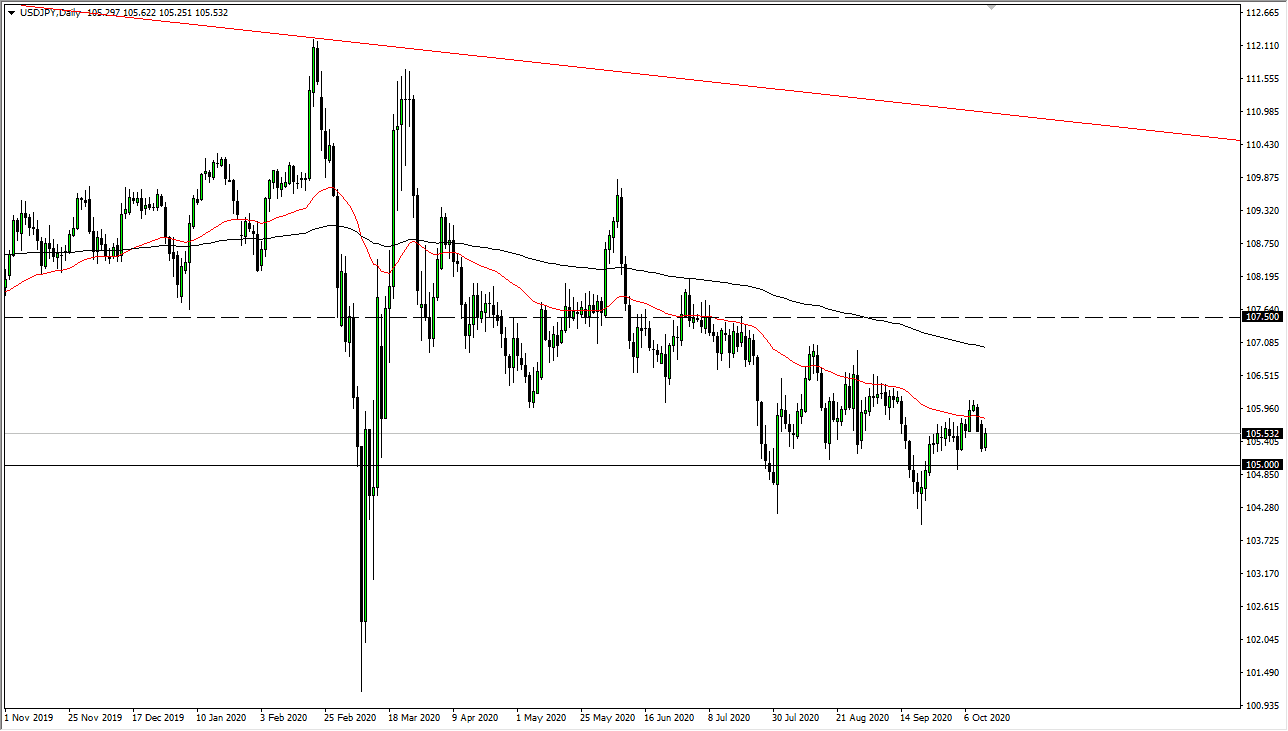

The US dollar has rallied a bit during the trading session on Tuesday but continues to struggle to keep the gains as we have seen quite a bit of negativity over the longer term. The 50 day EMA above causes a lot of resistance over the longer term, and as you can see, we have respected that level multiple times. The area between the 50 day EMA and the 200 day EMA has offered significant resistance, and therefore I think it is only a matter of time before the sellers get in and push on this rally. Beyond that, the market is in a downtrend, so I have no interest in trying to fight this overall move.

The ¥105 level underneath is a large, round, psychologically significant figure and if we drift down towards that area it is likely that the market will have some type of reaction to it. However, it has been sliced through a couple of different times, so this tells me that it will have less influence on the market than it previously had. The market breaking below the ¥105 level opens up the possibility of a move down to the ¥104 level, where we had bounced from before and formed a massive low.

To the upside, I do not really have a scenario in which I am willing to buy this pair, because both of these are safety currencies. If the US dollar rallies here, then it is probably better to buy the greenback against other currencies as the Japanese yen has been so strong. The US dollar falling against the Japanese yen can be a result of a “risk-off” move, but it also can be a reaction to the US dollar falling in general based on the idea of fiscal stimulus. All things being equal, this is a market that has been grinding lower and I think the phrase “grinding” is the most important thing to pay attention to. This is a one-way trade at the moment and one that is more or less favored for short-term traders because the moves have not been spectacular. Both the 50 day and the 200 day EMA are both slanting downward, and are spread out quite nicely, signifying a strong downtrend.