Mexico surpassed 900,000 Covid-19 infections, and Mexican President López Obrador calls for more interest rate cuts by the Banco de México to assist the gradual economic recovery. With the second wave of the pandemic sweeping across Europe and the US, a new mutation was identified in Europe that originated in Spain, and France and Germany announced light nationwide lockdown measures for November. It remains unknown how Mexico will respond once cases accelerate over the winter months. The USD/MXN completes its short-covering rally after being rejected by its short-term resistance zone.

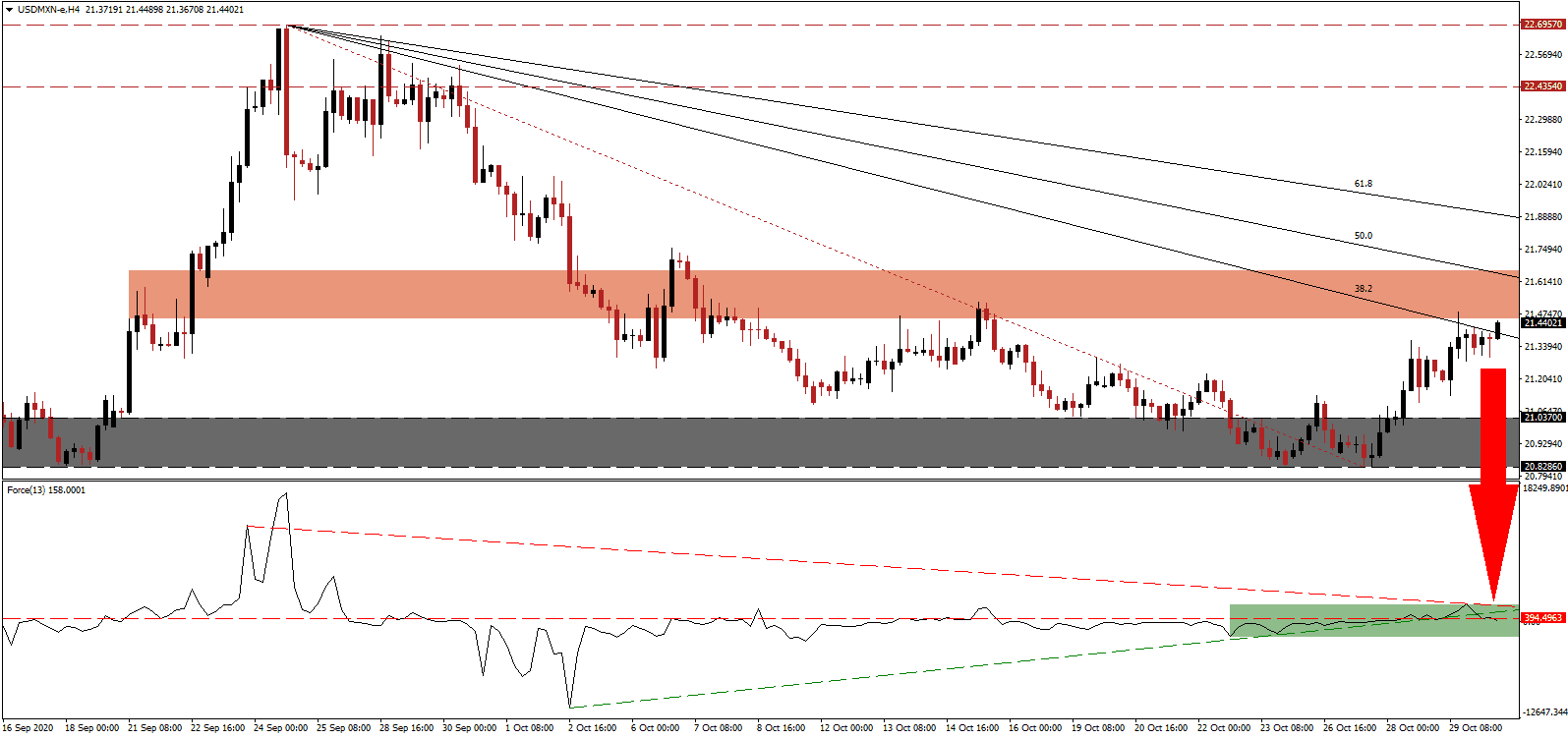

The Force Index, a next-generation technical indicator, confirms the rise in bearish momentum after the rejection of a small advance, allowing the adjusted descending resistance level to pressure it below its ascending support level. After the move below its horizontal resistance level, as marked by the green rectangle, this technical indicator is on course to slide below the 0 center-line, placing bears in control over the USD/MXN.

According to the latest data by the Instituto Nacional de Estadística y Geografía (INEGI), the post-Covid-19 lockdown recovery continues to slow. The August expansion came in at 1.1% compared to July, below expectations for an increase of 1.9%. Primary activities contracted by 5.9%, while secondary and tertiary ones rose by 3.3% and 0.4%, respectively. Third-quarter GDP forecasts call for an expansion of 11.7% and a 2020 plunge of 9.3%. After the USD/MXN was rejected by its short-term resistance zone located between 21.4538 and 21.6595, as identified by the red rectangle, the sell-off is set to resume.

Alfonso Romo, the Chief of Staff for President López Obrador, called on the nation's industrialists to embrace the Fourth Industrial Revolution during opening remarks of the Annual Meeting of Industrialists. The Fourth Industrial Revolution refers to the use of technology to optimize manufacturing, cut costs, and become more competitive globally. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/MXN into its support zone located between 20.8262 and 21.0370, as marked by the grey rectangle. An extension into its next support zone between 19.8919 and 20.2760 remains a probability amid dominant breakdown pressures.

USD/MXN Technical Trading Set-Up - Breakdown Resumption Scenario

- Short Entry @ 21.4400

- Take Profit @ 19.9000

- Stop Loss @ 21.8900

- Downside Potential: 15,400 pips

- Upside Risk: 4,500 pips

- Risk/Reward Ratio: 3.42

Should the Force Index push through its descending resistance level, the USD/MXN could launch another breakout attempt. With US Covid-19 cases approaching 100,000 per day, the healthcare system is on the verge of collapse. Election jitters, a weak labor market, and an uncertain economic outlook at to bearish pressures in the US Dollar. The upside potential remains reduced to its resistance zone between 22.4354 and 22.6957, granting Forex traders an excellent secondary selling opportunity.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

- Long Entry @ 22.1900

- Take Profit @ 22.6200

- Stop Loss @ 21.8900

- Upside Potential: 4,300 pips

- Downside Risk: 3,000 pips

- Risk/Reward Ratio: 1.43