Pakistan presently holds the 24th spot on the list of countries most-infected with Covid-19. The testing capabilities remain limited, with less than 20,000 carried out per 1,000,000 in the fifth most populous country. While the global pandemic continues to wreak havoc globally, Pakistani Prime Minister Imran Khan faces growing pressure from the opposition, organized into the Pakistan Democratic Movement (PDM) on September 20th, 2020. It consists of eleven opposition parties attempting to oust Prime Minister Khan, claiming the 2018 election fraud back by the powerful military. With a leadership unlikely, the USD/PKR is well-positioned to accelerate its breakdown sequence.

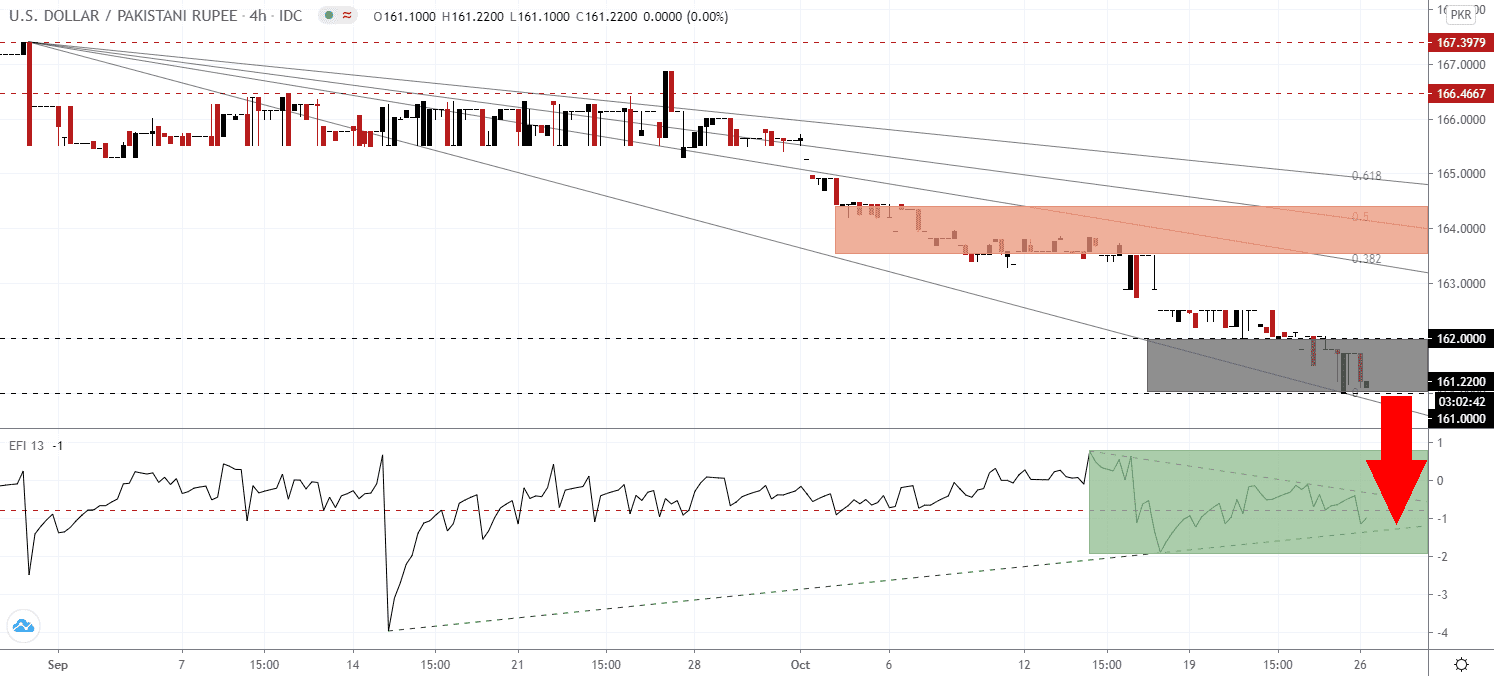

The Force Index, a next-generation technical indicator, reversed the breakout above its horizontal resistance level, as marked by the green rectangle. Adding to downside pressures is the descending resistance level, favored to result in a push below its ascending support level. This technical indicator is on course to slide deeper into negative territory, ensuring bears maintain control over the USD/PKR.

While the political climate heats up and the country may face more Covid-19 restrictions as the second wave of the pandemic intensifies, the Pakistani business community remains focused on the surge in demand, both domestically and globally. The US-China trade war opened export opportunities, and many Pakistani companies reported sales to the West for the first time. Beneath the issues Pakistan faces, sound fundamentals suggest the economic backbone to deliver future growth. After the USD/PKR moved below its downward revised short-term resistance zone between 163.5112 and 164.4400, as marked by the red rectangle, downside pressures magnified.

Adding another bullish catalyst for the Pakistani business community was the 35.6% increase in revenues from the IT sector during the first two months of the 2020-2021 financial year. Leading the expansion was the strong demand for software consultancy services. Pakistan Railways additionally confirmed it would outsource passenger management for eight trains to the private sector. The USD/PKR presently challenges its support zone located between 161.000 and 162.000, but the descending Fibonacci Retracement Fan Sequence increase breakdown momentum. The next support awaits between 156.7000 and 158.0000.

USD/PKR Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 161.2500

- Take Profit @ 156.7500

- Stop Loss @ 162.5000

- Downside Potential: 45,000 pips

- Upside Risk: 12,500 pips

- Risk/Reward Ratio: 3.60

In the event of a breakout in the Force Index above its descending resistance level, the USD/PKR may attempt a reversal. Forex traders should take advantage of any advance from present levels with new net short positions. While the US Dollar is under intensifying bearish pressure from multiple sources, underlying fundamentals for Pakistan continue to improve. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/PKR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 163.5000

- Take Profit @ 164.7500

- Stop Loss @ 162.5000

- Upside Potential: 12,500 pips

- Downside Risk: 10,000 pips

- Risk/Reward Ratio: 1.25