The S&P 500 is moving almost solely on stimulus so keep that in mind. With that being the case, if we get any sign of stimulus it is likely that we will break out above the 3600 level and continue to go even higher. Ultimately, taking a look at several different levels right now for opportunities to buy the S&P 500 if we get some type of dip. After all, that has worked for 12 years and even though we had recently seen a major breakdown, we also sell the Federal Reserve step in and trying to save the market immediately.

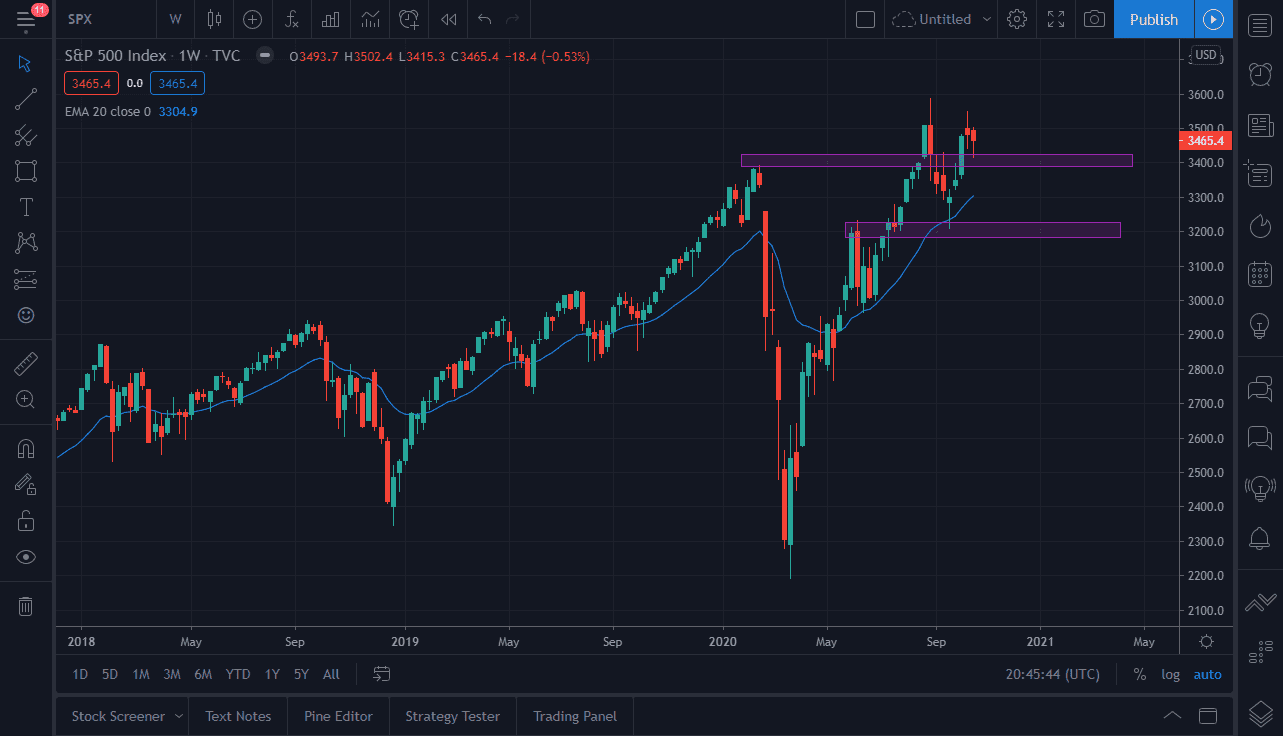

Looking at the candlestick for the last couple of weeks for the month, you can see that we continue to chop around but the 3400 level seems to be offering a little bit of support. Breaking down below there allows the market to go looking towards the 3200 level underneath which is even more supportive. Between the two areas we have the 20 week EMA, so that is worth paying attention to as well. We have been in an uptrend forever, and therefore it is likely that we could see a massive pullbacks only to see buyers come back.

One thing is for sure though, if we were to break down below the 3200 level, we would wipe out a massive hammer from the weekly chart and break a major area. Nonetheless, it is still likely to find central bankers willing to come in and save everything, so again, I am waiting for value. I do not think that we get some type of major meltdown, but I do expect pullbacks occasionally between now and the election, and of course the decision on what to do about stimulus in the United States. The markets will get it eventually, but it may be a “sell the news” type of event as we have been trying to rally heading towards it. Nonetheless, look at a couple of days of weakness after stimulus as an opportunity to pick up value. To the upside, I do believe that the 3800 level might be the target if we can finally take off. Expect a lot of volatility, and keep your position size very small.