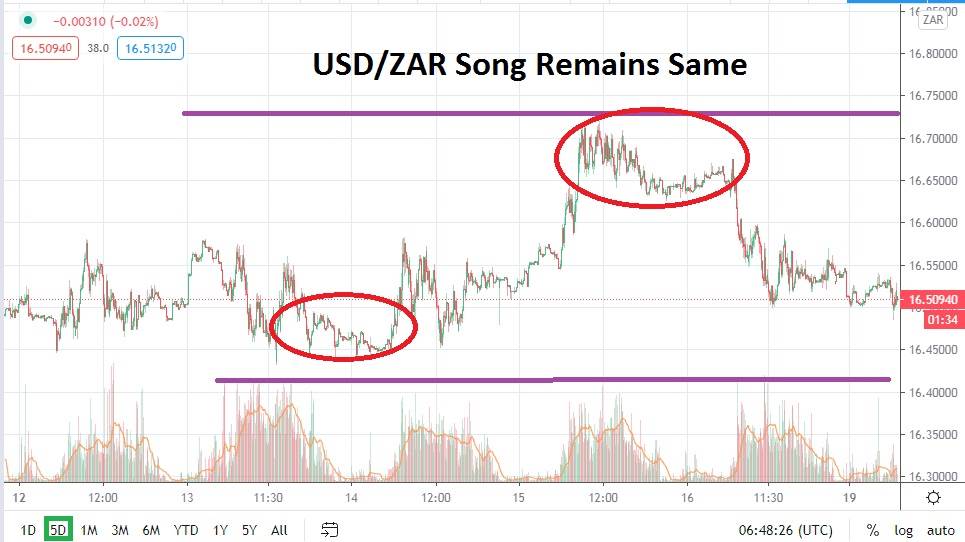

The USD/ZAR has embraced an intriguing value range which may entice technical traders to speculate even if they are not typically paying attention to the South African Rand. The 16.50000 juncture has become a dynamic inflection area for the USD/ZAR and it has produced solid reversals in a near sing song manner which technically has produced dynamic rhythm. It is not often that support and resistance levels reflect the same level of magnitudes a handful of trading sessions later. However, the USD/ZAR has produced not only a consolidated range, but also managed to maintain rather interesting target zones.

Technical traders who like to pursue trends with momentum limit orders may be drawn to the USD/ZAR because support levels appear to be quite adequate and have shown a limited ability to be broken lower, while resistance junctures have served as lift off spots when broken and higher values are pursued which are still within the known range of the forex pair. The 16.58000 resistance level appears to be a rather dynamic value which has produced additional bullish momentum when trading has been sustained above this price and it has clearly set off test sof the 16.70000 level for the USD/ZAR until pushed back again towards support.

The USD/ZAR is a forex pair technical traders can take advantage of buying and selling opportunities and trade fairly comfortably. This does not mean there is no risk within the USD/ZAR. This forex pair does have an inclination to produce sudden breakouts which can be volatile and leave speculators bloodied. However for risk takers who also have the ability to manage their positions via the use of stop loss orders, the USD/ZAR may prove to be a worthwhile speculative asset near term.

A large part of the rather consolidated dynamic within the USD/ZAR currently is the mixed investor sentiment shadowing the global markets. Equity indices have proven nervous but nevertheless have maintained their higher values, particularly in the US market which have spurred on other international stock exchanges.

However, the US elections which are only a couple of weeks away and the recent surge of coronavirus throughout Europe have created a tremor of fragile behavior for financial institutions too. Risk is certainly being pursued by investors who seek higher profits, but many are waiting for a loud thud to engulf the room and create havoc. This sets the tone for the USD/ZAR to continue to test its range while it maintains its stance within the vapors of its bearish mid-term range. It’s all about following momentum within the USD/ZAR near term and being careful of higher targets for resistance and support which has proven capable.

South African Rand Short Term Outlook:

Current Resistance: 16.58000

Current Support: 16.43000

High Target: 16.79100

Low Target: 16.33000