With the second Covid-19 wave of infections rampaging across Europe and globally, while the economy is under significant stress, more European countries quietly adopt the highly criticized Swedish approach to the pandemic. The death toll in Sweden was higher than its Nordic neighbors, and the economic performance was not significantly better. Politicians now hope that voluntary social distancing measures will deliver results, but the data so far suggests otherwise. The USD/SEK bounced off its support zone, but the well-established bearish chart pattern is intact with bearish pressures dominant.

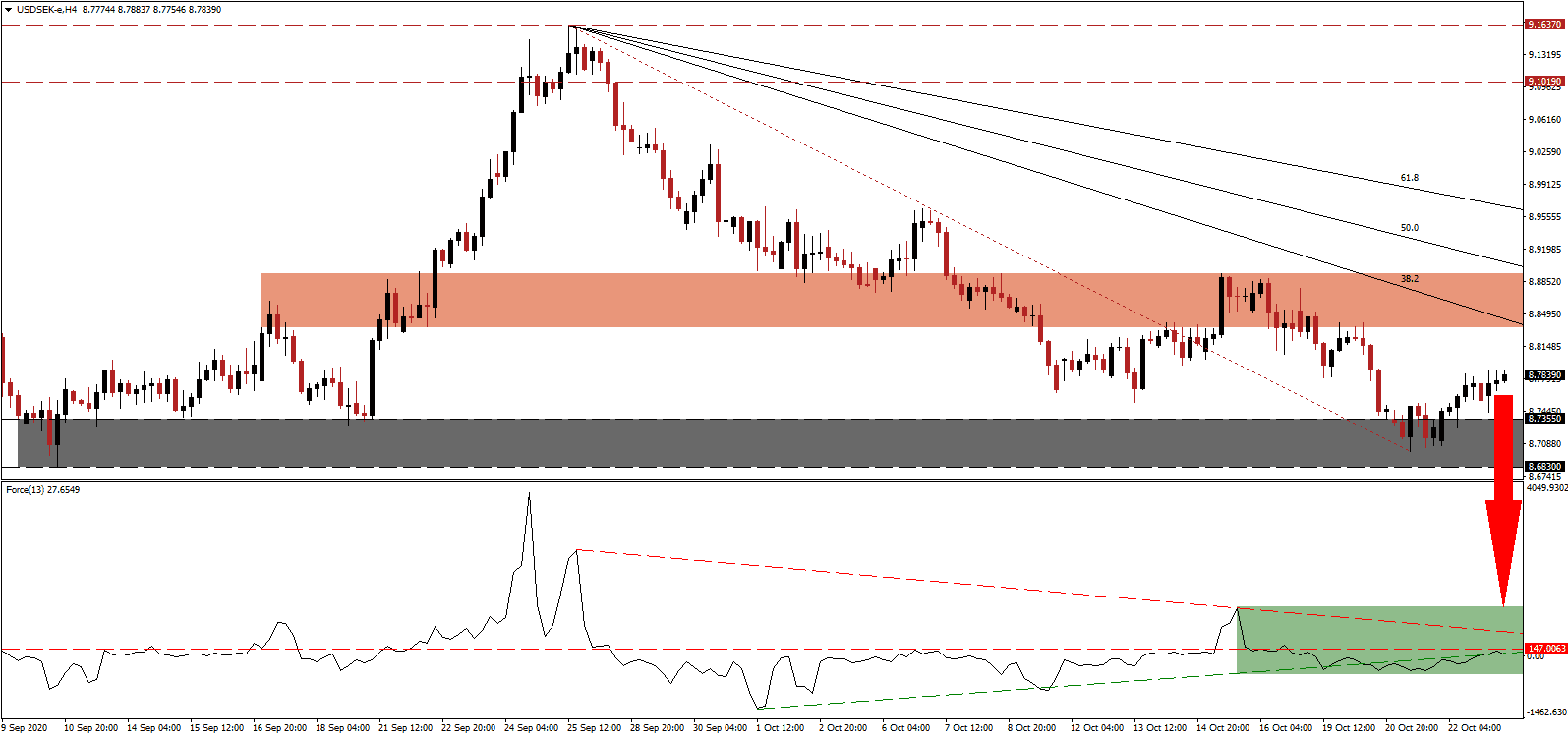

The Force Index, a next-generation technical indicator, was able to recover from its most recent lows but maintains its position below the horizontal resistance level. It presently challenges its ascending support level, as marked by the green rectangle, but the descending resistance level is well-positioned to reject it. With this technical indicator in negative territory, bears remain in control of the USD/SEK.

Andrew Ewing, a professor at the University of Gothenburg, pointed to the data and the most recent surge in new Covid-19 infections across Sweden, arguing the light touch of Sweden failed, and too many people died without reason. He is a member of Vetenskapsforum or Science Forum Covid-19, a collective of 200 Swedish scientists against the government's handling of the pandemic, backed by scientific data. The USD/SEK faced a spike in bearish pressures following the breakdown below its short-term resistance zone located between 8.8353 and 8.8933, as marked by the red rectangle.

Since Sweden is an export-oriented economy and many bellwethers of its industrial sector derive just 5% of revenues domestically, global trade is more important than domestic restrictions. With the seasonal influenza season merging with the second Covid-19 infection wave and strained healthcare resources, Sweden started more stringent lockdown measures, attempting to avoid mistakes made during the first wave. The descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to force a breakdown in the USD/SEK below its support zone located between 8.6830 and 8.7355, as identified by the grey rectangle. The next support zone awaits between 8.2858 and 8.4180.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 8.7850

- Take Profit @ 8.2850

- Stop Loss @ 8.8850

- Downside Potential: 5,000 pips

- Upside Risk: 1,000 pips

- Risk/Reward Ratio: 5.00

A breakout in the Force Index above its descending resistance level could lead the USD/SEK temporarily higher. With US political uncertainty merging with an already diminishing economic outlook and more unsustainable debt, the upside remains limited to its resistance zone between 9.1019 and 9.1637. Forex traders should take advantage of any advance with new net short positions.

USD/SEK Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 8.9700

- Take Profit @ 9.1200

- Stop Loss @ 8.8850

- Upside Potential: 1,500 pips

- Downside Risk:850 pips

- Risk/Reward Ratio: 1.77