Although the USD/INR has seen a bearish reversal seemingly take place the past couple of days, technically the Indonesian Rupiah still appears vulnerable to potential higher moves. Since early June the Indonesian Rupiah has seen a strong bullish trend become established as it has incrementally broken through resistance levels.

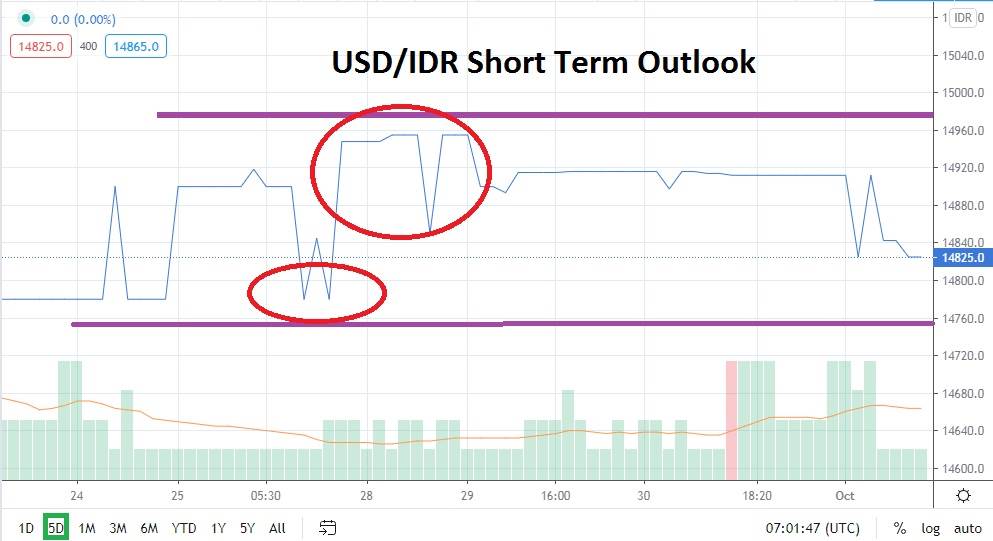

Resistance a touch below the 15000.0 juncture has become an important psychological barrier. In mid-September, the USD/IDR challenged the 14980.0 mark and begun to trade lower until it hit approximately 14600.0 on the 21st of September, but then the forex pair began to trade higher again. The past week and a half of trading has once again proven that the bullish cycles within the USD/IDR appear to be stronger than the short term moves downward.

Speculators should pay attention to support levels that have consistently proven adequate and have steadily been increasing. While support levels are now being approached this morning and may take on the appearance of suggesting a retracement could emerge, the 14775.0 juncture below does look rather strong. This small trend downwards which has developed in the past handful of hours may represent an opportunity to actually seek a buying position of the USD/INR and look for further upside action.

Indonesia does have a transparent government, but it is still suffering from the economic impact of coronavirus domestically. Indonesia’s economy is expected to contract more than has been previously forecasted and its debt ceiling projections for 2021 will be significantly higher than past years. Indonesia has also announced it is going to issue a new round of bonds in order to secure its financial infrastructure.

After enduring the implications of coronavirus earlier this year, the USD/IDR did begin producing a solid bear move downwards starting in early April. However, since early June the USD/IDR has reversed higher and its climb upwards has not found a great deal of resistance.

The slow and steady bullish move of the USD/IDR has not been done with panic buying of the US Dollar, which indicates the trend is taking place due to calm reactions within domestic and international commerce that Indonesia is transacting. Buying the USD/IDR with limit orders and continuing to look for upside momentum to continue appears to be the correct choice with this forex pair.

Indonesian Rupiah Short Term Outlook:

Current Resistance: 14920.0

Current Support: 14775.0

High Target: 14980.0

Low Target: 14715.0