South Africa continues to struggle with slow-moving reforms, and President Cyril Ramaphosa's efforts to revitalize the economy are met with criticism and were labeled xenophobic to some degree. While the Covid-19 pandemic accelerates globally with the second wave of infections, Africa's most industrialized nation attempts to restructure its economy. A rising trend towards anti-immigration, amid record-high unemployment, adds to domestic issues for the government to address. The USD/ZAR presently challenges its short-term resistance zone following a breakdown and rejected reversal, but the build-up in bearish pressures hints at a second breakdown.

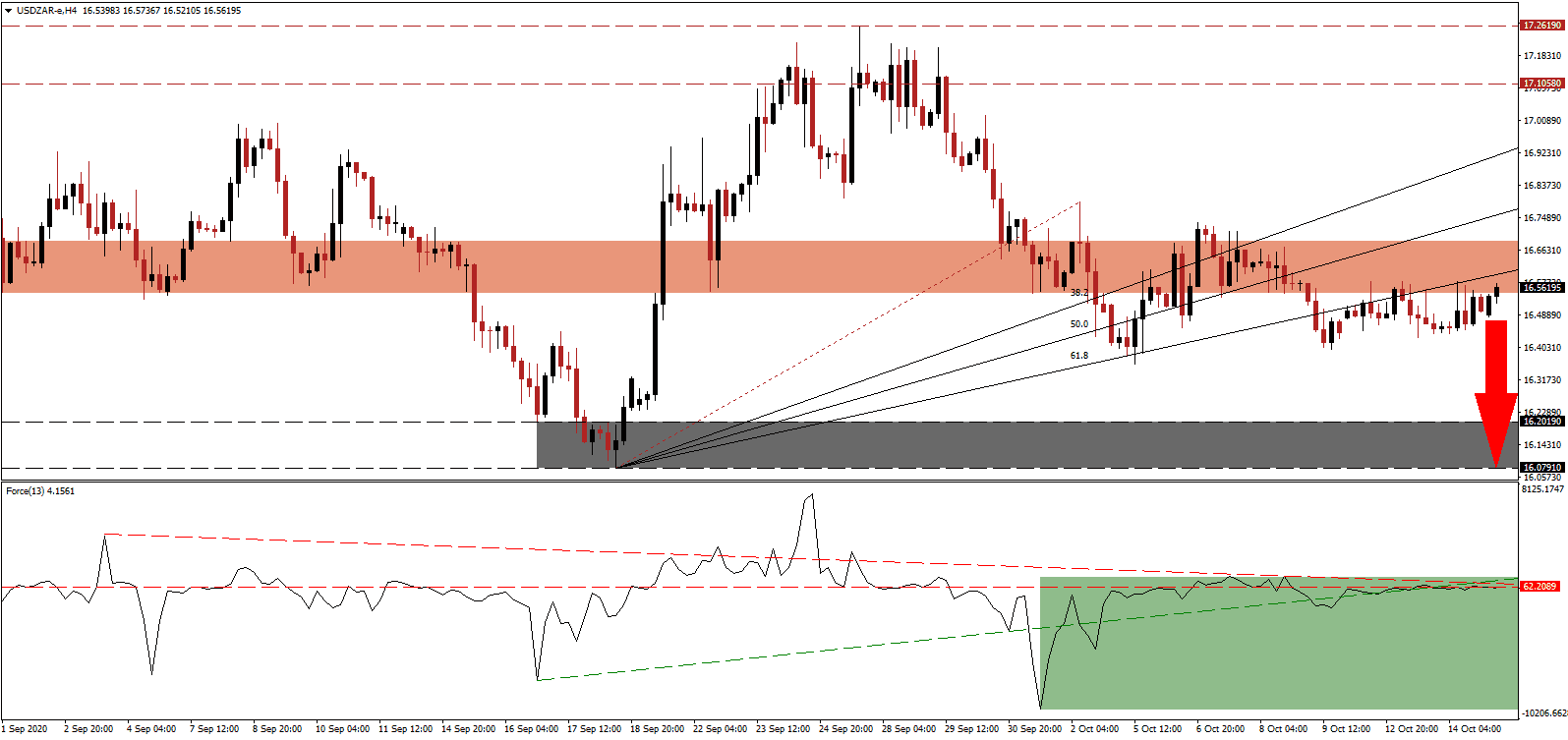

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level, while the descending resistance level maintains downside pressures. Adding to the rise in bearish momentum was the breakdown below its ascending support level, as marked by the green rectangle. This technical indicator is poised to move below the 0 center-line, granting bears complete control over the USD/ZAR.

According to the latest World Economic Outlook by the International Monetary Fund (IMF), the South African economy will contract by 8.0% in 2020, unchanged from its June assessment. It revised the 2021 GDP forecast down by 0.5% to 3.0%. The unemployment rate is forecast to reach 37%, while some economists note the extended unemployment rate may climb to 50%. After re-entering its short-term resistance zone located between 16.5471 and 16.6873, as marked by the red rectangle, it faces rejection by the ascending 61.8 Fibonacci Retracement Fan Resistance Level.

Adding to short-term optimism is the latest reading from the BankservAfrica Economic Transaction Index (BETI), which measures financial transactions between South African banks. It surprised to the upside with an increase of 0.4% in September, the fourth consecutive monthly improvement, and an indicator for a record expansion in the third quarter, anticipated between 40% to 50% annualized. It positions the USD/ZAR to resume its correction and accelerate into its support zone between 16.0791 and 16.2019, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 16.5600

Take Profit @ 16.0800

Stop Loss @ 16.6500

Downside Potential: 4,800 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 5.33

A breakout in the Force Index above its ascending support level, serving as resistance, could pressure the USD/ZAR higher. The upside potential remains confined to its intra-day high of 16.7926, the end-point of its Fibonacci Retracement Fan sequence. With Covid-19 infections rising across the US, favored to exceed the previously daily records, the long-term outlook for the US Dollar continues to deteriorate. Forex traders should sell any rallies moving forward, as the US government is poised to add to its debt levels.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 16.7000

Take Profit @ 16.7900

Stop Loss @ 16.6500

Upside Potential: 900 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 1.80