Most of last week’s transactions were positive for the USD/JPY, which moved towards the 106.10 resistance, its highest level in three weeks. At that time, we indicated that the pair may be exposed to selling operations as investors still prefer the Japanese currency as a stronger safe haven at the expense of the dollar. We, therefore, referred to the strength of the second Coronavirus wave and added to that hints on the part of the US administration that an agreement on a stimulus plan for relief from the Coronavirus consequences will be close. Fiscal stimulus is back again in the US as the White House is now backing a broad stimulus program, but not as large as the Democrats’ $2.2 trillion package. The currency pair closed last week's trading down to the support level at 105.60.

China’s markets have reopened after a long holiday. On the economic side, the Caixin PMI was a little confusing. And remember, prior to the holiday, the Manufacturing PMI dropped to a reading of 53.0 from 53.1. While the Services PMI rose to 54.8 from a reading of 54.0, which is better than expected. However, the composite index - which includes manufacturing and services together - decreased to 54.5 from 55.1. More attention has been paid to the strength of the Chinese yuan, which has now reached levels last seen in April 2019. It appears that there is a change in Beijing's usual system, as we indicated, that it is in its interest to accept a rebound currency, as it encourages foreign investments.

Japanese employment earnings and spending for August improved sequentially with the previous quarter but were not as strong as expected. Cash dividends fell 1.3% year-on-year after declining 1.5% in July. The lion's share of the 100,000 emergency payment appears to have been distributed. Household spending was down 6.9% from a year ago, better than a 7.6% contraction in July, but economists expected a 6.7% decline. The data coincides with a modest recovery in Japan, and the Bank of Japan report shows improvement in eight of the nation's nine regions.

On another level, the US Congressional Budget Office predicted that the US budget deficit reached a record $3.1 trillion in the recently-ended 2020 budget. As for the size of the economy, the deficit - an estimated 15.2 percent of GDP - was the largest since 1945, and 2020 was the fifth year in a row in which the deficit increased as a percentage of GDP, according to the CBO statement in their monthly forecast.

The US Treasury and Office of Management and Budget will release the actual numbers later this month if the agencies stick to past practices. Notably, the CBO figure, based on the daily Treasury data, was $180 billion lower than expected just a few weeks ago, with revenue coming in at $123 billion above that forecast, and spending was slightly lower -by $ 56 billion - than forecast.

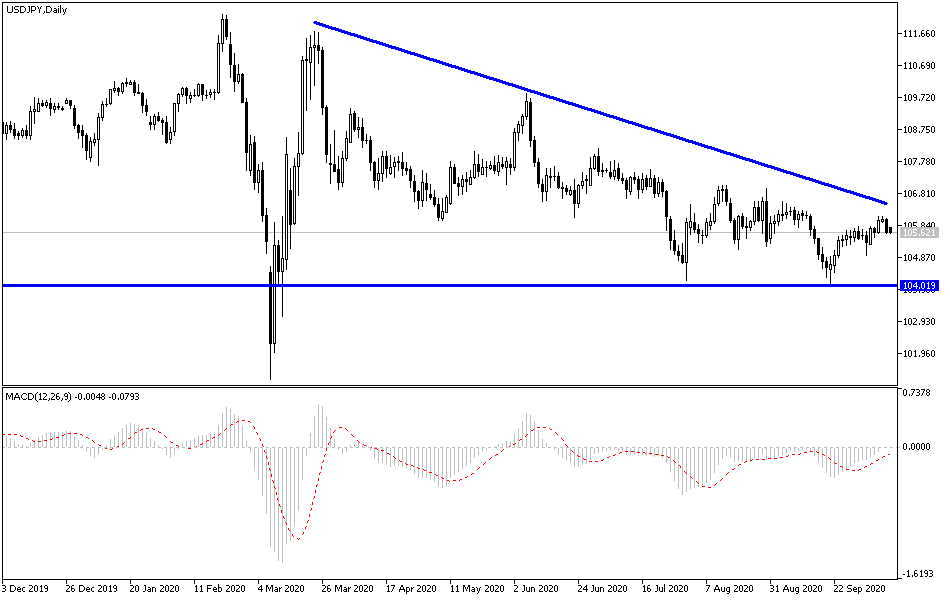

According to the technical analysis of the pair: According to the USD/JPY performance on the daily chart, and despite the recent rebound gains, the pair did not reach a reversal of the downward trend, which still dominates the performance on the long run, and as I mentioned before, the stronger opportunity will not occur without testing the 108.00 resistance and stability above it. On the downside, a retreat to the 105.30 support will trigger selling again. I would still prefer to buy the pair if it fell to the support levels at 104.90 and 104.00, respectively.

Today there will be an American holiday celebrating Columbus Day. From Japan, the producer price index, basic machinery orders and bank loans will be announced.