South Africa may reintroduce several lockdown restrictions to slow the second wave of the Covid-19 pandemic amid a rise in community transmissions. The South African Minister of Health, Zweli Mkhize, and his wife tested positive for Covid-19, serving as a reminder that nobody is immune to the threat of contracting it. Africa’s most industrialized country shows signs of the virus across all parts of society and in rural areas, suggesting the next wave will be more severe than the previous one. The USD/ZAR presently challenges its support zone, from where a breakdown is favored amid dominant bearish momentum.

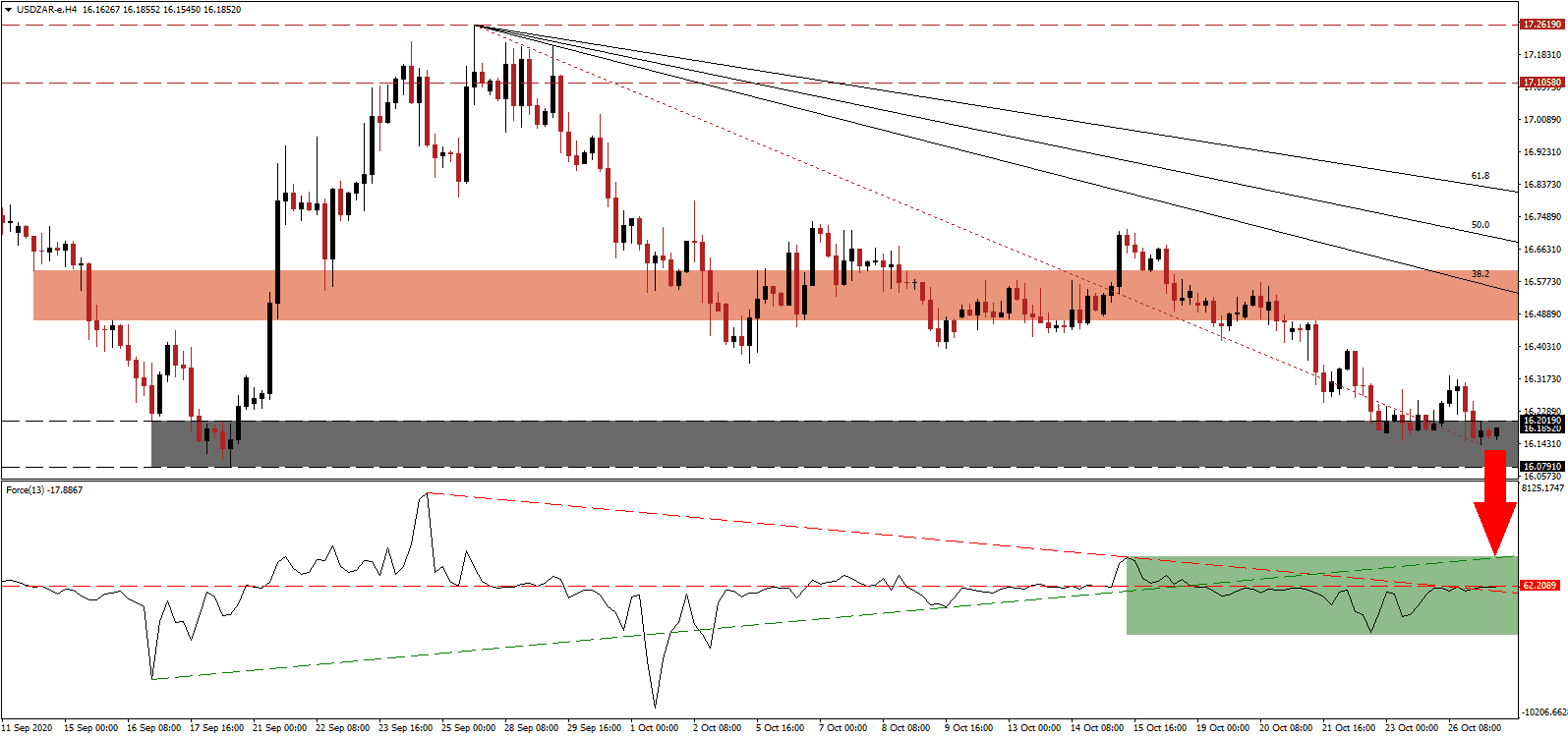

The Force Index, a next-generation technical indicator, remains below the horizontal resistance level but eclipsed its descending resistance level. Bearish pressures intensified following the breakdown below its ascending support level, as marked by the green rectangle. This technical indicator maintains its position below the 0 center-line in negative territory, allowing bears to retain control over the USD/ZAR.

Jeffrey Schultz, a BNP Paribas senior economist, outlined a scenario where he believes the South African economy will outperform expectations by the South African Reserve Bank (SARB). He points to the most recent high-frequency indicators for the mining, manufacturing, and retail trade sector, which came in above forecast, suggesting a 65.0% quarter-over-quarter GDP growth rate in the third quarter. Following the breakdown in the USD/ZAR below its short-term resistance zone located between 16.4710 and 16.6054, as marked by the red rectangle, downside momentum expanded.

Adding a long-term growth catalyst is the confirmation by the South African Department of Energy that cities may source their electricity independently. It ends the power monopoly of state-owned Eskom, responsible for rolling blackouts over the past thirteen years, and partially blamed for the economic problems of South Africa during that period. Many cities seek to diversify their energy needs via alternative energy, primarily solar. The USD/ZAR is well-positioned to collapse below its support zone located between 16.0791 and 16.2019, as identified by the grey rectangle. Price action will face its next support zone between 15.4844 and 15.7308, while the descending Fibonacci Retracement Fan sequence enforces the bearish chart pattern.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 16.1900

- Take Profit @ 15.4900

- Stop Loss @ 16.4000

- Downside Potential: 7,000 pips

- Upside Risk: 2,100 pips

- Risk/Reward Ratio: 3.33

Should the Force Index reclaim its ascending support level, serving as resistance, the USD/ZAR could attempt a temporary reversal. With the outlook for the US economy into the holiday shopping season bleak, political uncertainty elevated, and US monetary policy designed to weaken the US Dollar, Forex traders should sell any rallies. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 16.5500

- Take Profit @ 16.7900

- Stop Loss @ 16.4000

- Upside Potential: 2,400 pips

- Downside Risk: 1,500 pips

- Risk/Reward Ratio: 1.60