The S&P 500 initially tried to rally during the trading session on Thursday but then gave back the gains as we simply have no idea where to go from here. The market probably still has enough negativity out there to keep it from going straight up in the air. After all, one of the biggest things that we are moving on right now is the fact that there may or may not be a stimulus. All things being equal, the market is assuming that there will be a stimulus, but the longer we wait, the more likely it is to be negative for markets. That does not necessarily mean that the market is going to collapse, because as you know stocks eventually rise all things being equal.

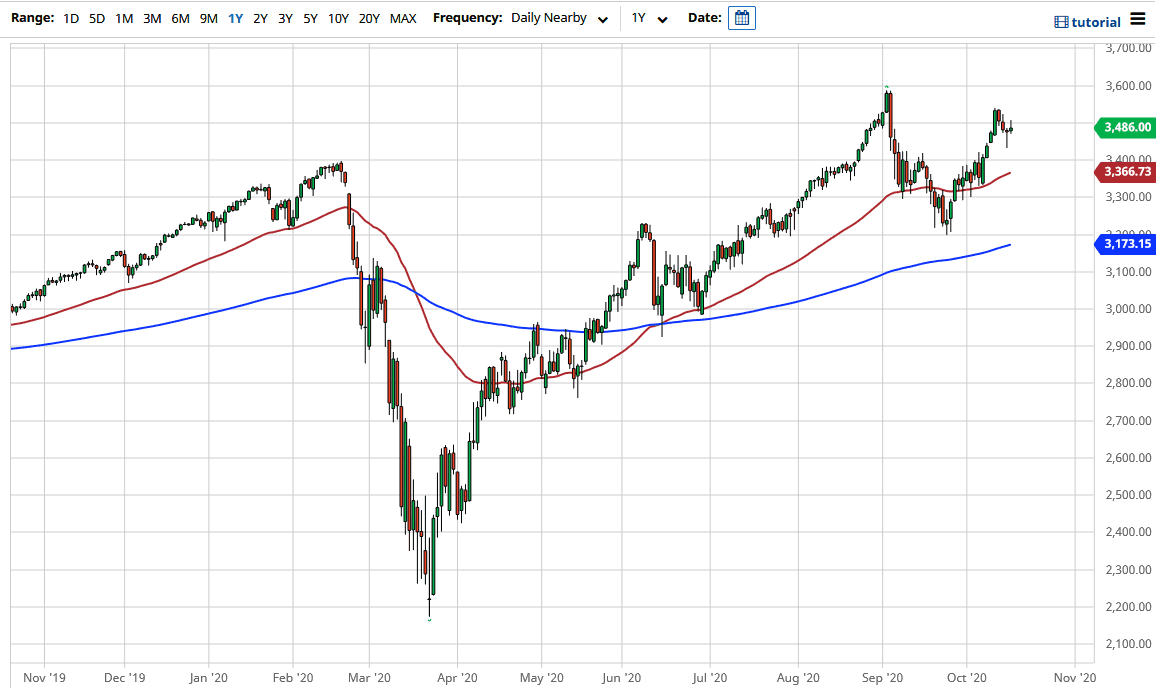

Looking at this chart, the 50 day EMA underneath should offer plenty of support at the 3366 level, but we also have the 3400 level that should offer plenty of support. Ultimately, we should get some type of stimulus or cheap money in order to make the markets go higher because that is what has happened time and time again. Having said that, there are people out there that are looking at the market right now as essentially forming a “double top”, and while that may technically be true, the reality is that we are still very much in an uptrend. Any pullback at this point in time will more than likely be looked at as a buying opportunity as it almost always is.

The election coming up will probably continue to dampen expectations of a bigger move, and at this point, I think we probably grind more than anything else. I like the idea of buying a pullback and the fact that we formed a shooting star on Friday directly after forming a hammer on Thursday suggests that we are not ready to make a bigger move quite yet. I believe that we drift a little bit lower, but this is not a selling opportunity, it is simply a sign that you need to be patient enough to find value underneath. To the upside, the 35 A.D. level is the all-time high, and I think that will be the target, but I think that you get a better price if you are patient enough to wait for it.