Mexican President López Obrador enjoys an ongoing increase in his approval rating, despite the Covid-19 pandemic, a damaged economy, and rising homicide across Latin America’s second-largest economy. The latest poll conducted by newspaper El Financiero showed his approval rating increased to 62% in September, up from 56% in June, making him one of the most popular leaders globally. Mexican view him as a champion of the poor instead of the wealthy and corrupt political class. It adds to long-term bullish pressures for the Mexican Peso, with the USD/MXN well-positioned to extend its correction with a new breakdown sequence taking it to multi-month lows.

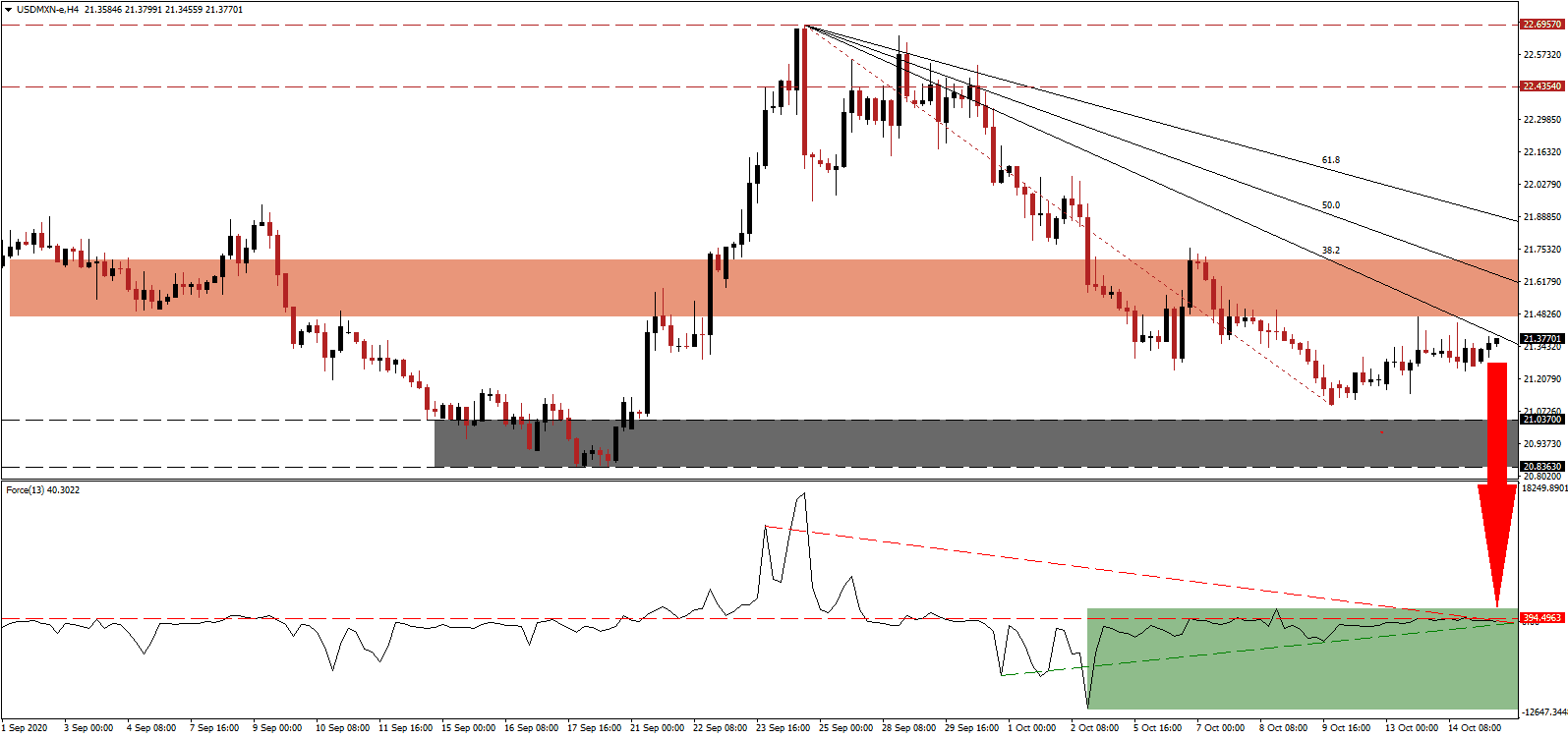

The Force Index, a next-generation technical indicator, failed to eclipse its horizontal resistance level, as marked by the green rectangle and faces downside pressures from its descending resistance level. This technical indicator is on course to slide below its ascending support level and into negative territory, allowing bears to resume complete control over price action in the USD/MXN.

Hopes for a V-shaped recovery have slowly been put to rest globally as the first round of stimulus failed to deliver. More governments favor adding to more debt, hoping to buy time for the economy to recover. President López Obrador continues to resist calls to sacrifice its future at the expense of ill-advised short-term gains. It increases the bullish outlook for the Mexican Peso, which outperforms the US Dollar since the pandemic. While the USD/MXN paused its sell-off and drifted higher, the short-term resistance zone located between 21.4698 and 21.7080, as marked by the red rectangle, maintains the bearish trend.

With infrastructure at the core of the economic recovery strategy, seven projects out of the thirty-nine announced in the Mex$300 billion plan have broken ground, with the rest scheduled for 2021. The Secretaría de Hacienda y Crédito Público pledged two more planned project clusters for 2022 and 2023. Mexico aims to boost infrastructure spending to 25% of GDP, creating a growth engine for jobs. The descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to force the USD/MXN into its support zone located between 20.8363 and 21.0370, as identified by the grey rectangle. A breakdown extension into its next support zone between 19.8919 and 20.2760 remains a distinct probability.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 21.3750

Take Profit @ 19.9000

Stop Loss @ 21.6200

Downside Potential: 14,750 pips

Upside Risk: 2,450 pips

Risk/Reward Ratio: 6.02

Should the Force Index push above its descending resistance level and accelerate, the USD/MXN could follow suit. Any advance will grant Forex traders a secondary short-selling opportunity amid a deteriorating outlook for the US Dollar. Today’s initial jobless claims data out of the US may offer more evidence of a crumbling labor market, while the risk of more debt remains. The upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/MXN Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 21.7200

Take Profit @ 21.8800

Stop Loss @ 21.6200

Upside Potential: 1,600 pips

Downside Risk 1,000 pips

Risk/Reward Ratio: 1.60