The US dollar had initially rallied during the Thursday session against the Brazilian real, showing signs of a continuation of the bullish pressure that had been part of the market for the last several days. Overall, we have been rallying a bit and it looks as if we are trying to break above the 5.6 level again. Having said that, we gave back a bit of the gains, so it does suggest that it is not going to be as easy as people think. A break above the candlestick for the trading session on Thursday would be a very bullish sign but I think we have got a way to go before that happens. I think a lot of this comes down to whether or not we are “risk on”, or possibly “risk off.”

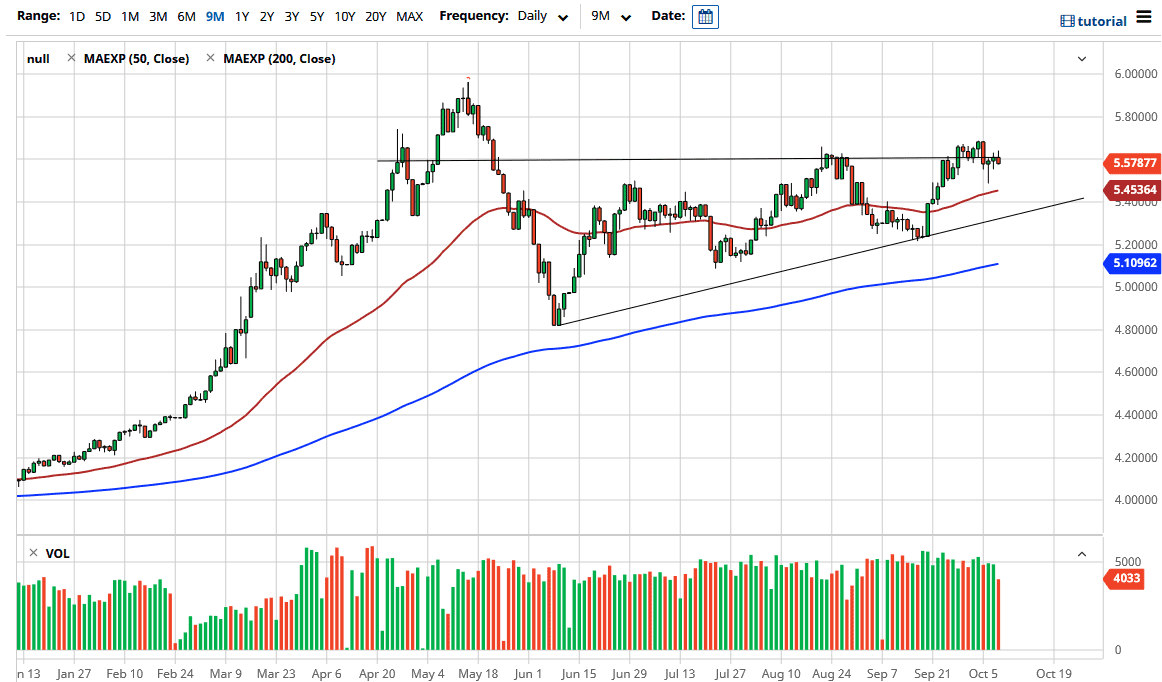

The 50 day EMA sits underneath and is offering a bit of support, but as you can see we have broken outside of the up ascending triangle, or you could even go as far as to say that the market is trying to form and continue a significant uptrend channel. Ultimately, this is a market that will continue to look for some type of clarity, and we are also starting to question whether or not the US dollar is going to strengthen or give up quite a bit of value. The Brazilian real is an emerging market currencies, so it will be interesting to see how this plays out. We circuit tight US dollar conditions it could really take off to the upside in this pair.

Furthermore, we have to pay attention to what is going on in Latin America, which is a whole lot of nothing good. The economic conditions continue to deteriorate in the region, and the Brazilian real is one of the most common ways to play your opinion when it comes to that region of the world. It is by far the biggest currency in South America, so it is the first place people go looking towards two make moves. Although the candlestick for the session on Thursday has shown signs of exhaustion, we have a couple of hammers from the previous session, so I think we have a real fight on our hands. I still favor the upside but need to see the Thursday session in order to put money to work.