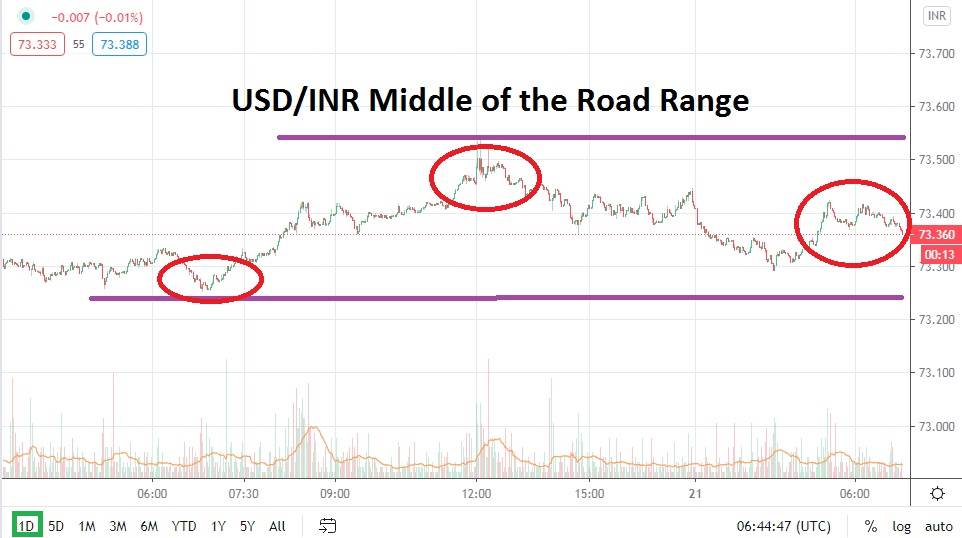

The USD/INR has traded within a tight range the past five days and speculators who are active within the forex pair have had an opportunity to take advantage of comfortable reversals. These trading conditions may continue near term, but speculators need to be on the lookout for impetus which could affect the cautious approach which has developed.

In trading this morning the USD/INR has been rather tame, but volatility should not be discounted and market participants should continue to use limit orders when involved with this forex pair to safeguard against price fills which may cause a surprise. The first wave of support for the USD/INR appears to be the 73.3000 mark, but this has proven a magnet too often the past month to call it a realistic support level. The 73.2300 support juncture continues to prove a value which typically spurs on reversals higher.

On the opposite side of the coin, resistance continues to factor in near the 73.4500 ratio and when broken higher the 73.5000 mark has proven to be adequate. The range of 73.2300 to 73.4500 has certainly proven to be the USD/INR’s range during the past five trading sessions with the occasional breakthrough.

The cautious approach being taken in forex globally is part of institutional sentiment which has begun to take a wait and see approach to the international markets. As the US election draws nearer speculators should expect mixed trading with intermittent storms filled with optimism and sudden pessimism. And this is the impetus which concerns many traders and institutional financial house. This simply means financial houses are nervous about what the immediate future will look like in the first week of November. Therefore traders should be using limit orders and look for quick trading opportunities to take advantage of forex conditions which may continue to prove choppy.

If whipsaw trading remains heightened speculators can choose to be buyers and sellers. It is important not to overtrade, just as it is critical to use leverage when speculating wisely. However, traders justifiably can look at the rather middle of the road range which has developed within the USD/INR and place their trades by looking at existing support and resistance levels and using them as entry points for speculative short term moves.

Indian Rupee Short Term Outlook:

Current Resistance: 73.4600

Current Support: 73.2900

High Target: 73.6100

Low Target: 73.1400