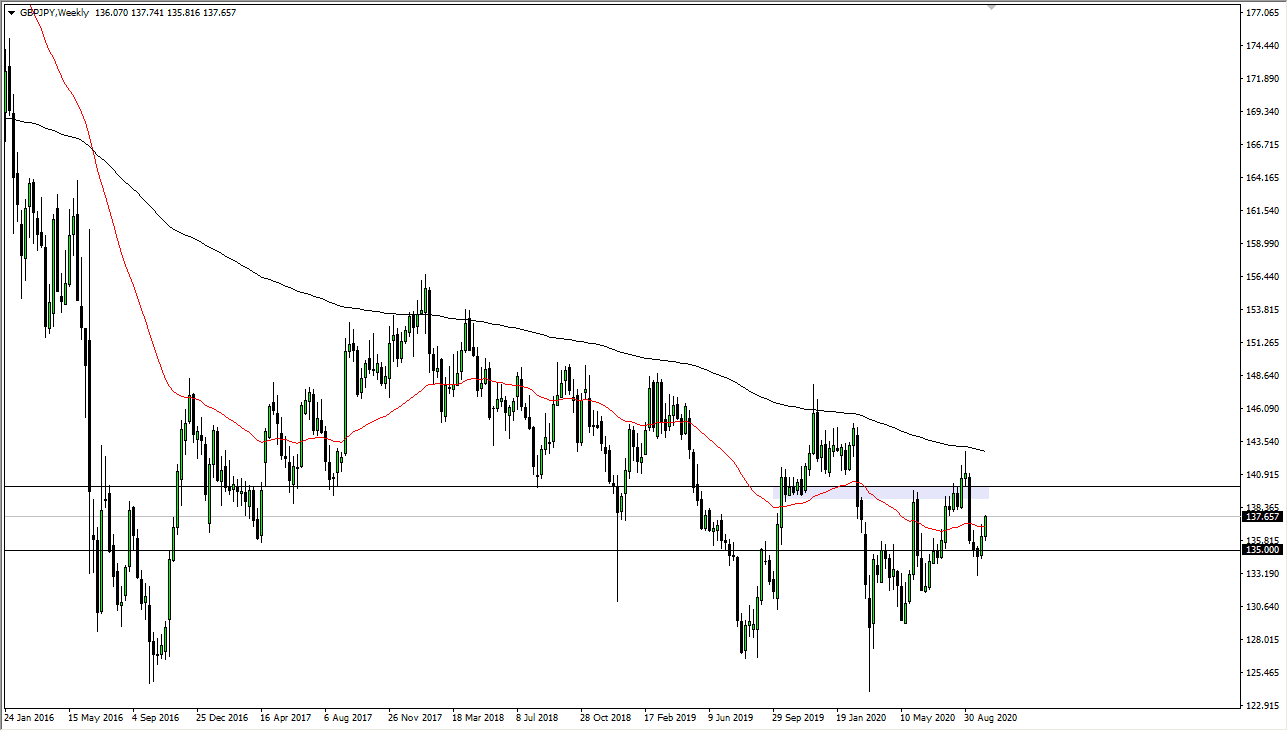

GBP/JPY

The British pound has gone straight up in the air against the Japanese yen during the course of the week, showing more of a “risk-on” feeling around the world. I think that as long as the stimulus keeps coming, people will be looking to buy riskier assets. Having said that, this market still faces a massive amount of resistance above at the ¥140 level. I believe that we will continue to be very choppy in the immediate vicinity.

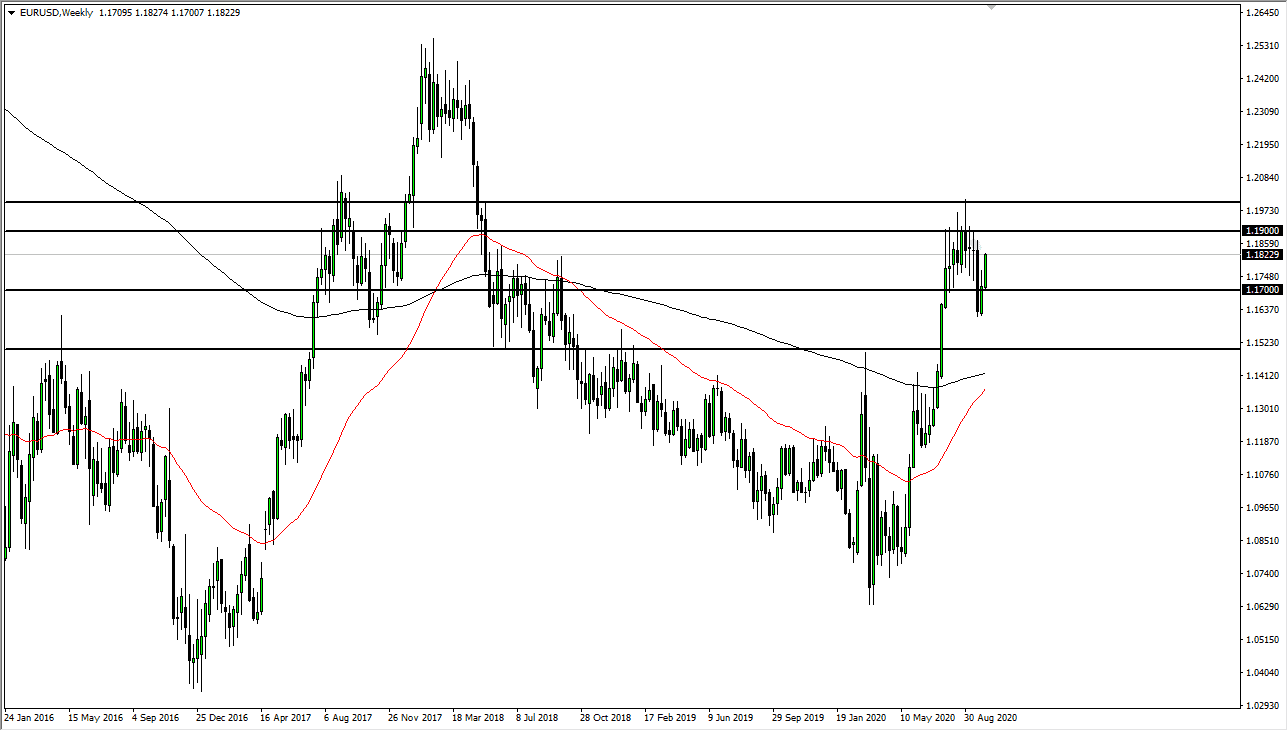

EUR/USD

The Euro has rallied during the course of the week, showing signs of massive strength as we are closing towards the top of the range. This is based upon the idea of the United States entering a new stimulus or a fiscal package, and this is the market trying to front-run the idea of the US dollar getting hammered. This is a continuation of the uptrend, but the biggest problem that I have here is that there is so much noise between here and 1.20, but I think this market has a lot of trouble just waiting to happen. If we were to somehow break above the 1.20 level, then you could become quite a bit more confident about the move higher. In the meantime, I have to question whether or not we are simply going to bounce around between 1.1850 and 1.17 for the time being?

AUD/USD

The Australian dollar initially fell during the course of the week but found enough support near the 0.71 level to turn around and bounce. By bouncing this way, it has, we have slammed into the bottom of the uptrend line that had defined the breakdown from before, and therefore we are at a very crucial point. Just above, the 0.73 level will offer resistance. I think we are going to see more of a grind back and forth than anything else, as we continue to hover around the 200 week EMA. The next couple of weeks are going to be nauseating when it comes to volatility.

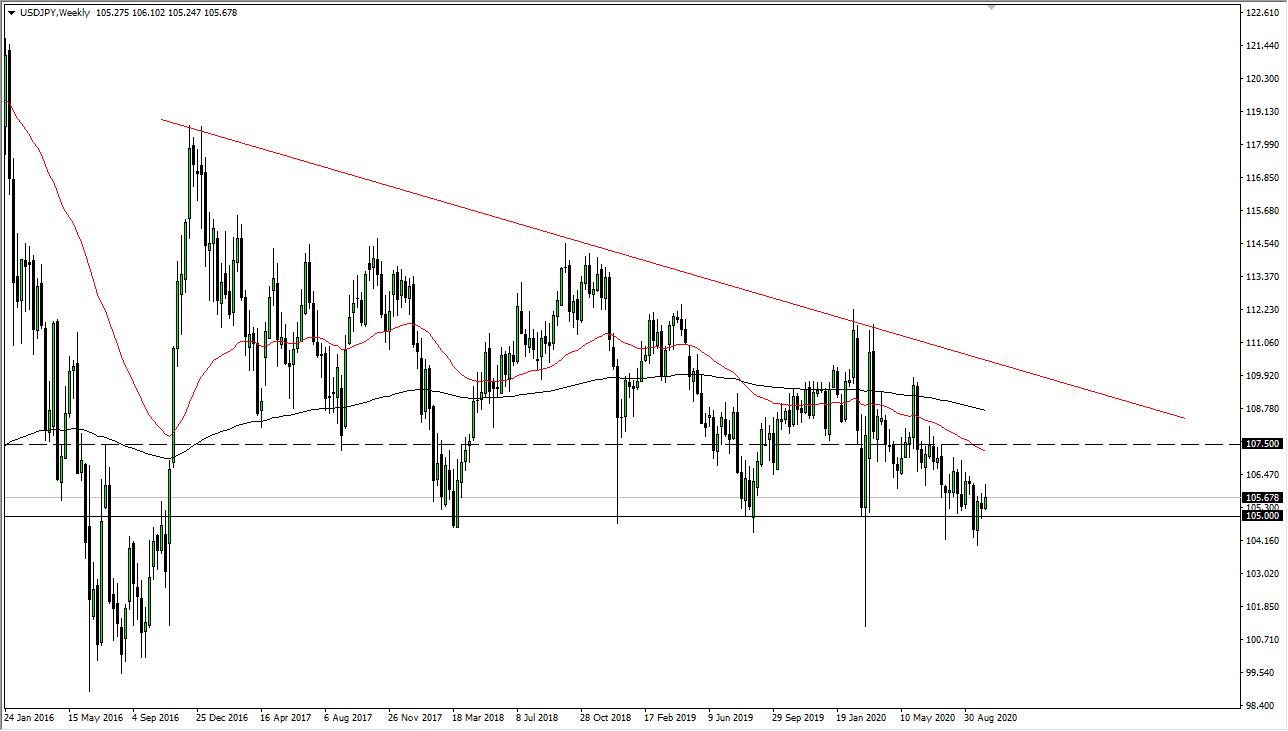

USD/JPY

The US dollar rallied initially against the Japanese yen for the week, but the US dollar continues to get hammered due to the idea of fiscal stimulus coming sooner rather than later. Furthermore, this pair does tend to fall if there is more of a “risk-off” type of scenario, so that also adds more credence to the idea of the downside. The ¥105 level continues to look like a potential target.