Singapore maintains control over the Covid-19 pandemic, primarily due to a highly disciplined public, unlike the US and Europe, where many ignore public health guidelines. Despite the adoption of a new normal, the Monetary Authority of Singapore (MAS) cautioned that the recovery would be gradual and uneven. Consumer spending is forecast to slow, and the central bank suggests the third-quarter economic rebound will conclude with an incomplete recovery. The USD/SGD was rejected by its short-term resistance zone, and bearish momentum is on the rise.

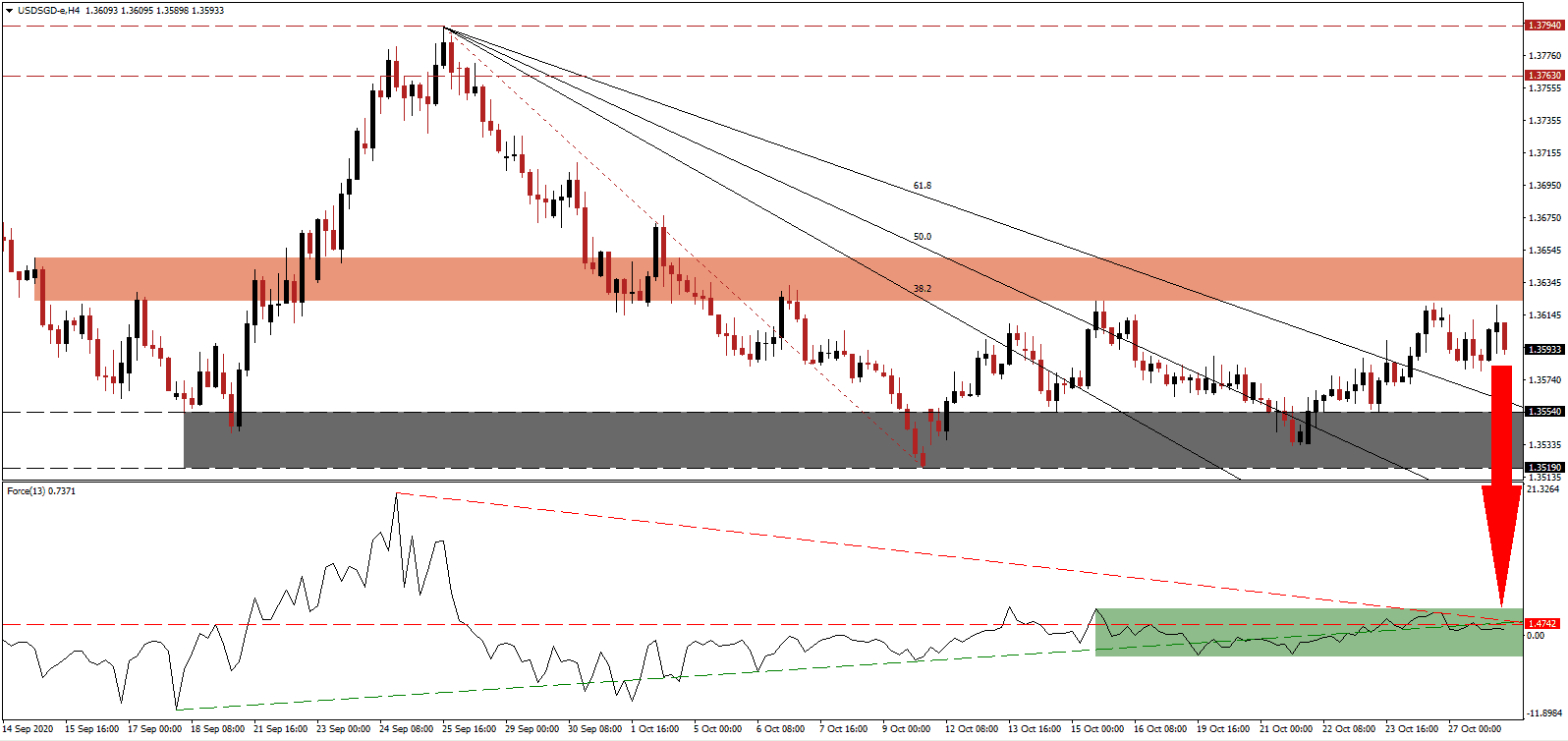

The Force Index, a next-generation technical indicator, recorded a lower high, resulting in an adjustment to the descending resistance level. Bearish momentum expanded after the breakdown below its horizontal support level, as marked by the green rectangle, from where a collapse below its ascending support level followed. Bears wait for this technical indicator to slide below the 0 center-line to regain complete control over the USD/SGD.

September industrial production surged 24.2% year-over-year, crushing forecasts for a 2.5% expansion. August was also revised higher to a gain of 15.4%. The back-to-back increases follow three consecutive months of increases, but MAS forecasts the trend will slow down amid a cooling global economy. Following the fourth rejection in the USD/SGD by its short-term resistance zone located between 1.3623 and 1.3650, as marked by the red rectangle, a new breakdown sequence is likely to materialize.

While the biomedical, electronics and chemical sectors continue to outperform, the domestic labor market recovery to pre-Covid-19 levels takes longer as compared to the global financial crisis of 2008, per an assessment by MAS. The central bank noted changes in consumption patterns, which will impact the structure of the labor market. A breakdown in the USD/SGD below its descending 61.8 Fibonacci Retracement Fan Support level can result in a collapse below its support zone between 1.3519 and 1.3554, as identified by the grey rectangle. The next support zone awaits between 1.3442 and 1.3462.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.3595

- Take Profit @ 1.3445

- Stop Loss @ 1.3630

- Downside Potential: 150 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 4.29

Should the Force Index spike above its descending resistance level, the USD/SGD could attempt a fifth breakout. Forex traders should consider it a secondary short-selling opportunity. The worsening outlook for the US economy magnified after the country crossed 9,000,000 confirmed infections. The upside potential remains confined to its intra-day high of 1.3676.

USD/SGD Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 1.3645

- Take Profit @ 1.3675

- Stop Loss @ 1.3630

- Upside Potential: 30 pips

- Downside Risk: 15 pips

- Risk/Reward Ratio: 2.00