The world celebrated the fact that the end of the world was not here due to the overly dramatic media reports of the demise of Donald Trump over the weekend. I am being a bit sarcastic but the media trying to “out scoop” everybody else this past weekend had market participants rather nervous as to what happened next as far as the president was concerned. We have clearly seen him recover quite a bit, and therefore seem to be more of a “risk-on situation” coming out of New York. The USD/JPY pair is a slave to the S&P 500 at times, and that was most certainly the way it played out during the day on Monday.

Furthermore, there is also the possibility that stimulus may get pushed through now because for some reason people think that since Donald Trump got sick that increases the odds of a stimulus deal being reached. I am not really sure where the connection is, but that seems to be the running narrative for the day. That has Wall Street excited because they love cheap money. That has been the main catalyst of the stock market rally for the last 12 years. When that happens, people do not buy the Japanese yen in order to find riskier assets in the form of US stocks. US stocks are priced in US dollars and therefore that would be the link.

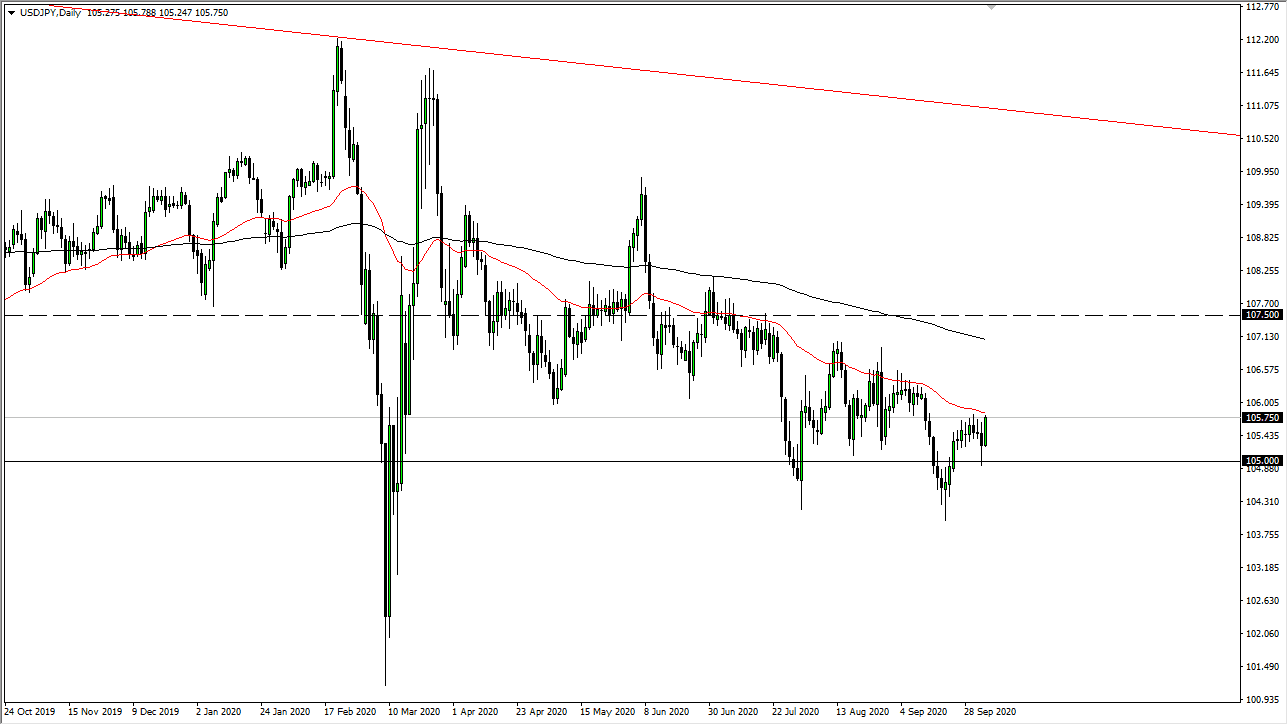

That being said, the 50 day EMA sits just above and it does cause a bit of resistance. I believe that if we can break above there, then the market is likely to go looking towards the 200 day EMA after that, although it is going to take quite a bit of effort to get there because there has been a bit of a “no man’s land” between the 50 day and the 200 day EMA indicators. I believe in selling the first signs of exhaustion because that has worked for some time. At that point, I would expect the market to go looking towards the ¥105 level, possibly the lows again, and all it would take is some type of bad news to make that happen. With this, I am not interested in buying the pair anytime soon as it has failed multiple times previously to do so.