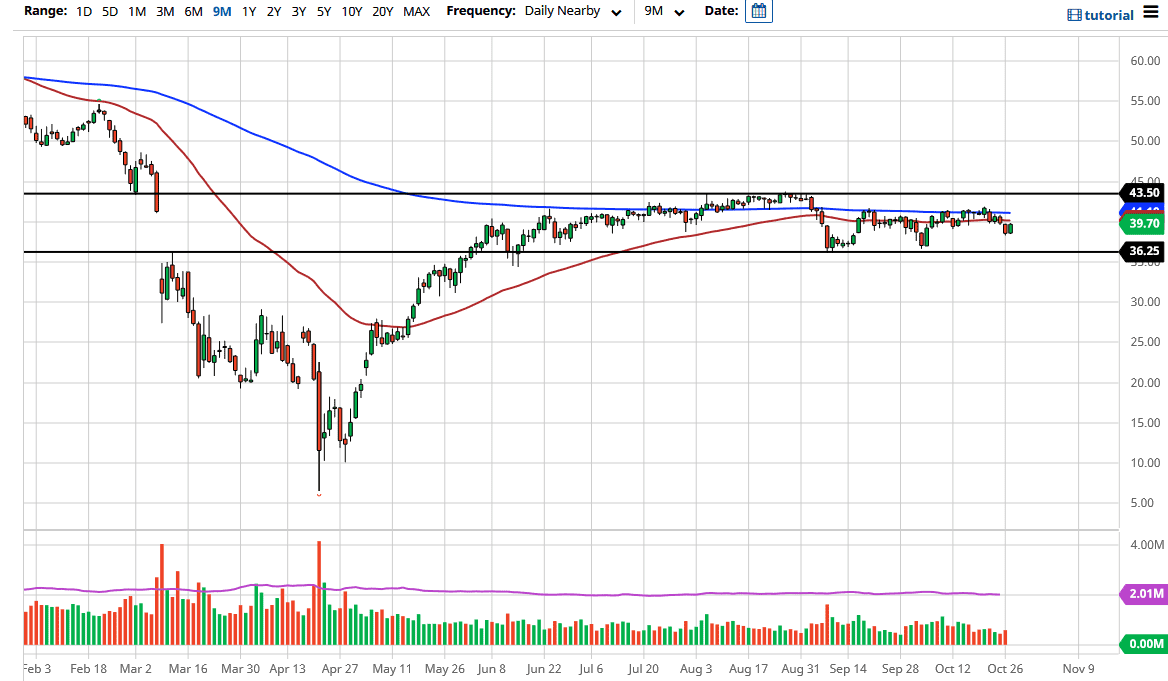

The 50 day EMA is very flat, just as the 200 day EMA is above there. In other words, this is a market that simply has nowhere to be. With that being said, the market is going to continue to go back and forth overall, as we are simply unaware of where to go next. Looking at this chart, it is obvious that we have massive amount of support and resistance right around this area, with the $36.25 level underneath being massive support. To the upside, the $43.50 level is massive resistance. In other words, the market is essentially trying to figure out who has more momentum at the moment.

Looking at this chart, if we were to break down below the three $6.25 level, the market is likely to go looking towards the $35 level, possibly down to the $30 level given enough time. That being said, the question now is whether or not we get enough selling pressure to make that happen. On the other hand, if we do get enough bullish pressure to break out, that could be a massive breakout just waiting to happen. That being said, it is almost impossible to imagine that scenario as we continue to see sellers jump in and push lower.

At this point, it is a question of whether or not OPEC is going to be able to keep the production numbers down, or whether or not the strengthening US dollar comes in an FX this market as well. Ultimately, this is a scenario that I think continues to be noisy to say the least, and therefore I think you have to play this market as a range bound market more than anything else at the moment. Furthermore, we have the election noise and of course Brexit that could throw the currency markets around, causing a bit of a “knock on effect” over here. At this point, I think that the market is simply looking for some type of clarity, but we do not have that right now, and therefore it is likely that we will see more choppy behavior than anything else so keep your position size relatively light and focus on short-term charts more often than not.