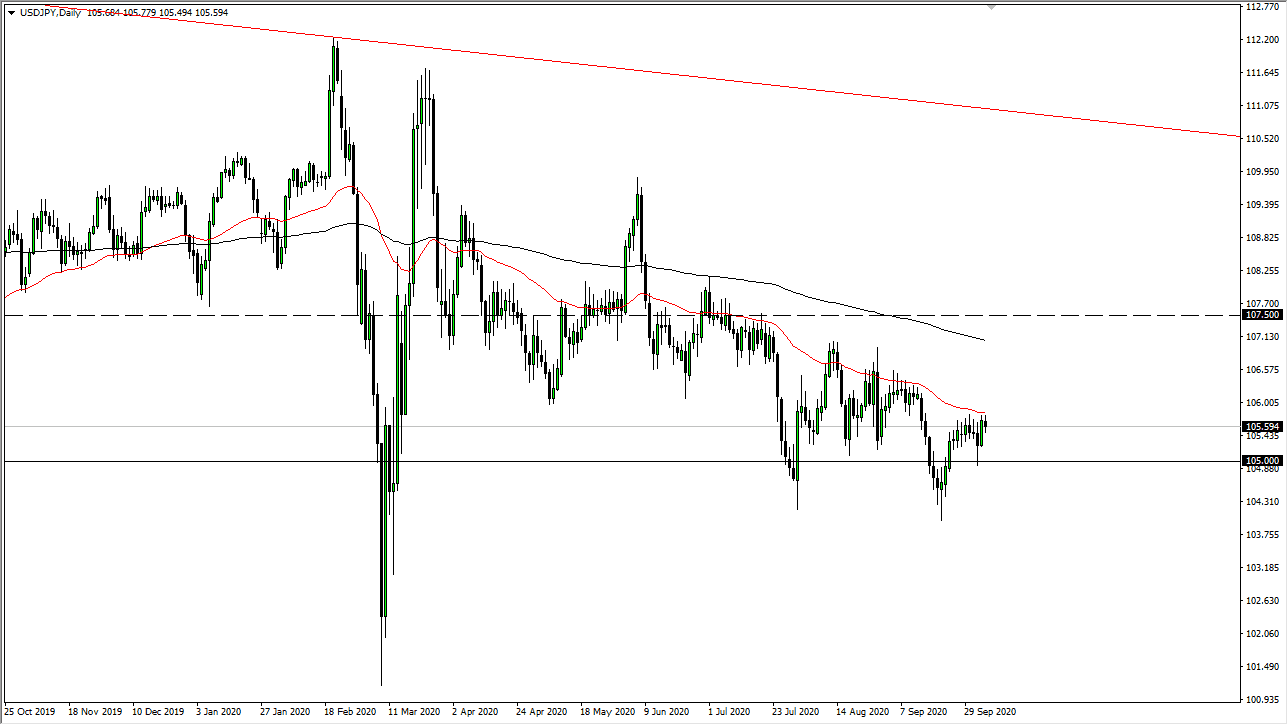

The US dollar has struggled with the 50 day EMA against the Japanese yen for some time, and the Tuesday session was no different. At this point, it is only a matter of time before the market rolls a little bit to the downside, perhaps reaching towards the ¥105 level. This is essentially a “risk-off” type of trade, as I think the market is likely to look at the economic situation and the coronavirus figures as a potential catalyst. Furthermore, Donald Trump has stepped it up and publicly stated that he was telling his negotiators to step away from the stimulus negotiations until after the election. This had an immediate negative effect on risk appetite overall in New York, and that could continue to put lower levels in the eyes of traders.

Looking at this chart, I believe that we will go looking towards the ¥105 level which has been supported recently and is a large round figure that will attract a lot of attention. Ultimately, this is a market that I think will continue to be negative overall and we have been in a long-term downtrend for some time, and the 50 day EMA does in fact seem to be offering a certain amount of dynamic resistance. Regardless, I think at the end of the day we are making “lower lows” and “lower highs.” That is the very essence of a downtrend, so there is no need to fight that overall attitude. Because of this, I believe that the market is going to be grinding lower, perhaps in more of a “risk-off” type of mode. As long as that is going to be the case, it makes sense that the Japanese yen could get a bit against most currencies, not just the US dollar. Pay special attention to this throughout Asia and Europe, because if we get some type of acceleration to the downside that could lead to continuation beyond the ¥105 level and down to roughly ¥104 where we have seen the market test support a couple of times. A breakdown below that level also offers the possibility of a move down to the ¥102 level. I have no interest in buying this pair right now, I see far too much in the way of resistance above, especially shortly above the ¥106 level.