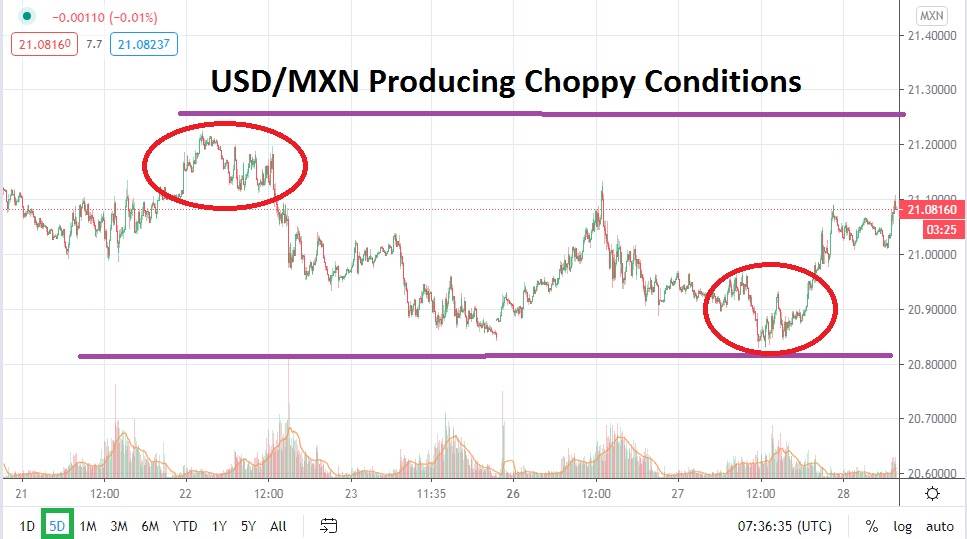

The USD/MXN tested important support levels near the 20.84000 early this week, but has seen a slight reversal emerge higher. Certainly it can be argued that the bullish creep upwards has not been significant and is a natural cycle within forex as values traverse a logical price range. However, short term considerations must also allow for the notion that risk adverse trading is growing as investors start to brace for the US elections which are less than a week away.

Traders cannot be faulted for considering what if scenarios for the USD/MXN if there is a change in the White House administration. The outcome is unclear however and assuming the election result in the US could prove to be a costly mistake considering the recent evidence that polling has proved to be a very unreliable barometer due to faulty and often biased survey techniques.

Risk adverse trading has been demonstrated on many equity indices and US future calls early today indicate a negative opening. The USD/MXN is a solid reflection regarding risk appetite. The current state of nervousness within forex may prove to be short lived, but traders need to keep behavioral sentiment in mind because choppy conditions are likely to escalate near term.

The support ratio of 20.96000 appears important, but sustained trading below this juncture will have to be proven in order for more bearish momentum to gain strength. Until then the 21.0000 juncture again is acting as a key inflection point for traders as they watch the USD/MXN. As of this morning the Mexican Peso has seen a slight bullish reversal higher and it is near important short term resistance. If the 21.18000 fails to prove be adequate as resistance the USD/MXN may find speculative momentum creates a surge in buying positions. The notion that nervous buying sentiment could develop short term bullish behavior in the forex pair and challenge the bearish trend which has dominated trading most of October is viable.

Speculators may want to pursue buying positions of the USD/MXN near term with the belief the forex pair will be affected by nervous sentiment and that support levels may fade into the distance momentarily. Buying the USD/MXN near the 21.12000 level and looking for upside price action may prove to be a worthwhile opportunity for traders.

Mexican Peso Short Term Outlook:

Current Resistance: 21.18000

Current Support: 20.96000

High Target: 21.26000

Low Target: 20.84000