No one is going to mistake the Pakistani Rupee for the Swiss Franc. Nor are there likely many investors who believe the Pakistani Rupee is a long term stable environment to protect wealth. However since late August the USD/PKR has provided speculators with a taste for adventure the opportunity to pursue a bearish trend within the forex pair which has been steady.

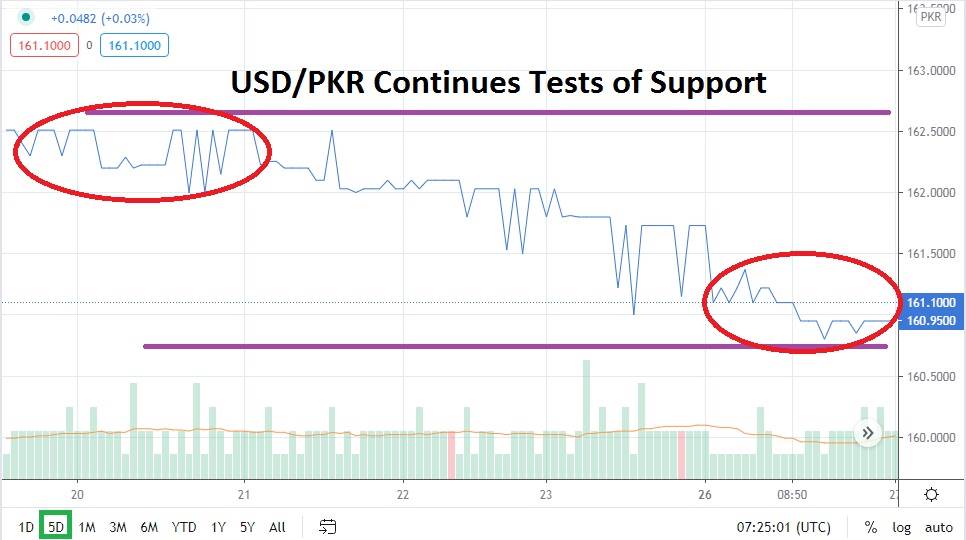

As of early trading this morning the USD/PKR is traversing near important support levels and this is not an overstatement. The last time the Pakistani Rupee tested the 161.1000 level was in the middle of June. If this support juncture crumbles lower the USD/PKR could be in a position to test the 159.6000 mark which was last seen in mid-May rather quickly.

While the USD/PKR certainly continues to trade within eyesight of all-time highs, the forex pair has established a reasonable bearish trend which has offered traders an opportunity to sell. Interestingly as global risk sentiment has turned cautious, and cautious trading has risen the past week, the USD/PKR has displayed the ability to swim against the tide and continue to provide a downward trajectory.

The USD/PKR doesn’t trade in a vacuum, but its recent price movements the past week and since the end of August do indicate that its value is not correlated to many of the dynamics of other emerging market currencies. Speculators need to understand that transparency is not clear and bright when trying to trade the USD/PKR, meaning there are transactions taking place between government institutions, international organizations and commercial enterprises which are difficult to know regarding the Pakistani Rupee.

The USD/PKR continues to display relatively stable resistance levels which have provided solid risk management since the end of August. Resistance has incrementally lowered too, and its current marks of 161.7000 to 162.1000 do look adequate as stop loss ratios. Traders should keep in mind it is important to use limit orders when trading the USD/PKR because it doesn’t have a lot of volume and is susceptible to violent spikes.

Speculators may want to continue to pursue selling positions of the USD/PKR with the belief the target below of 160.6000 is approachable. Patience and the ability to withstand overnight carry charges need to be considered when trading the Pakistani Rupee, but for traders with the stamina and ability to manage their risks, looking for further bearish momentum from the USD/PKR makes sense.

Pakistani Rupee Short Term Outlook:

Current Resistance: 161.7000

Current Support: 160.6000

High Target: 162.1000

Low Target: 160.0000