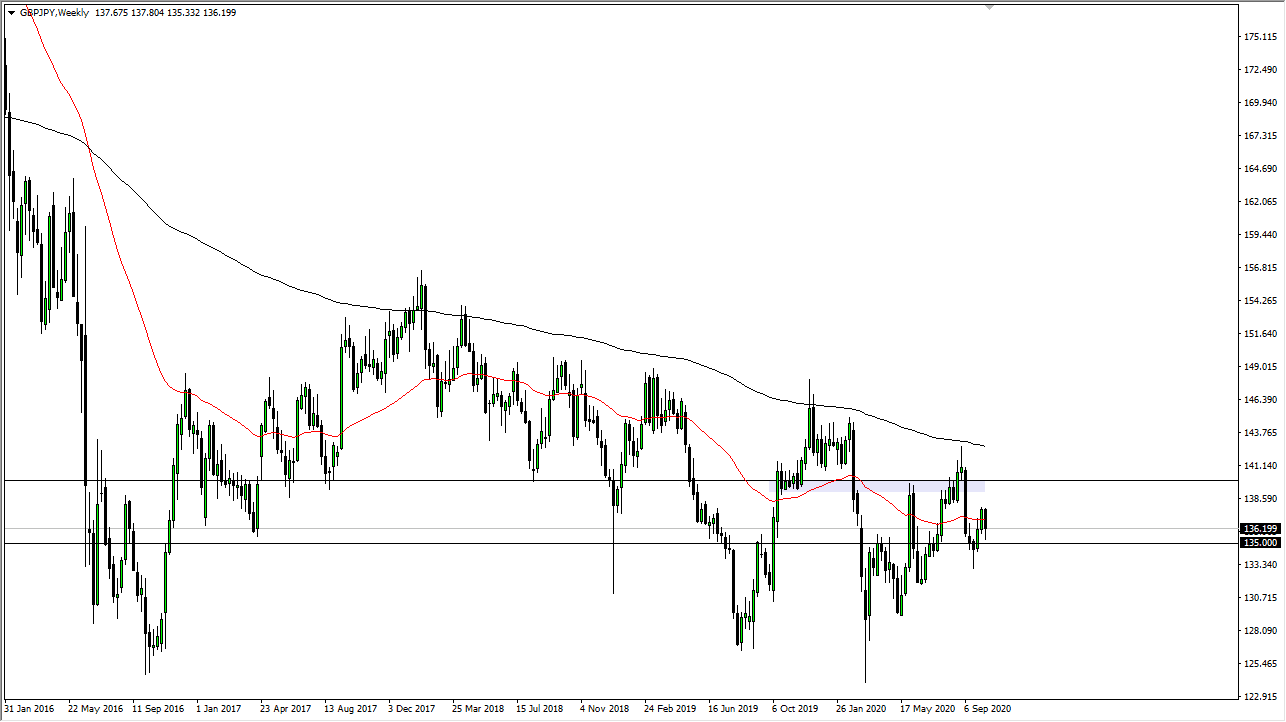

GBP/JPY

The British pound broke down a bit during the trading week, reaching down towards the ¥135 level. At this point, the market has rallied a bit, reaching towards the ¥135 level. Ultimately, this is a market that I think continues to see a lot of noise in general, but at this point, I think the 100 ¥135 level continues to cause buying pressure which perhaps sends the market back towards the top of the range of the last couple of weeks, near the ¥138 level.

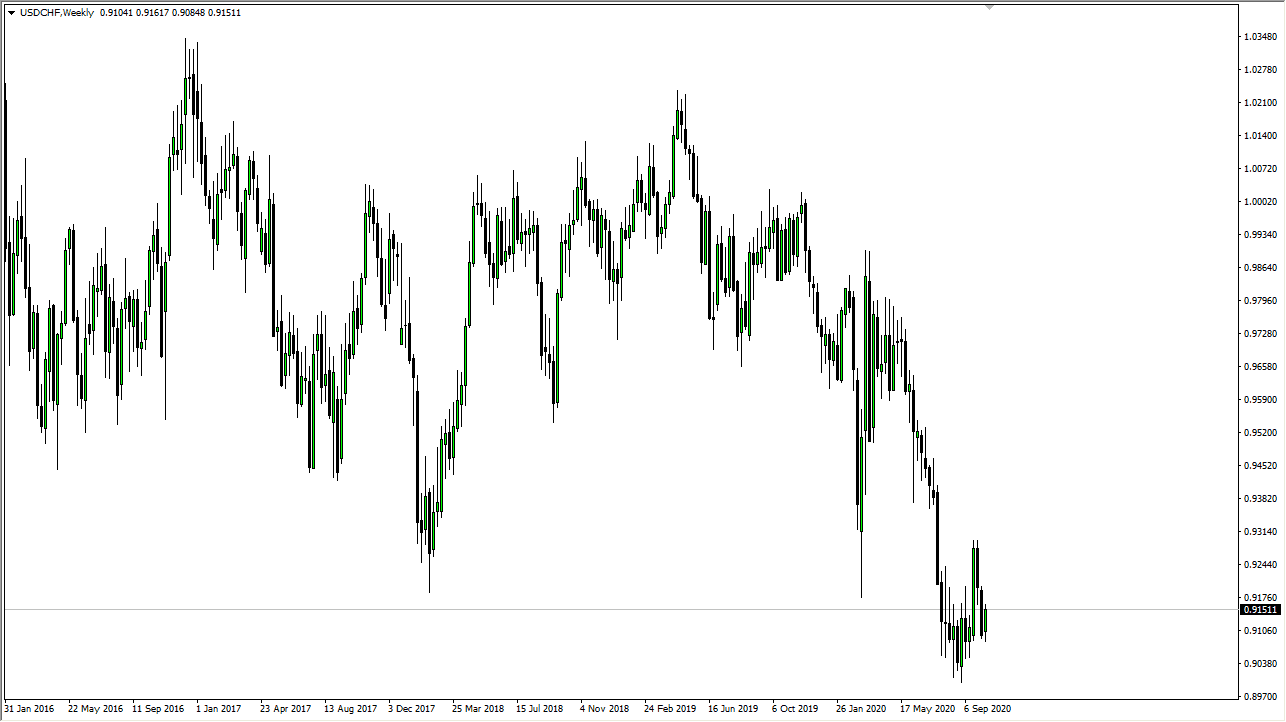

USD/CHF

The US dollar has rallied a bit during the course of the week as we are starting to see the greenback get a little bit of love after what has been a very tough couple of months. Having said that, it is likely that short-term pullbacks will probably be bought into as the greenback could go as high as the 0.93 handle. To the downside, I think there is massive support at the 0.90 level that will continue to be crucial for this market. With that, any time we got close to that area it is likely that we will find buyers.

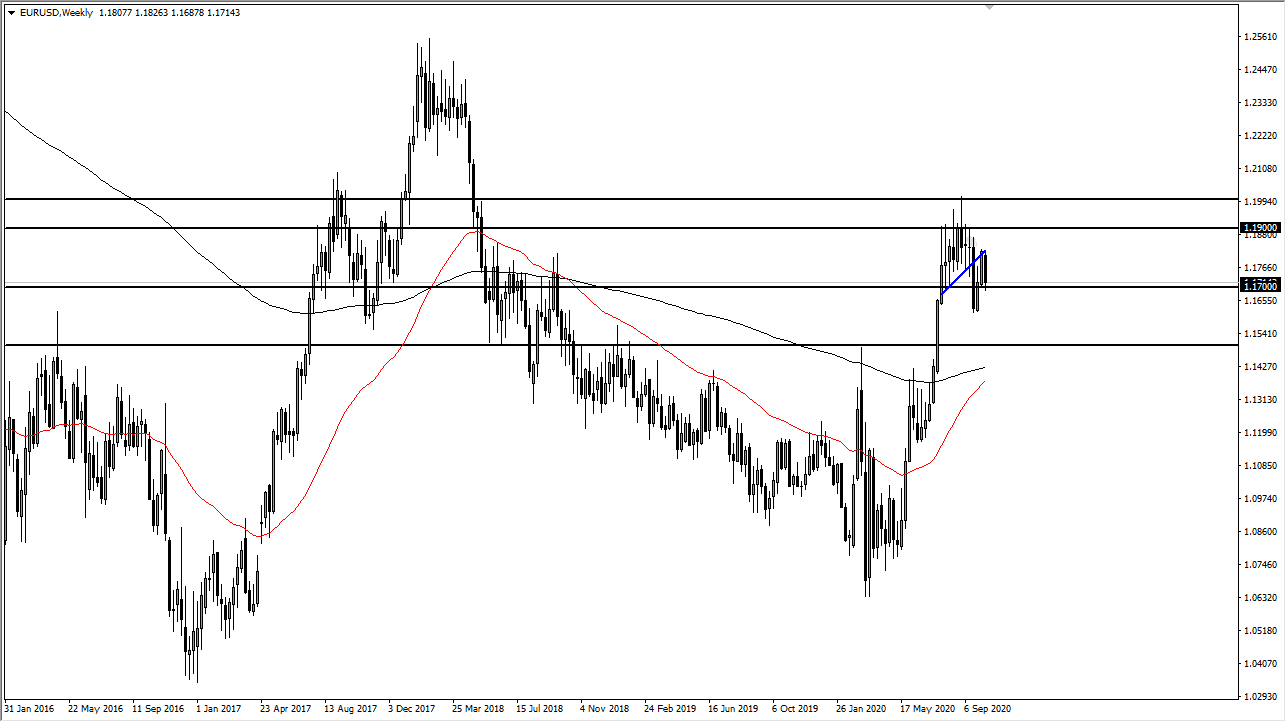

EUR/USD

The Euro had a rough ride against the US dollar, and at this point, I think the market is likely to see further downward pressure but in the short term, we may get a little bit of a bounce. That bounce should offer a nice opportunity to start shorting again as we have recently broken through a major trendline. Longer-term, if we can break down below the 1.17 level, we are very likely to go looking towards the 1.16 handle next. After that, there is even more support and a bigger target below at the 1.15 level which will be very interesting for a lot of longer-term traders.

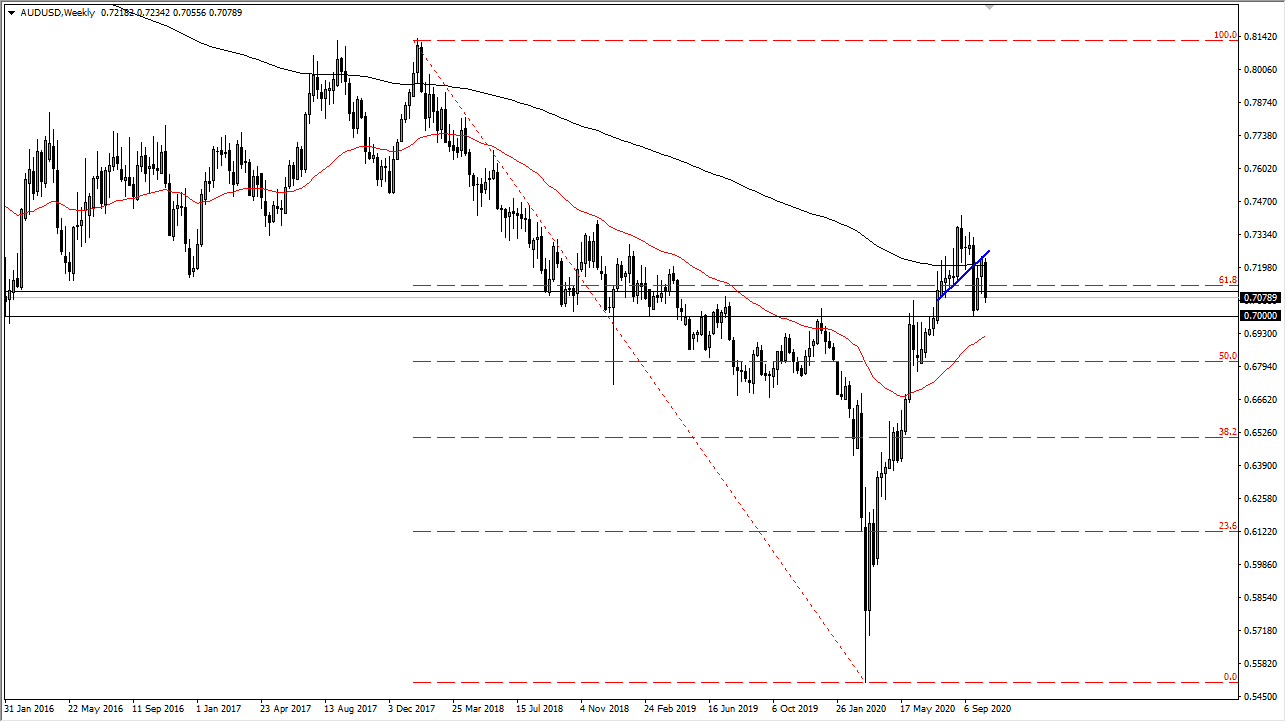

AUD/USD

The Australian dollar has broken down significantly during the course of the week but has yet to make a “lower low.” That being said, it is interesting that we are approaching the 0.70 level, and if we can get below there then we could see this pair unwind. Keep in mind that the Australian dollar is highly sensitive to risk appetite. If we get a lot of negativity and fear out there, then it is likely that we continue to go lower. While we could go higher, I think there is still a lot of concern out there to keep this market somewhat sedated. At best, I suspect that we go sideways.