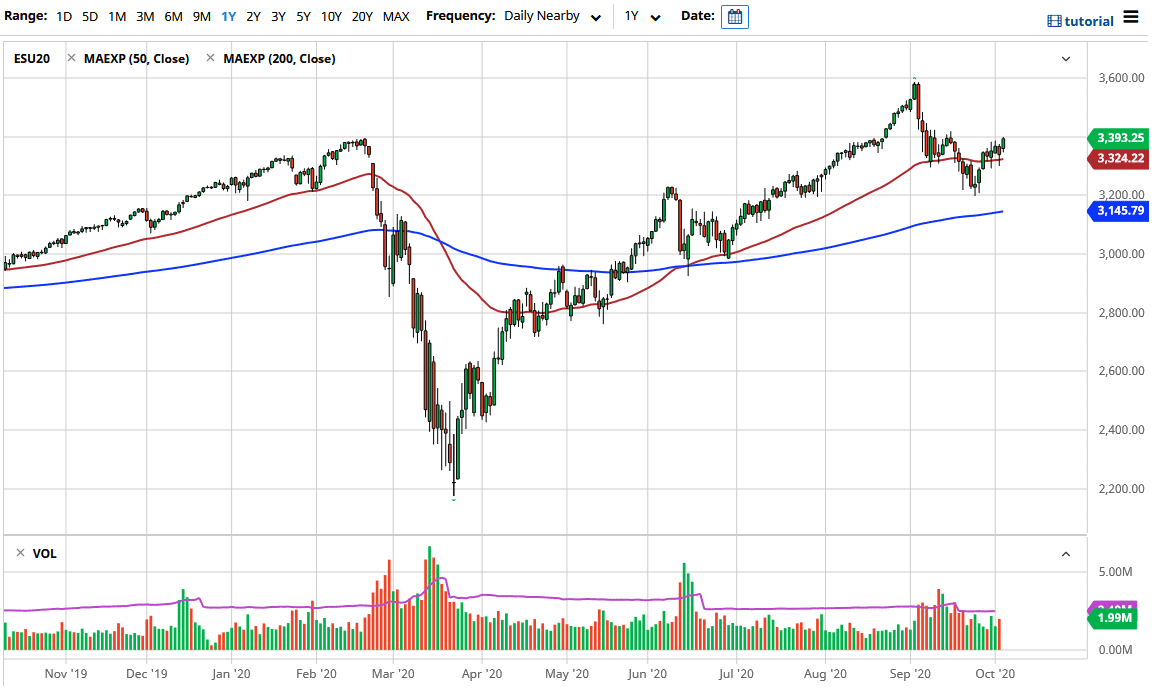

The S&P 500 has rallied a bit during the trading session on Monday, breaking towards the 3400 level. At this point, it looks like we are going to continue to see a lot of momentum, and therefore if we can break above the 3420 level, it is likely that we should continue to go much higher given enough time. I think that short-term pullbacks continue to be buying opportunities and therefore I have no interest in trying to get too cute with this trade. This market is one that you should not be shorting because Wall Street seems to be whipping itself into a fury yet again.

Looking for that free money and that handout, Wall Street will continue to buy the S&P 500 because “There Is No Alternative”, which is the mantra. Whether or not that is true is a completely different story but that is what they believe right now. Short-term pullbacks will be bought into as the 50 day EMA seems to be somewhat short-term supportive. Even if we break down below there, the market is likely to continue to grind back and forth between the 3200 level on the bottom and the 3400 level on the top. Once we get that break above the 3420 level though, that opens up the possibility of a move all the way to the 3600 level.

When I look at the chart, it does not take a lot of imagination to see some type of “V-shaped bottom” trying to form itself, so, therefore, I think that the momentum is certainly much easier to gather to the upside than the down. Even if we were to break out, it is not until we got well below the 3200 level that I would even consider shorting, and even then, I think that the 3000 level will offer significant support. All things being equal, I like the idea of buying dips, but I also recognize that you may have to jump in and buy some type of break out. After all, there is essentially “dead air” between the 3420 level and the 3600 regions. All things being equal, we are still very much in an uptrend and that has not changed despite the fact that we had a significant pullback.