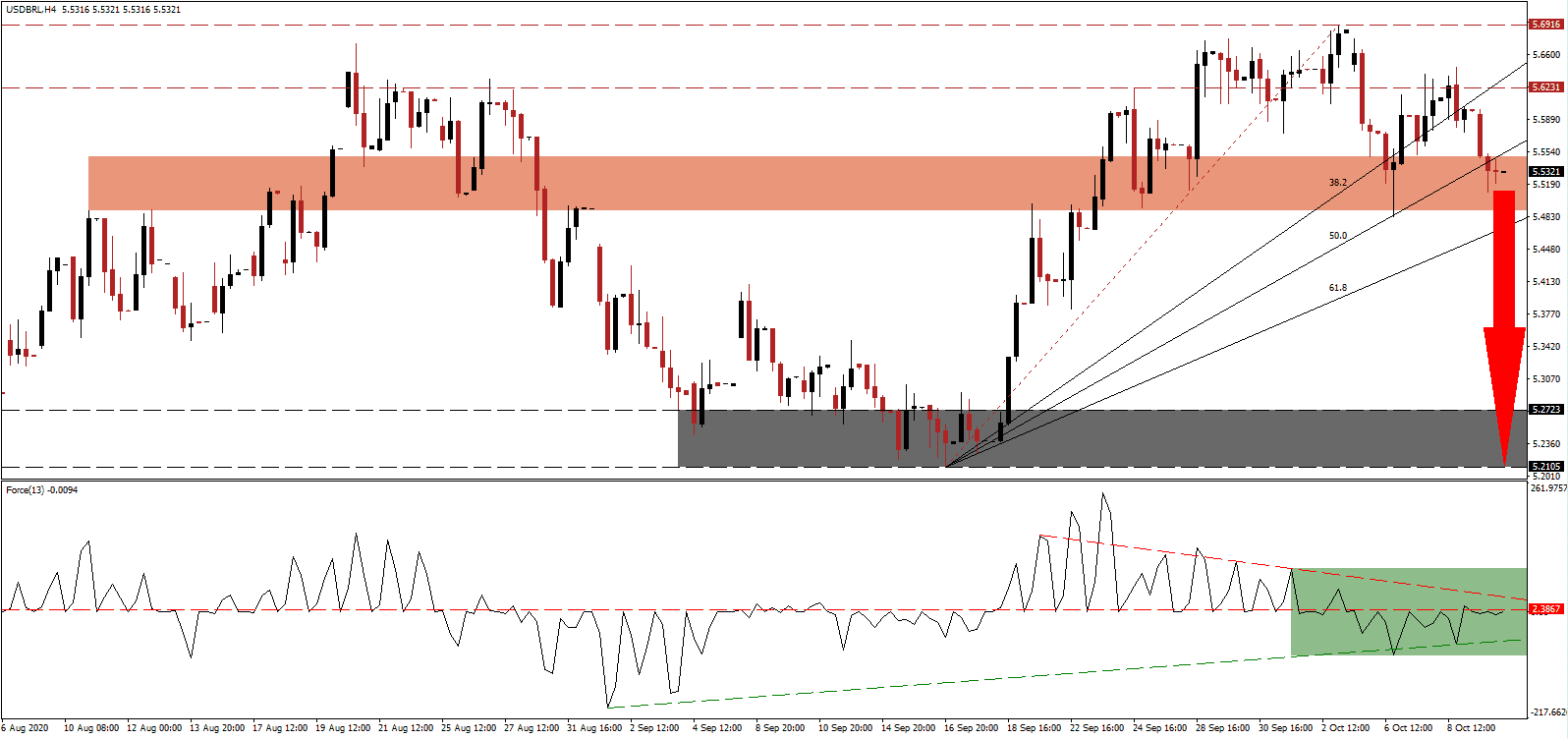

With new Covid-19 infections on the rise, Brazil continues to face an uphill economic battle, on top of the healthcare crisis. Latin America’s largest economy remains the third-most infected country behind the US and India, with the second-highest death toll. Despite the ongoing pandemic, September unemployment claims dropped 10.6% compared to last year, but are still up 5.7% year-to-date. The USD/BRL completed a breakdown below its resistance zone and is presently challenging a former short-term support/resistance zone.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level after recording a higher low. It maintains its position above its ascending support level, as marled by the green rectangle, but faces downside pressure from its descending resistance level. Bears are in control of price action in the USD/BRL with this indicator below the 0 center-line.

September inflation clocked in at 0.64%, the fastest increase since 2003, amid a surge in food and energy costs. At 3.14% annualized, it remains below the 4.00% target of the Banco Central do Brasil. While interest rates are at an all-time low of 2.00%, the government emergency spending could lead to an upward adjustment, adding to bullish pressures on the Brazilian Real. Following the slide in the USD/BRL below its ascending 50.0 Fibonacci Retracement Fan Support Level, a breakdown through its short-term resistance zone between 5.4898 and 5.5488, as identified by the red rectangle, is favored.

After the Brazilian government of President Jair Bolsonaro lifted 15,000,000 from poverty due to its emergency cash payments, many are poised to slip back into it. Amid financial pressures, the government announced a cut of 50% in the subsidy from R$600 to R$300 per month. The program will expire by the end of 2020. A stabilizing budget adds to the long-term bullish outlook for the currency. The correction in the USD/BRL is well-positioned to gather pace and accelerate into its support zone located between 5.2105 and 5.2723, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Acceleration Scenario

Short Entry @ 5.5325

Take Profit @ 5.2100

Stop Loss @ 5.6000

Downside Potential: 3,225 pips

Upside Risk: 675 pips

Risk/Reward Ratio: 4.78

A breakout in the Force Index above its descending resistance level may lead the USD/BRL into a limited reversal. The upside potential remains capped at its resistance zone located between 5.6231 and 5.6916, presenting Forex traders an excellent secondary selling opportunity. With the US Dollar under pressure from monetary policy, debt, and a crumbling labor market, this currency pair maintains its long-term bearish stance.

USD/BRL Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 5.6400

Take Profit @ 5.6900

Stop Loss @ 5.6000

Upside Potential: 500 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 1.25