The US dollar has rallied a bit during the trading session on Friday, as the Dollar continues to build a bit of a base against the Canadian dollar. Looking at the fundamentals for the Canadian dollar, it certainly seems as if Canada could be running into a bit of trouble, as the Toronto housing market continues to soften right along with Vancouver. That being said, my friends in both of those cities can still attest to the fact that housing prices are still historically high, but they are starting to fall. Beyond that, and perhaps more importantly, crude oil markets look like they are under serious threat, and that will put a bit of an anchor around the neck of the Canadian dollar as it used as a proxy for crude oil.

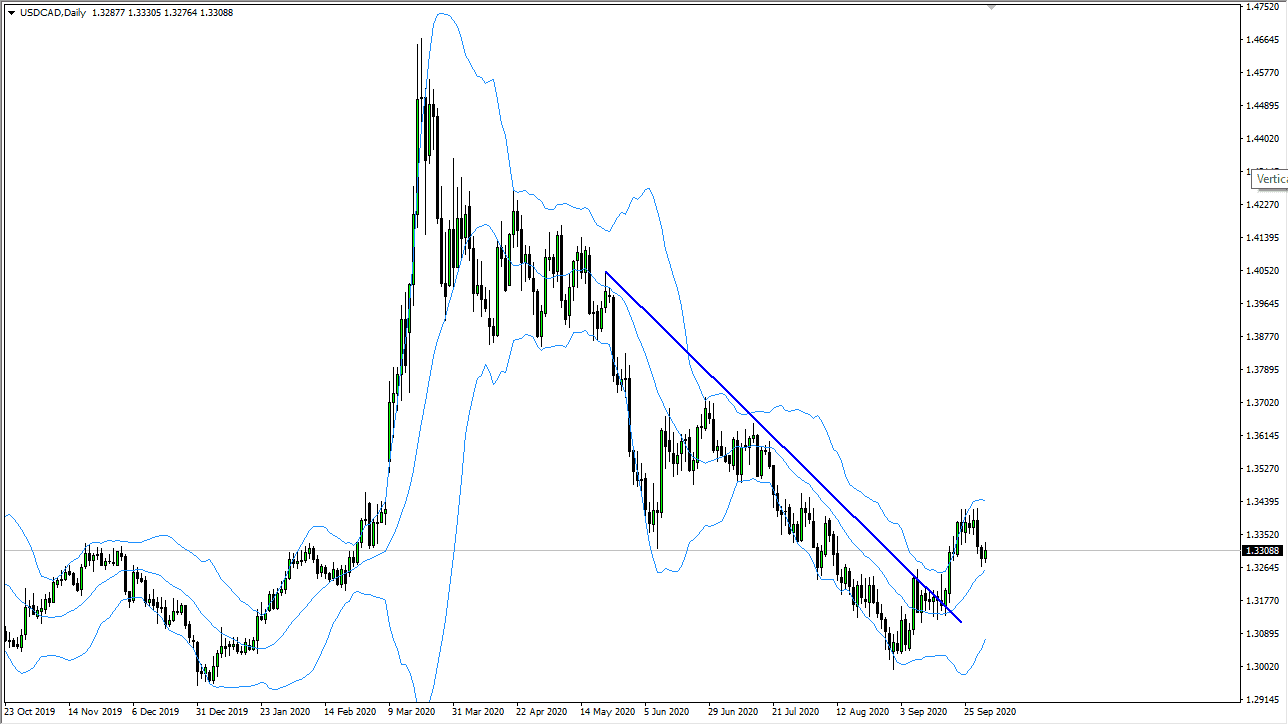

On this chart, I have the Bollinger Bands indicator. This is not an indicator used very often, but I brought it up on this chart to illustrate a point. The 20 SMA is offering support, and we have recently breached the top of the indicator, showing that we had been a bit overbought. Now we are in the “median” area of the indicator, and it suggests that there could be a little bit of buying. Furthermore, we are broken above a significant downtrend line and now it looks like we are trying to build upon that move.

Currently, the West Texas Intermediate market is testing the $37.50 level, and the Brent market is testing $40 for support. Both look extraordinarily vulnerable, and if the sellers takeover, it is very likely people will dump oil-based currency such as the Canadian dollar. This also lends itself to show strength and the greenback, which would lead us to this market. The 1.34 level above would be resistant, and if we can get above there it is likely that this market could go much higher, perhaps reaching towards the 1.36 handle. On the other hand, if we pull back from here, I think there is plenty of support near the 1.32 level as well. Having said, I am bullish, and I am looking for a buying opportunity. What is worth noting is that the USD/CAD pair is mirroring the US Dollar Index quite nicely these days, and because of this, one should lead or follow the other.