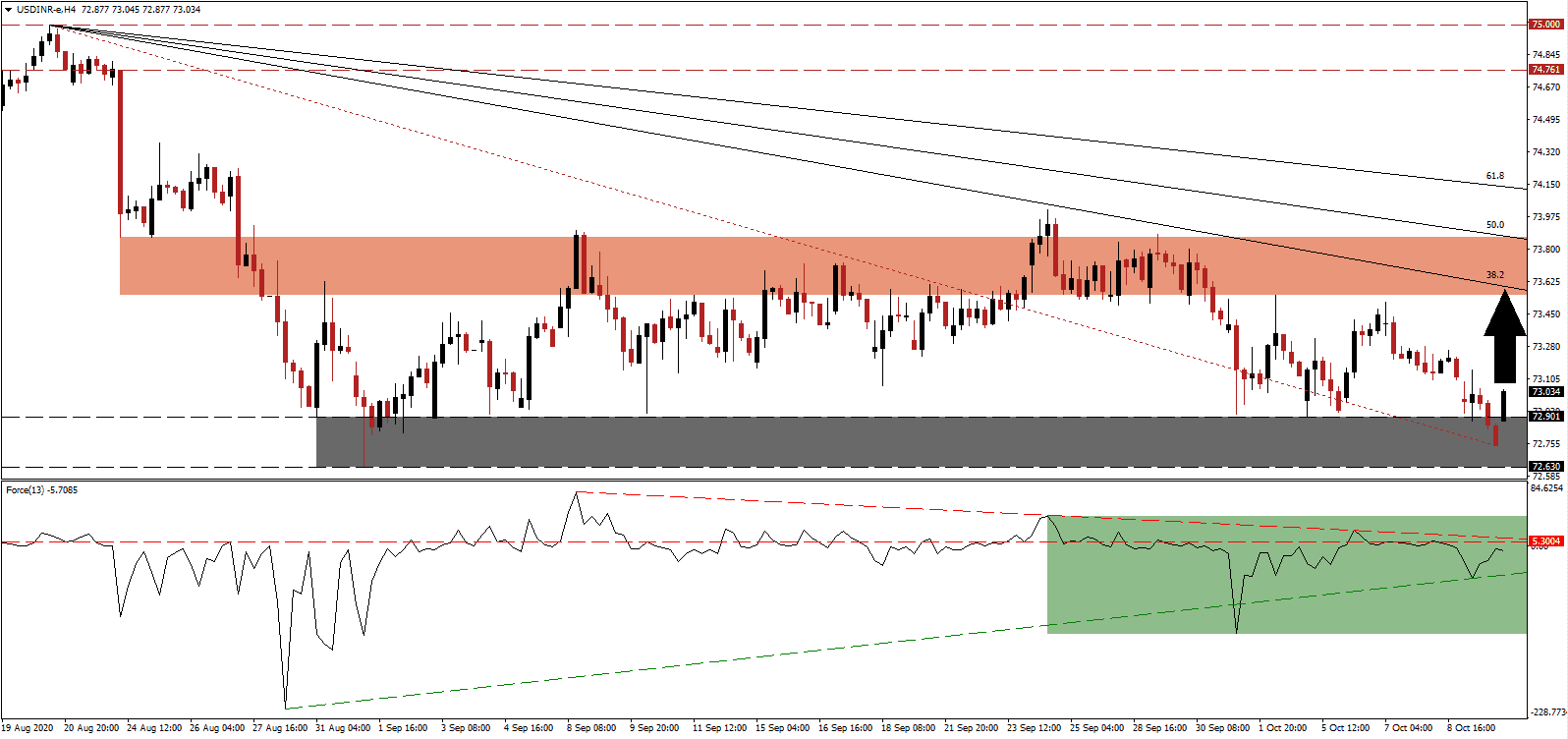

India became the second country behind the US to surpass 7,000,000 Covid-19 cases, with the US set to breach the 8,000,000 level today. Despite the surge across the third-largest economy in Asia, especially over the past month, optimism over an economic recovery is on the rise following a record GDP plunge of 9.5% forecast by the Reserve Bank of India (RBI) for the fiscal year ending March 2021. The USD/INR challenged its support zone before a minor bounce in price action took it above it, assisted by a gradual build-up in bullishness.

The Force Index, a next-generation technical indicator, recorded a higher low and continues to drift higher, as marked by the green rectangle, which resulted in an adjustment to its ascending support level. It remains below its horizontal resistance level, enforced by its descending resistance level, but a brief spike above it and into positive territory is likely. While bulls may temporarily gain an advantage over the USD/INR, the long-term bearish trend remains dominant.

Agriculture and associated industries will lead the expected recovery in India, per an assessment delivered by RBI Governor Shaktikanta Das. Automobile and cement sales are at multi-year highs, which catapulted the September manufacturing PMI to its highest level since January 2012 at 56.8. It remains unclear how much of this activity is related to pent up demand after the two-month nationwide lockdown. After the USD/INR dipped into its support zone located between 72.630 and 72.901, as marked by the grey rectangle, a short-covering rally may add to more upside.

Economic optimism reverberates across the domestic financial sector, with HDFC CEO Keki Mistry suggesting the worst is behind India, and that the recovery so far has been more powerful. The Lancet journal released a study noting India remains on course to overtake Japan as the third-largest economy globally by 2050. While the USD/INR may extend its current breakout into its downward revised short-term resistance zone located between 73.550 and 73.861, as identified by the red rectangle, the descending 50.0 Fibonacci Retracement Fan Resistance Level keeps the long-term downtrend intact.

USD/INR Technical Trading Set-Up - Confined Breakout Extension Scenario

Long Entry @ 73.000

Take Profit @ 73.600

Stop Loss @ 72.600

Upside Potential: 6,000 pips

Downside Risk: 4,000 pips

Risk/Reward Ratio: 1.50

Should the descending resistance level reject the Force Index, the USD/INR will forego the short-term bullish scenario and revert into its bearish stance. Forex traders should take advantage of any price spike with new net short positions amid a bearish long-term outlook for the US Dollar, which continues to worsen. The next support zone awaits price action between 71.419 and 71.710.

USD/INR Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 72.350

Take Profit @ 71.400

Stop Loss @ 72.600

Downside Potential: 9,500 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.80