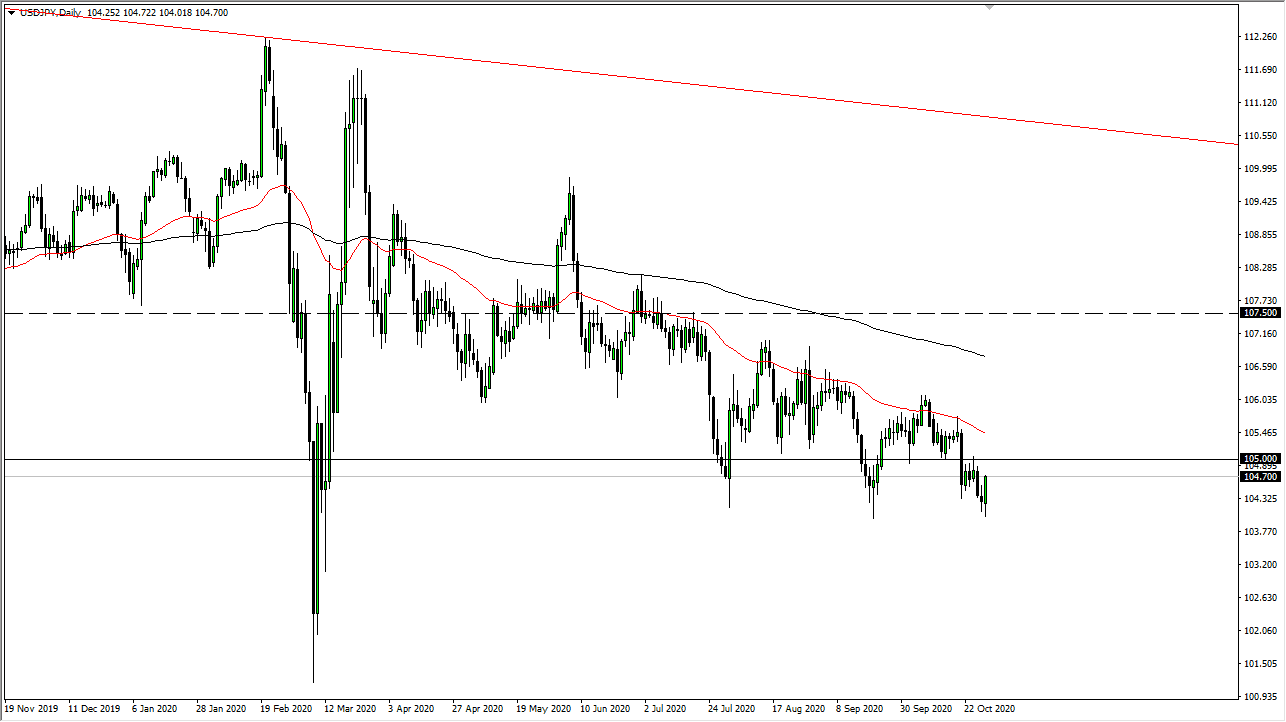

The US dollar has initially fallen during the trading session on Thursday, to reach down towards the crucial ¥105 level. That is a large, round, psychologically significant figure so that in and of itself will attract a certain amount of attention. However, you can see that we have bounced significantly from there to reach above the ¥104.50 level. Ultimately, this is a market that I do think will eventually have selling pressure above.

Looking at this chart, the ¥105 level could be an area where a lot of sellers would come back in and start pushing this pair lower, but I also recognize that the 50 day EMA above there will also probably cause a bit of downward pressure. Looking at this chart, I think that selling signs of exhaustion will be the best way going forward, perhaps on a smaller time frame. Do not get me wrong, I do not necessarily think that this market is going to melt down, but it certainly looks as if we are going to be going lower given enough time. It is probably going to be more or less a grind lower, which makes quite a bit of sense considering that both of these currencies are considered to be safety currencies, so people are going to be flooding towards them both. That creates friction in this pair and therefore less movement than you would see another pair such as the AUD/JPY, GBP/USD, etc.

Above current trading, the 50 day EMA, which is colored in red on the chart, and the 200 day EMA, which is colored in black, I believe there is a significant amount of resistance from what we have seen over the last several months. I think that if we do break out above the 50 day EMA, then you start to look towards the daily charts for an opportunity to start shorting again. I doubt that is going to be the case though, due to the previous selling pressure that we had seen at the ¥105 level earlier in the week. Ultimately, I do think that we break down below the ¥104 level, and then go down towards the ¥102 level, based upon not only the descending triangle, but the fact that it was the most recent major bounce higher. I remain bearish and will continue to sell.