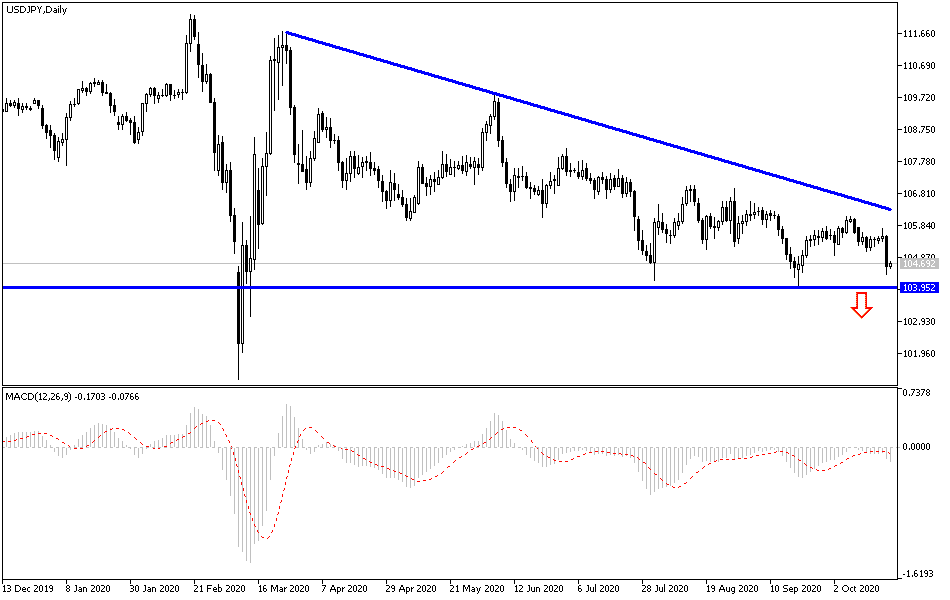

In recent USD/JPY technical analysis, we noted that the limited and narrow movement within price limits for several trading sessions in a row heralds an upcoming strong move. This actually happened during yesterday's trading session, as the pair collapsed to the 104.34 support before settling around 104.70 at the time of writing. The strong bears gains came with support from investors abandoning the US currency amid uncertainty about the results of the US presidential elections and obstructing efforts to pass more stimulus plans necessary to revive the US economy in the face of the recession caused by COVID-19, as the United States of America is still leading the world in numbers of cases and deaths due to the fatal disease.

During the Corona era, according to the Federal Reserve's latest report on economic conditions, known as the Beige Book, economic activity in most parts of the country was "light to modest" and some US states reported stabilizing retail sales even though demand for cars remained flat as lower inventories restricted sales, restaurant owners are concerned that the cold weather will slow sales in the coming months. The bank's communications are concerned about the possibility of high rates of delinquency.

The report added that employment levels were growing across the country, albeit at a slow pace. Manufacturing was the most consistent sector to add jobs across the country. Wages rose only slightly, often linked to how easy it was to find workers. Consumer prices in the United States rose slightly as construction, manufacturing, and retail firms outpaced the cost increases for their customers, and businesses faced increased costs due to COVID-19.

The report covers the US economy until October 9 and is one of the last comprehensive overviews of the economic situation before the presidential elections to be held on November 3. The image is somewhat tepid. As the US economy recovered from the depths of the recession that began in March, many economists believe that the level of activity will decline in the coming months. Fed officials are pressing Congress to pass another coronavirus relief package to help consumers and businesses survive while the coronavirus pandemic continues to restrict activity.

According to the technical analysis of the pair: the USD/JPY stability below the 105.00 support supports the bears' stronger control over the performance, as is the case in the long run. Nevertheless, with the technical indicators reaching oversold areas, the support levels at 104.40, 103.90, and 103.00 may be the most suited for buying now and waiting for a rebound to the upside with the awaited correction. On the upside, I still see that the resistance level at 108.00 is the most important for a real shift in the general direction of the pair. What will affect the currency pair in the coming days will be the results of opinion polls about who will win the US elections and negotiations to approve more stimulus plans for the US economy and the extent of controlling the Corona epidemic and obtaining vaccines. This is in addition to the extent of investors’ risk appetite.

The currency pair will react today to the announcement of the weekly jobless claims, along with existing home sales.