A state of risk appetite dominates the financial markets performance, of which the Forex market is an important component. This is since the announcement of Trump's health improvement, who was exposed to the Coronavirus, amid an official announcement at the end of last week. Accordingly, the USD/JPY had a better opportunity to move towards the 106.10 resistance before settling around the 106.00 level at the time of writing. Markets were not satisfied with Trump's discharge from hospital, who after his recovery, announced ending talks to provide further stimulus to the US economy until after the presidential elections.

At the same time, economic experts warn that President Donald Trump's move to cut off talks on another government aid package will further weaken the US economy, which is struggling to recover from the collapse caused by the Coronavirus, and increase the difficulties faced by unemployed Americans and faltering companies. In this regard, half of all small businesses expect to need more aid from the government over the next 12 months to survive, according to a survey conducted by the right-wing National Federation of Independent Business. NFIB said sales of about a fifth of small businesses are still 50% or more lower than pre-pandemic levels.

For the nearly 25 million demobilized Americans receiving unemployment benefits, weekly payments have shrunk, on average, by two-thirds since the $600 per week federal benefit expired more than two months ago. Then Trump offered an additional $300 for six weeks, but that money has also run out.

On another level, Fed Chairman Jerome Powell reiterated his belief that the US economy needs more financial support even though the recovery from the Coronavirus “natural disaster” remains strong so far. In a speech to the National Association of Business Economics, Powell said it was better for Congress to provide more financial support than necessary. "Lack of support will lead to a weak recovery, creating unnecessary hardship for families and businesses," Powell added. This would push more companies to declare bankruptcy and expose families to severe economic hardship.

On the other hand, Powell said, even if the political measures are more than required, "they will not be in vain." Accordingly, he said: “The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work hand in hand to provide support for the economy until it clearly emerges from the quagmire.” In this regard, both political parties in Congress confirm that they want to pass a follow-up to the CARES Act in March, which provided $2.2 trillion in financial aid to companies and the unemployed, but Republicans in the Senate have complained that the new financial incentives supported by the Democrats are too expensive and wanted a more targeted approach.

Amid continuous efforts, US Treasury Secretary Stephen Mnuchin and House Speaker Nancy Pelosi have spoken in an attempt to break the deadlock over the stalled coronavirus relief bill. Late Tuesday evening, President Donald Trump said he was ending negotiations on the deal.

During a question-and-answer session, Powell said that now is "not the right time" to worry about putting the federal budget deficit back on a sustainable path. Also in his speech, Powell praised lawmakers for the four previous fiscal measures that were passed in March and April, describing them as "the largest and most innovative financial response to an economic crisis since the Great Depression."

In a hint of fears of the second coronavirus wave: "There is a risk that the quick gains from the reopening may carry over to a longer period than expected to return to a full recovery as some sectors struggle with the continuing repercussions of the epidemic," Powell said. Although the US unemployment rate fell to 7.9% in September from the epidemic peak of 14.7%, the labour market recovery "still has a long way to go."

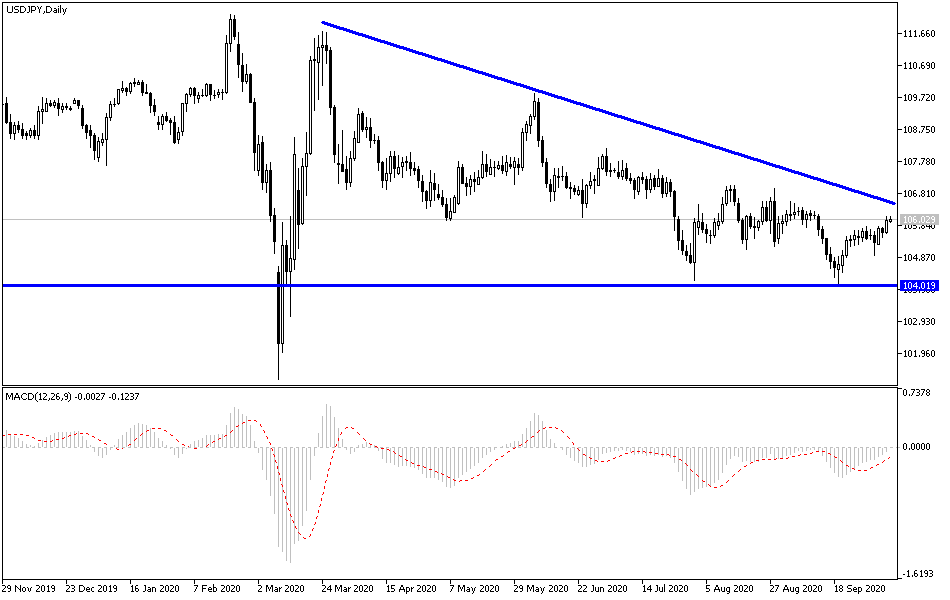

According to the technical analysis of the pair: Markets have begun to pass the absorption of Trump's discharge from the hospital and the end of the US stimulus talks, and will begin to focus on the strength of the second coronavirus wave and the imposition of new global restrictions to contain the disease. This explains the stalling of the dollar's gains against the yen, and thus bears may return to control performance, especially if they pushed the pair to the support levels at 105.55 and 104.90, as the Japanese currency is safer for investors in times of uncertainty. On the upside, I still stick to the view that the resistance level at 108.00 is the most important one to confirm the reversal of the general trend to the upside.

In addition to the extent of risk appetite, the USD/JPY pair will be affected by the announcement of the US jobless claims.