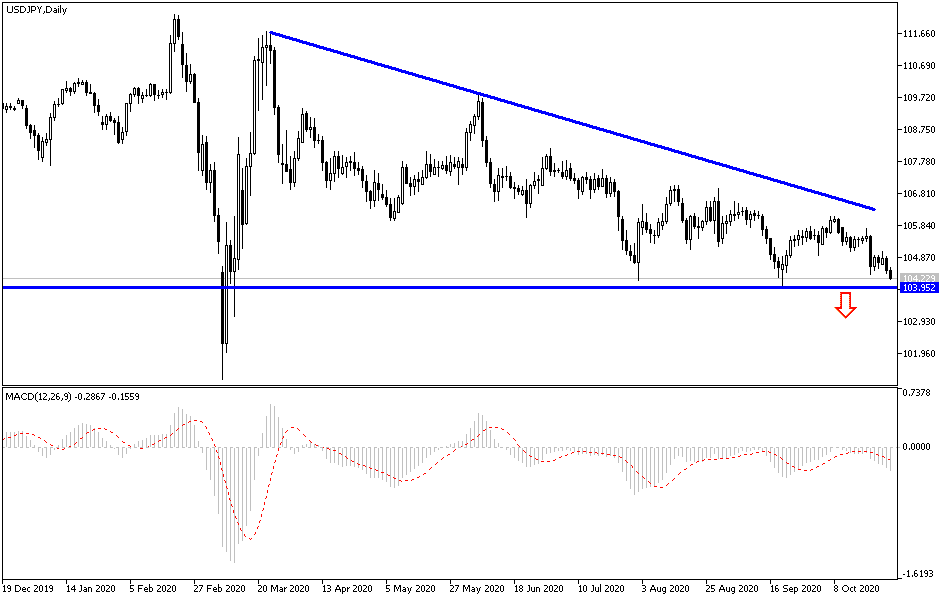

More restrictions from countries around the world to contain a second massive wave of the Coronavirus spread have increased investors' appetite towards safe havens, and the Japanese yen is ideal for this goal. Therefore, the USD/JPY bearish movement increased pushing it towards the 104.16 support at the time of writing, the lowest level in five weeks. Supporting this decline was a slight drop in US consumer confidence in October with the emergence of a new wave of coronavirus cases across the country. The Conference Board reported that the US Consumer Confidence Index fell to a reading of 100.9 from 101.8 in September, but is still well below pre-epidemic levels. The moderate decline for the month followed a sharp rise in September.

Consumer spending accounts for 70% of economic activity in the US, so lower confidence is garnering much attention from economists, especially as the US approaches the holiday shopping season.

US consumer confidence fell to a reading of 85.7 in April as large swaths of the country were closed due to the deadly virus. The index was consistently above the 100 level in the months prior to that, with the index reaching 132.6 in February before the severity of the COVID-19 infections became clear, and now, with average daily deaths across the country up 10% in the past two weeks, from 721 to nearly 794 as of Sunday, according to data from Johns Hopkins University. Newly confirmed infections are increasing daily in 47 states, while deaths are rising in 34 states.

The portion of the index that measures current conditions - which is based on consumers' assessment of current business and labour market conditions - increased from 98.9 to 104.6. However, this month consumers were less optimistic about the future, as the Expectations Index fell to 98.4 in October from 102.9 last month. Factors including the recent spike in coronavirus cases across the U.S., along with continued job losses and uncertainty during next week's presidential election, may have played a role in consumers' concerns about the future.

As for the US presidential elections, the consequences of which will be dominated by dealing with the COVID-19 virus and the economy, America’s deficit in goods and services now exceeds what it was under President Barack Obama. Steel and aluminium makers have slashed their jobs despite Trump's protectionist policies on their behalf. His deals barely produced a ripple in the $20 trillion economy. For most Americans, Trump's strict trade policy ultimately meant little, good or bad, to their financial health.

Whether Trump wins a second term or be replaced by Joe Biden, much of his legacy in commerce appears likely to last. It is therefore possible that his hard-line stance toward China will last beyond his presidency for the following reason: it reflected and shaped a belief, among Democrats and Republicans alike, that Beijing had long violated its pledges to treat foreign companies fairly, committed predatory business practices, and dominated other countries in the world.

According to the technical analysis of the pair: Recent bear’s domination on the USD/JPY performance, pushed technical indicators into oversold areas, and therefore, one can think of buying from the current support levels at 104.15, 103.75 and 102.90, respectively. The current performance brings us back to the levels of last March at a time when the epidemic crisis was strongly affecting the global financial markets. Global governments and central banks stand ready to intervene again to support the global economy. On the upside, technically, a return to move towards the most important 106.00 resistance at the present time, will confirm the reversal of the current bearish view.

Today's economic calendar has no important data affecting the performance of the pair.