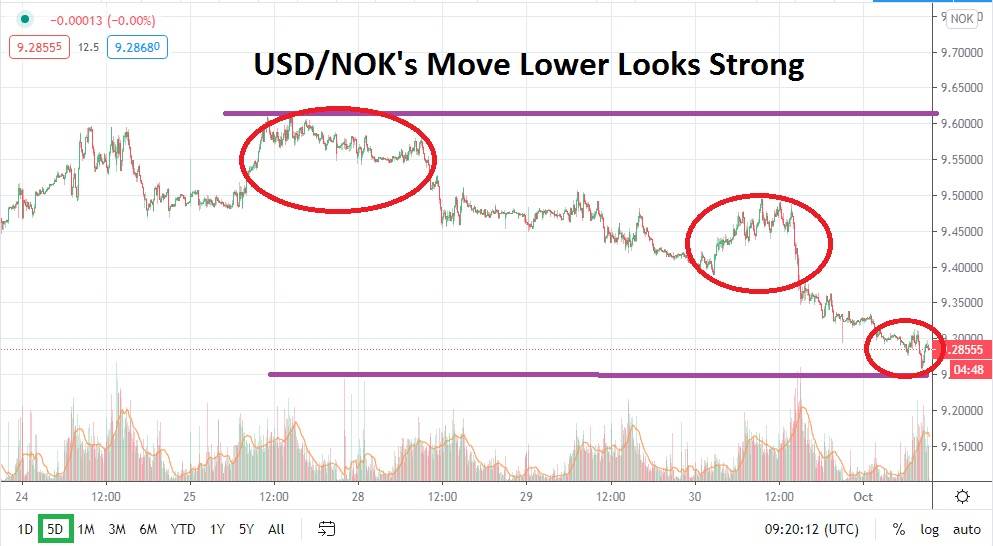

The USD/NOK is trading near the 9.27800 vicinity and this is a remarkably interesting support level. If support can be broken lower the USD/NOK would suddenly be engaged within a trading range it has not traversed since the 21st of September, which is the day the forex pair experienced a spike higher and broke through resistance.

If risk appetite remains strong in the global markets, there is reason to suspect the USD/NOK may see a bearish trend emerge. Lower support levels near the 9.16000 to 9.10000 will prove extremely interesting if the selling of the USD/NOK finds sustained momentum near term. Since reaching an important low of 8.61000 on the 1st of September the USD/NOK has certainly experienced a bull run higher.

However, the recent bullish move was still within the stronger depths of a solid bearish trend which has been embraced since late March. The buying of the USD/NOK has taken place as risk sentiment has turned cautious and global equity indices have produced mixed results in September. Speculators may believe the USD/NOK has room to traverse lower and will begin to challenge support levels sooner rather than later on renewed risk appetite.

Traders need to be aware that US jobless numbers will be reported tomorrow, and this will certainly be accompanied by a fair amount of volatility leading up to the publication of the employment statistics. However, it is the results from American and European equity indices which will spur on forex markets in the coming two days. Investors already know the jobs numbers will show a significant amount of unemployment due to the impact of coronavirus. Short term gyrations are certain today and tomorrow as positions are taken within the USD/NOK in anticipation of the jobless report, but speculators need to be patient as the numbers produce a rather predictable amount of volatility.

Selling the USD/NOK is a tempting proposition for speculators who believe the bearish trend of the Norwegian Krone will continue to be re-established. Selling the forex pair within its current price action may prove worthwhile and downside momentum seems to carry the best risk reward scenarios. Traders should use solid stop-loss orders and be prepared for fast trading conditions today and tomorrow based on the results from equity indices and the jobs report from the States.

Norwegian Krone Short Term Outlook:

Current Resistance: 9.34000

Current Support: 9.25000

High Target: 9.44000

Low Target: 9.16000