The Pakistani Rupee has seen a wave of increased selling against the USD since the 1st of October. The USD/PKR has consistently broken through support the since the beginning of the month and this may be raising alarm bells within speculators who enjoy the risk taking the forex pair delivers. Pakistan claims that the coronavirus pandemic is showing signs of improvement within the domestic front.

An improved situation regarding the virus would certainly mean better conditions for Pakistan’s economy. However, it would be wise to acknowledge that the problems for the Pakistani Rupee did not suddenly begin with the outbreak of coronavirus; the USD/PKR has been suffering from a bullish trend higher for a long time.

Yet it must be admitted that the USD/PKR is now testing lower values seen in late May. Also the USD/PKR was trading near the 154.100 mark in early March before the implications of coronavirus hit the forex pair in a hard manner. While there has certainly been a long term trend in which the Pakistani Rupee has lost value to the USD, if technical traders break down the value cycles of the USD/PKR, justifiable reasons can be made to consider pursuing the bearish momentum which has emerged since the 1st of October.

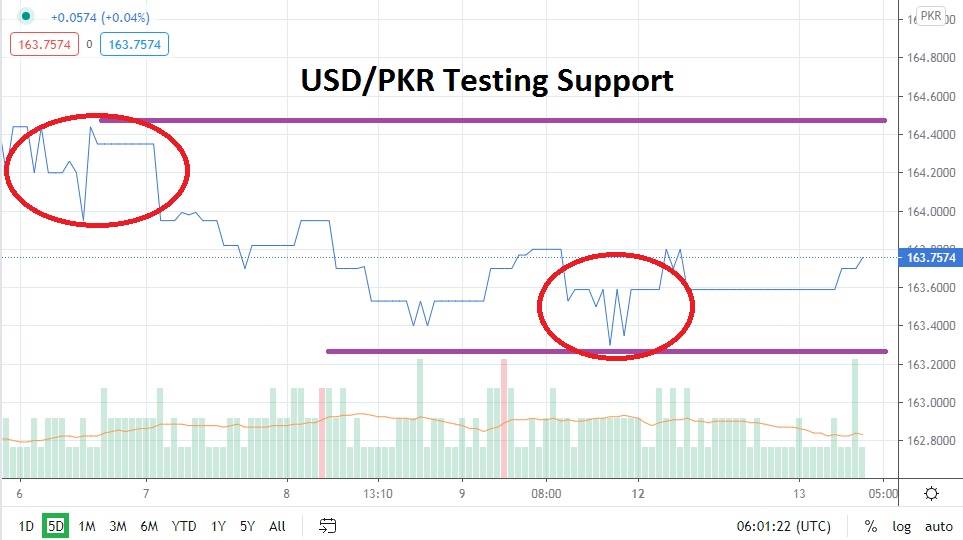

Risk management is a key component of trading the USD/PKR, but the reason why traders operate is in order to profit and this must be done with a solid taste for risk taking too. After hitting the 166.800 level approximately on the 25th of September the USD/PKR has enjoyed a bearish trend downwards in which support levels have been put to the test.

Global risk appetite has resurfaced in October and coupled with sentiment in the short term that Pakistan has gotten its coronavirus problems under control, the USD/PKR may be finding this combination a solid propellant for bearish momentum. The USD/PKR has the capability of trading lower and continuing to test support levels, and speculators may not want to argue with the trend even if they have doubts about the long term capabilities of the Pakistani Rupee.

Selling the USD/PKR on slight retracements higher using limit orders to enter positions may be a solid speculative decision while looking for the forex pair to test support near the 163.300 level. Suddenly the USD/PKR has developed a downward slope and traders may feel the urge to pursue its trajectory near term.

Pakistani Rupee Short Term Outlook:

Current Resistance: 164.2000

Current Support: 163.3000

High Target: 164.5000

Low Target: 163.0000