Many countries are reporting an alarming increase in Covid-19 infections. Singapore maintains relative control over the pandemic, with low double-digit new daily cases, 245 active ones of which none are critical. It allows Singapore to recalibrate its domestic economy and strengthen its core industries. The export-oriented country cannot escape the global economic slowdown in trade, expected to remain for a prolonged period. The USD/SGD paused its corrective phase following the breakdown below its short-term resistance zone and is presently challenging it, a healthy development for the long-term downtrend.

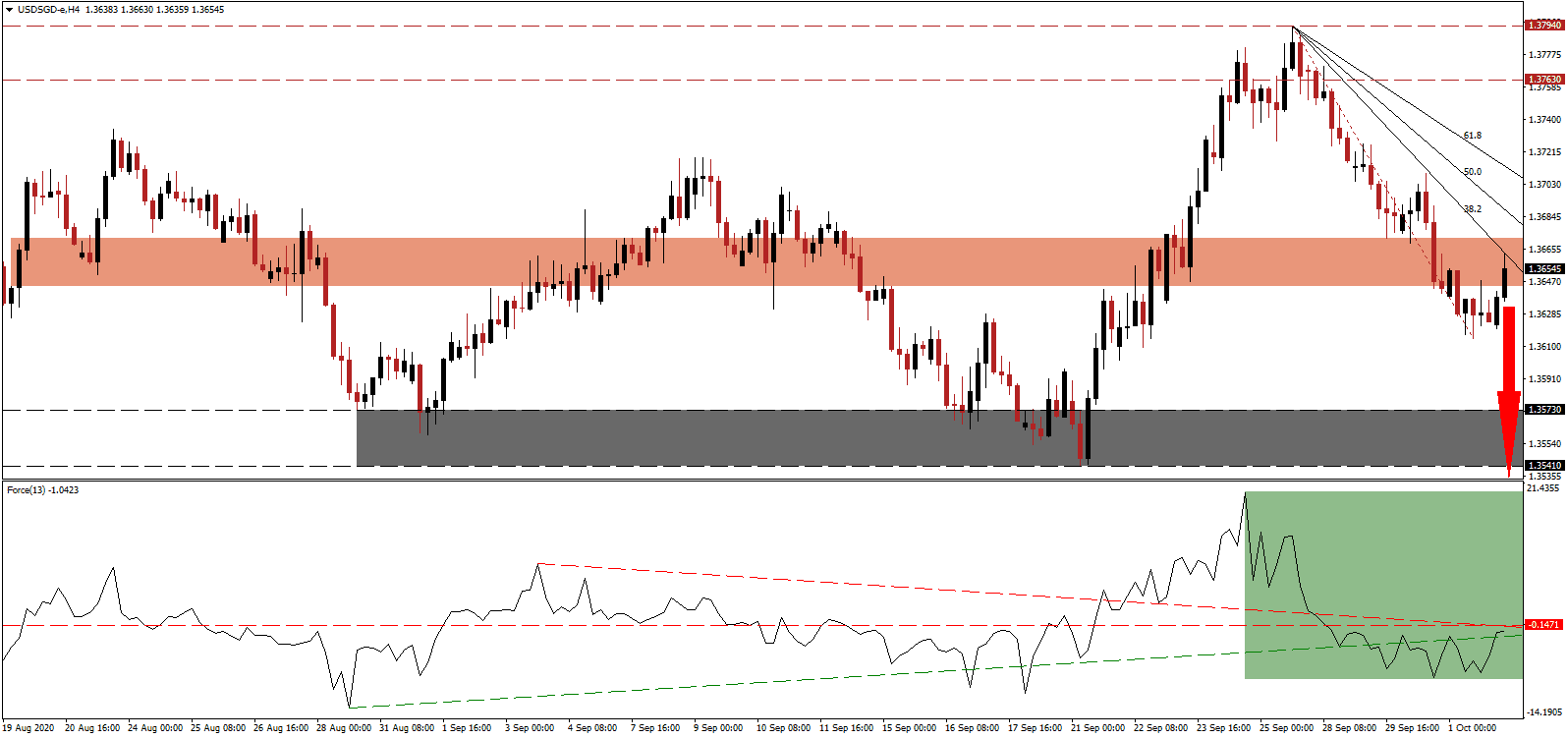

The Force Index, a next-generation technical indicator, retreated from a new multi-week peak, and a minor negative divergence materialized. After correcting below its ascending support level, it reclaimed it, as marked by the green rectangle, but maintains its position below the horizontal resistance level. The descending resistance level is favored to pressure this technical indicator farther into negative territory with bears in charge of the USD/SGD.

Industrial production for August surprised to the upside with a 13.7% rise year-over-year, led by demand for semiconductors, up 56.9%, and other electronics, up 44.2% powering data centers, cloud services, and the 5G network. Precision engineering and biomedical manufacturing rose 9.4% and 8.4%, responsively, adding to optimism for third-quarter GDP. The USD/SGD presently retests the strength of its short-term resistance zone located between 1.3644 and 1.3672, as marked by the red rectangle, enforced by its descending 38.2 Fibonacci Retracement Fan Resistance Level.

Adding to positive economic progress, Josephine Teo, the Minister of Manpower and the Second Minister of Home Affairs of Singapore, confirmed that more than 1,500 companies announced 9,000 professional job openings, of which 81% are high-paying management positions. The private property market booms despite the Covid-19 pandemic, but small business confidence dropped to an all-time low, suggesting an even economic recovery. The USD/SGD is well-positioned to accelerate into its support zone located between 1.3541 and 1.3573, as identified by the grey rectangle, from where a breakdown may extend the correction.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.3655

- Take Profit @ 1.3535

- Stop Loss @ 1.3690

- Downside Potential: 120 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 3.43

Should the Force Index use its ascending support level to extend its current advance, the USD/SGD could attempt a breakout. US economic data remains mixed, with employment sub-components confirming contraction. Initial jobless claims remain high, and the US Federal Reserve monetary policy depressed the US Dollar. Forex traders should view any price spike as a selling opportunity with the upside potential limited to its resistance zone between 1.3763 and 1.3794.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.3720

- Take Profit @ 1.3765

- Stop Loss @ 1.3690

- Upside Potential: 45 pips

- Downside Risk: 30 pips

- Risk/Reward Ratio: 1.50