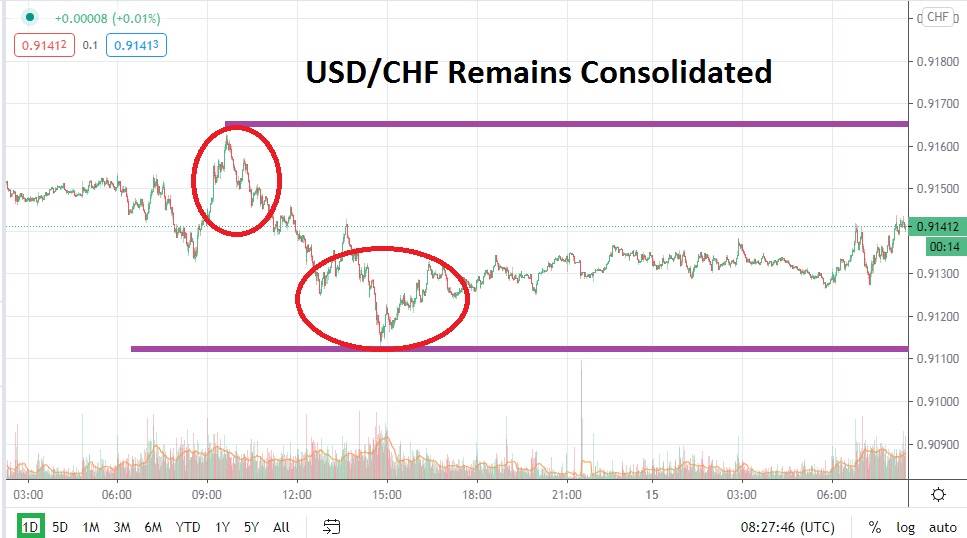

The USD/CHF continues to demonstrate a rather steady and progressive bearish trend as the Swiss France tests important support levels. On the 12th of October the forex pair went to lows near .90800 before reversing higher. After testing a high of .91600 yesterday the USD/CHF is near the .91550 juncture early today.

After testing its lowest boundaries a few days ago, the USD/CHF has certainly retraced higher. However, it remains within a consolidated holding pattern which may allure technical traders who believe its price range remains attractive to pursue selling positions while pursuing downside action within it current value band which is near the top of its short term resistance.

The current price range of the USD/CHF should be intriguing to speculators because it is essentially challenging an important inflection point which could reestablish lower values seen in September and late August. On the 1st of September the USD/CHF was trading near the .89880 level and it sustained a lower range of value until the third week of the month when the forex pair began to trade above the .91250 juncture on a steady basis.

Speculators who are looking at September and October technical charts may be target the .912000 region. If the USD/CHF is able to sustain trading below this juncture for a couple of days it would indicate more bearish momentum is likely. However, the consolidated range of the USD/CHF makes it an attractive short term speculative position in order to perhaps use current support levels as a take profit mark until these support levels are punctured lower and trading can remain below them.

The USD/CHF is a solid speculative trade because of it rather reliable trading range which makes it less susceptible to sudden spikes and offers traders an opportunity to test their technical skills within a forex pair that is not volatile. If global risk appetite remains steady it is reasonable to assume the Swiss Franc will not only continue to attract enthusiasts because it is looked at as a reliable safe haven asset, but as a speculative trade too because of the relative weakness of the USD which has been produced the past six months.

Selling the USD/CHF and looking for downside action from its current price levels is a justifiable trade in order to seek more bearish momentum. Traders should not expect massive movements within the forex pair, but if selling is embraced the USD/CHF could begin to challenge support levels and make them appear vulnerable near term.

Swiss Franc Short Term Outlook:

Current Resistance: 0.91610

Current Support: 0.91220

High Target: 0.91850

Low Target: 0.91110