The USD/JPY pair returned to the vicinity of last week’s trading, stabilizing around the 105.80 and stable near it at the time of writing. With the markets awaiting today to announce the last Federal Reserve Bank meeting minutes at a time when the markets are looking for important signals from the bank on the future of stimulus for the US economy as Congress stopped providing necessary support. The pair quickly recovered after testing the 104.95 support after the announcement of the US President Trump, his wife, and a good number of the White House team, testing positive for the Coronavirus. The rapid improvement in Trump's condition contributed to the rapid improvement in the performance of the USD/JPY pair.

Before announcing the last Federal Reserve Bank meeting minutes, Governor Jerome Powell said yesterday that economic support from the US government - including unemployment insurance payments, direct payments to most American households, and financial support for small businesses - has so far prevented a "downward spiral" of recession. The job loss reduces spending, forcing companies to cut more jobs.

Powell also said that the US economy still faces threats, and without further help, these downward trends could derail the recovery. Powell also emphasized that “growth is still far from complete. Lack of support will lead to a weak recovery, creating unnecessary difficulties for families and businesses. Over time, household and corporate bankruptcies will rise, hurting the productive capacity of the economy and impending wage growth.”

During a question-and-answer session with economists, Powell noted that the pandemic economic recession has disproportionately affected the personal service sectors, especially restaurants, bars, hotels, travel companies, cinemas, and other entertainment venues. The severe damage to these industries has left millions of people unemployed, likely for a long time until they are finally called to their former jobs or switch to new jobs.

On another level, the World Trade Organization said yesterday that the volume of world trade is likely to decline less than expected this year and that the expected recovery next year will not return it to pre-crisis levels, as it warned of the downside risks from the resurgence of Coronavirus infections in the coming months.

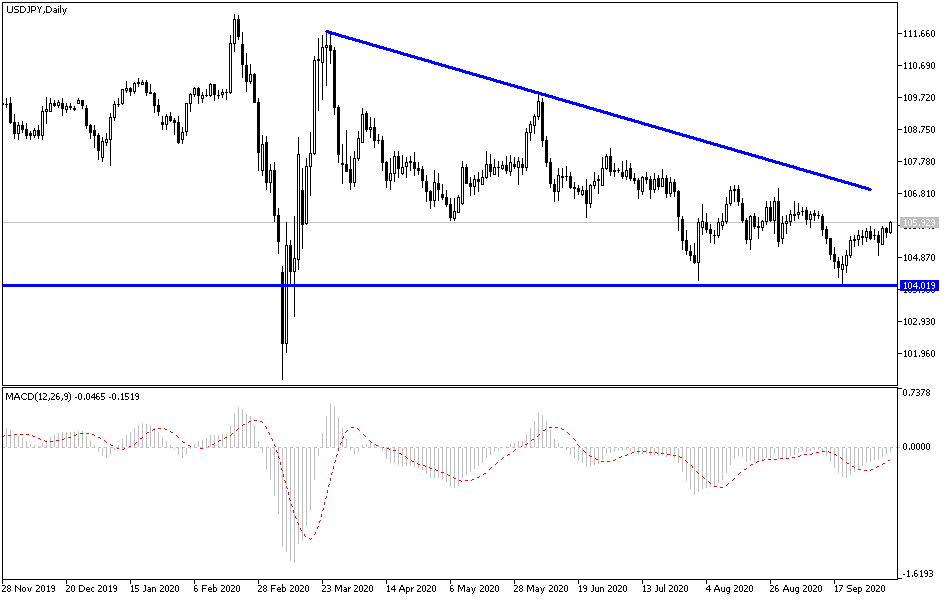

According to the technical analysis of the pair: As noted, the upward correction path for the USD/JPY is still suffering from obstacles, the most prominent of which is investor interest in buying the Japanese yen more than the dollar as a safe haven in light of global geopolitical tensions and the continuing fears of the strength of the second coronavirus wave. As I mentioned before, I stress that the upward correction will not succeed without crossing the resistance barrier at 108.00. Otherwise, the stronger control of the bears will remain, especially if the pair returns to the vicinity of the support levels at 105.00, 104.35, and 103.90, and I support buying the currency pair from the last two levels. The pair didn’t react much to the technical indicators reaching oversold areas. The announcement of the last Federal Reserve Bank meeting minutes and President Trump's recovery will have a strong and direct impact on the performance of this currency pair.