Most of the developed world struggles with an out-of-control second wave of the Covid-19 pandemic and a public tired of restrictions. Many governments decided to waive the white flag, admit defeat, and hope the population will follow recommendations with compliance until a treatment exists. Singapore remains one of a few countries that have the situation under control, reporting single-digit new daily infections, and Asia overall is positioned to handle what a growing number of epidemiologists call a challenging winter, better due to a more disciplined society. The USD/SGD assembled enough bullish momentum to extend its breakout above its support zone temporarily, giving way for the next phase of the sell-off.

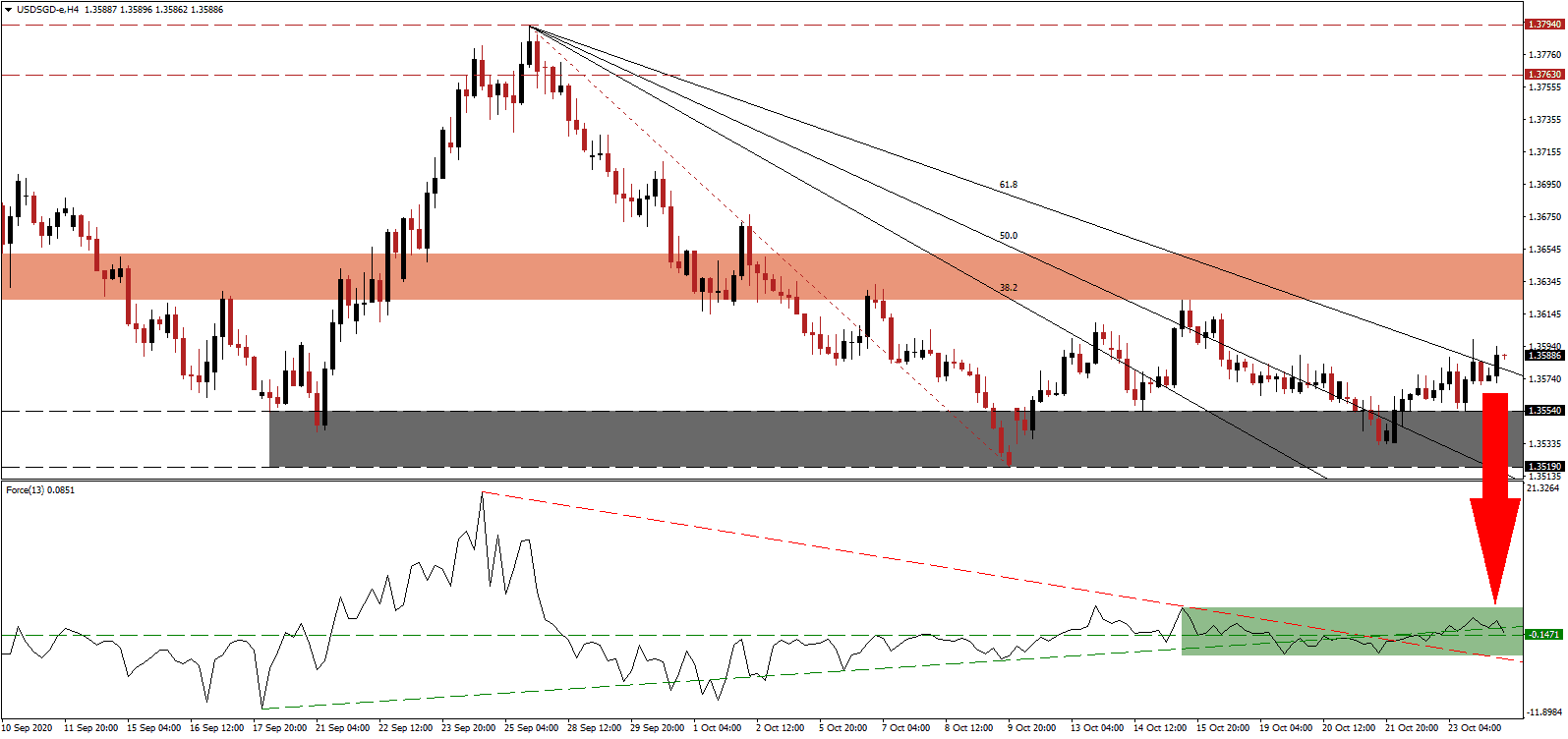

The Force Index, a next-generation technical indicator, converted its horizontal resistance level into support but reverted below its ascending support level. Bullish momentum overtook bearish one following the breakout above its descending resistance level, as marked by the green rectangle, but shows indications of a reversal. This technical indicator is on course to cross below the 0 center-line, handing control over the USD/SGD back to bears.

Gan Kim Yong, the Minister for Health of Singapore, announced a pilot project for pre-event Covid-19 testing using Antigen Rapid Tests (ART) on October 20th, 2020. Earlier this morning, it was carried out during the opening of Singapore International Energy Week (SIEW) 2020 and labeled a success. It is part of efforts by the government to ease restrictions on group sizes for events, as the export-oriented Southeast Asian financial center adjusts to a new normal. While the USD/SGD may attempt to spike into its short-term resistance zone located between 1.3623 and 1.3652, as identified by the red rectangle, the long-term bearish trend remains intact, favoring a new breakdown sequence.

Singapore and Germany announced a Reciprocal Green Lane agreement. It will allow essential business travelers and those on official business to commute via direct flights. Singapore has a similar arrangement with ten other countries, which may serve as a model moving forward until an effective treatment will convert the Covid-19 pandemic into a seasonal one together with the influenza virus. While the USD/SGD eclipsed its descending 61.8 Fibonacci Retracement Fan Resistance Level, the reversal in momentum suggests a retracement into its support zone located between 1.3519 and 1.3554, as marked by the grey rectangle. A collapse into its next support zone between 1.3442 and 1.3462 is likely.

USD/SGD Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 1.3590

- Take Profit @ 1.3445

- Stop Loss @ 1.3630

- Downside Potential: 145 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 3.63

A renewed and sustained advance in the Force Index above its ascending support level, serving as resistance, may lead the USD/SGD higher in the short-term. With uncertainty over the US election, new daily record-high Covid-19 infections, and limited restrictions to halt the spread, Forex traders should sell any rallies. The US Dollar also faces downside pressure from monetary policy, reducing the upside potential to its intra-day high of 1.3676.

USD/SGD Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 1.3645

- Take Profit @ 1.3675

- Stop Loss @ 1.3630

- Upside Potential: 30 pips

- Downside Risk: 15 pips

- Risk/Reward Ratio: 2.00