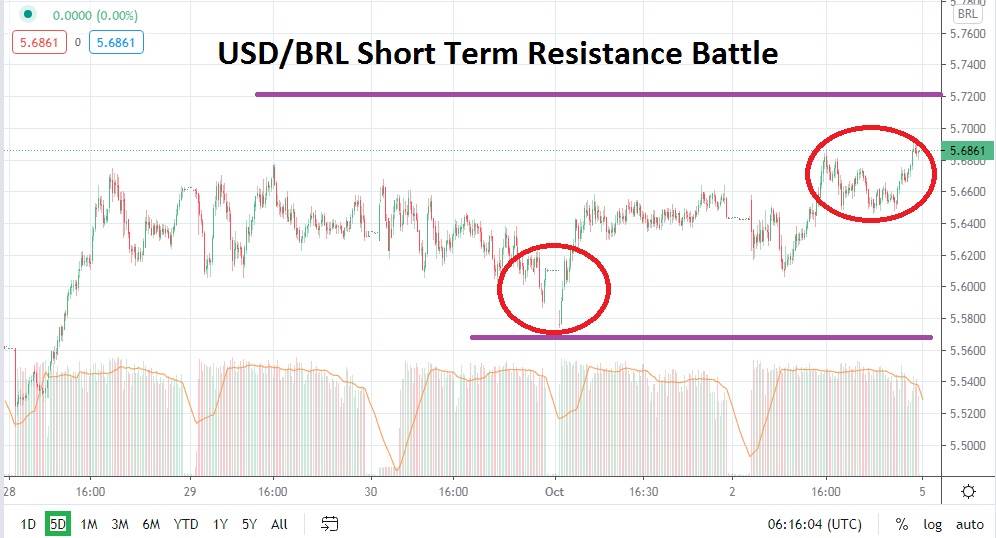

The USD/BRL has sustained its bullish momentum and is continuing to battle resistance levels which may prove important as psychological barometers if they are proven to be weak. The 5.6800 price level has been targeted and hit. If the 5.7000 level is seriously challenged it could set off volatile trading within the Brazilian Real, as investors find their trading programs dealing with values not seen since May of this year when the USD/BRL was hit hard by fears regarding coronavirus.

Underlying risk appetite in Brazil has not been helped the past two days as traders dealt with news regarding US President Trump’s health issues, nor the unspectacular results in Brazil’s equity market, particularly the Ibovespa which has struggled. Brazil continues to feel the effects of implications and outlook regarding coronavirus economically and this has helped to sour the picture regarding the USD/BRL.

Interestingly, the USD/BRL has not suffered a death spiral and speculators should keep this fact in mind. Even though the Brazilian Real has seen a bullish trend in September emerge, it has not been catastrophic. The USD/BRL remains within a known value range and it may prove technically proficient in the coming weeks. Yes, resistance levels appear vulnerable short term, but as of the 17th of September the USD/BRL was trading near the 5.2000 level.

Speculators have a tough decision to make near term. The USD/BRL has certainly shown little sign of producing a sudden bearish reversal, but a selling cycle is likely to occur, but the strength of the move is what needs to be considered. In the meantime, traders may want to continue to test upside momentum with buying orders of the USD/BRL when slight pullbacks occur and then search for more bullish traction near term.

Trading the USD/BRL will need careful attention to short term trends by speculators. If a trader is patient and has the capability of holding onto a trade in order to let if flourish this may be the best path, but carrying charges and the use of wide stop loss ratios can prove difficult for under-capitalized traders using too much leverage.

After a strong trend and being challenged by higher values within the USD/BRL the past five days of trading, speculators with a taste for adventure may consider selling the USD/BRL and looking for some bearish action to emerge. However, stepping in front of the bullish momentum will take plenty of courage.

Brazilian Real Short Term Outlook:

Current Resistance: 5.7000

Current Support: 5.6300

High Target: 5.7550

Low Target: 5.5600