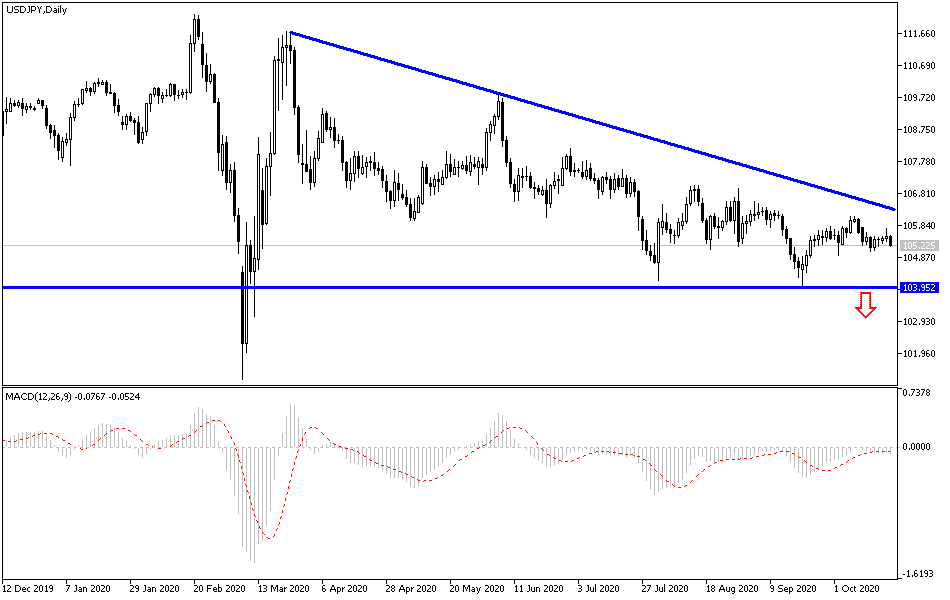

The pressure on the US dollar has returned again, and therefore it has retreated against the rest of other major currencies. The USD/JPY retreated to the 105.25 support at the time of writing after an attempt to rebound higher during yesterday's trading session that pushed the currency pair towards the 105.75 resistance. The bears’ control over performance is still the strongest in light of the risk aversion that dominates the performance in global financial markets, with a new outbreak of the Coronavirus that has contributed to imposing new restrictions on global economic activity. This environment is fertile for gains to the Japanese currency as it is a traditional and historical safe haven for investors in times of uncertainty.

On the economic side, home building in the US increased 1.9% in September after declining in the previous month, as home construction continues to be one of the bright spots in the US economy. The US Commerce Department reported that the increase last month pushed home construction to a seasonally adjusted annual rate of 1.42 million homes and apartments after a 6.7% decline in August. Requests for building permits, a good measure of future activity, rose 5.2% to 1.55 million units, after a drop in the spring due to pandemic-related lockdowns, US housing made a strong recovery as demand for homes with larger space grew and mortgage rates remained at very low levels.

According to official data, the construction of single-family homes increased by 7.8% in September, offsetting a 14.7% decline in the smaller apartments sector. Consequently, single-family construction is now at its highest level since 2007. Construction work increased in every region of the country with the exception of the Midwest, which recorded a decline of 32.7%. The construction sector increased 66.7% in the Northeast with smaller gains of 6.2% in the South and 1.4% in the West.

Economists believe that housing construction in the United States will continue to boom in the coming months.

In a development that contributed to shaking confidence in the markets, a complaint issued by the US Department of Justice accused Google of thwarting competition and potential innovation through its market power and financial strength. In particular, the US complaint alleges that Google sought to ensure that the search engine and its ad network remained in a position to reach the largest possible number of people while making the emergence of viable competitors nearly impossible. In this regard, US Deputy Attorney General Jeff Rosen described Google as "the gateway to the Internet" and a giant search advertisement. Google, whose market value is parent company Alphabet Inc is just over $1 trillion, controls about 90% of searches on the global web.

According to the technical analysis of the pair: According to the USD/JPY performance on the daily chart, the bearish momentum is still stronger and its strength will increase if the pair breaks below the 105.00 support because it will stimulate more selling to move towards the next support levels at 104.75 104.00 and 103.45, respectively. On the other hand, according to the performance over the same period of time, the 108.00 resistance is still the most important to confirm the occurrence of a true reversal of the current bearish trend. During today's trading session, the pair is not expecting any important or influential data, whether from Japan or the United States of America, and investor sentiment will have a strong and direct impact on today's performance.