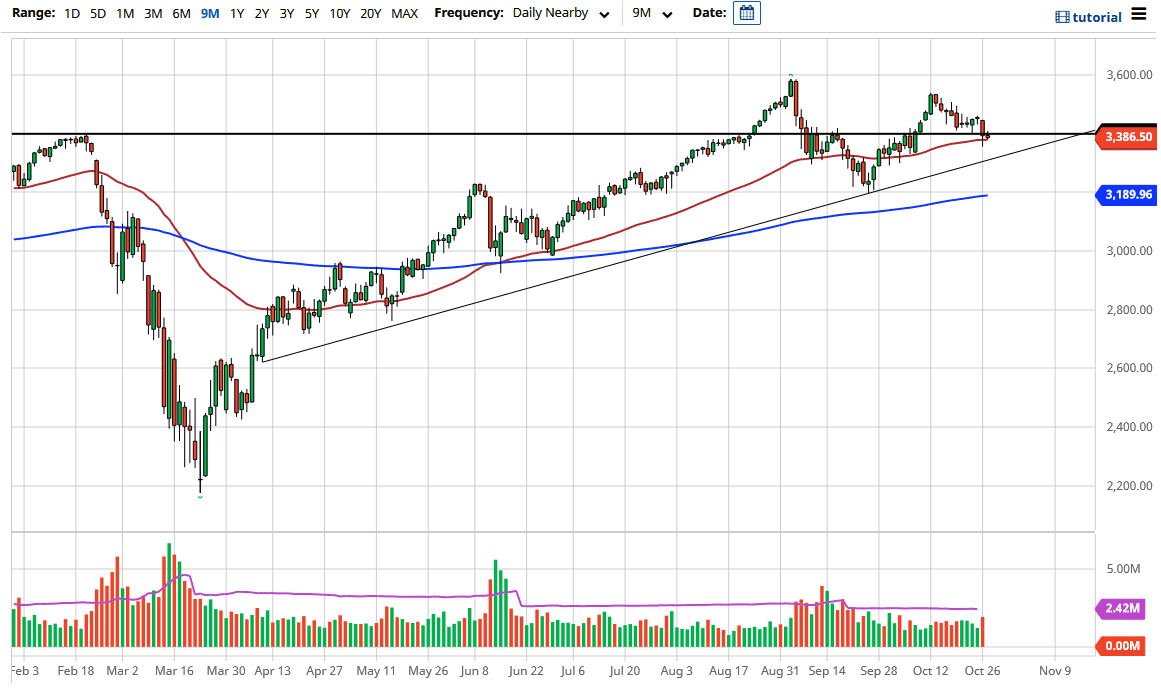

The S&P 500 initially tried to rally a bit during the trading session on Tuesday but gave back the gains as soon as we tried to pop above the 3400 level. Now that the market has pulled back from there, we tested the 50 day EMA which makes quite a bit of sense, as it is a longer-term trend indicator that a lot of people pay close attention to. Even if we do break down below there, I think there are plenty of places where we have buyers underneath. The uptrend line that I have marked on the chart could come into play, and then of course the 200 day EMA after that which is near the 3200 level.

What is worth paying attention to is that the 3200 level is where he had bounced significantly, so that is an area that I think would come into play. If we break down below the 3200 level, then it confirms a double top and as a result it could send this market much lower. Even having said that, I am still not looking for a selling opportunity. In this market, it is obvious that the market has been in an uptrend for 12 years, although we have had a significant pullback occasionally. Having said that, those pullbacks have always ended up being a nice buying opportunities and at this point the market has been trained to expect the Federal Reserve to come in and save everybody’s account, or perhaps even Congress and it stimulus to come into play.

The markets will be very noisy between now and the election, and I suspect that the futures market will be all over the place. If that is going to be the case, you should have plenty of opportunity to get involved with value and should look at pullbacks as potential value. Between now and then, if we get some type of supportive daily candlestick, I am more than willing to buy this market for short-term trade. Having said that, if you have the trade in this market and stop losses said, it is almost certain that during election night you will probably get them hit as I would anticipate a lot of back and forth. Regardless, I have no interest in selling and will wait for value.